Filling out a Payroll Check form accurately is crucial for both employees and employers. Mistakes can lead to delays in payment, incorrect amounts, or even legal issues. One common mistake is not including the correct employee identification number. This number is essential for tracking payroll and ensuring that the payment is processed correctly.

Another frequent error is miscalculating the hours worked. Employees should double-check their hours to ensure they match their timesheets. If the hours are recorded incorrectly, it could result in underpayment or overpayment, which complicates payroll records.

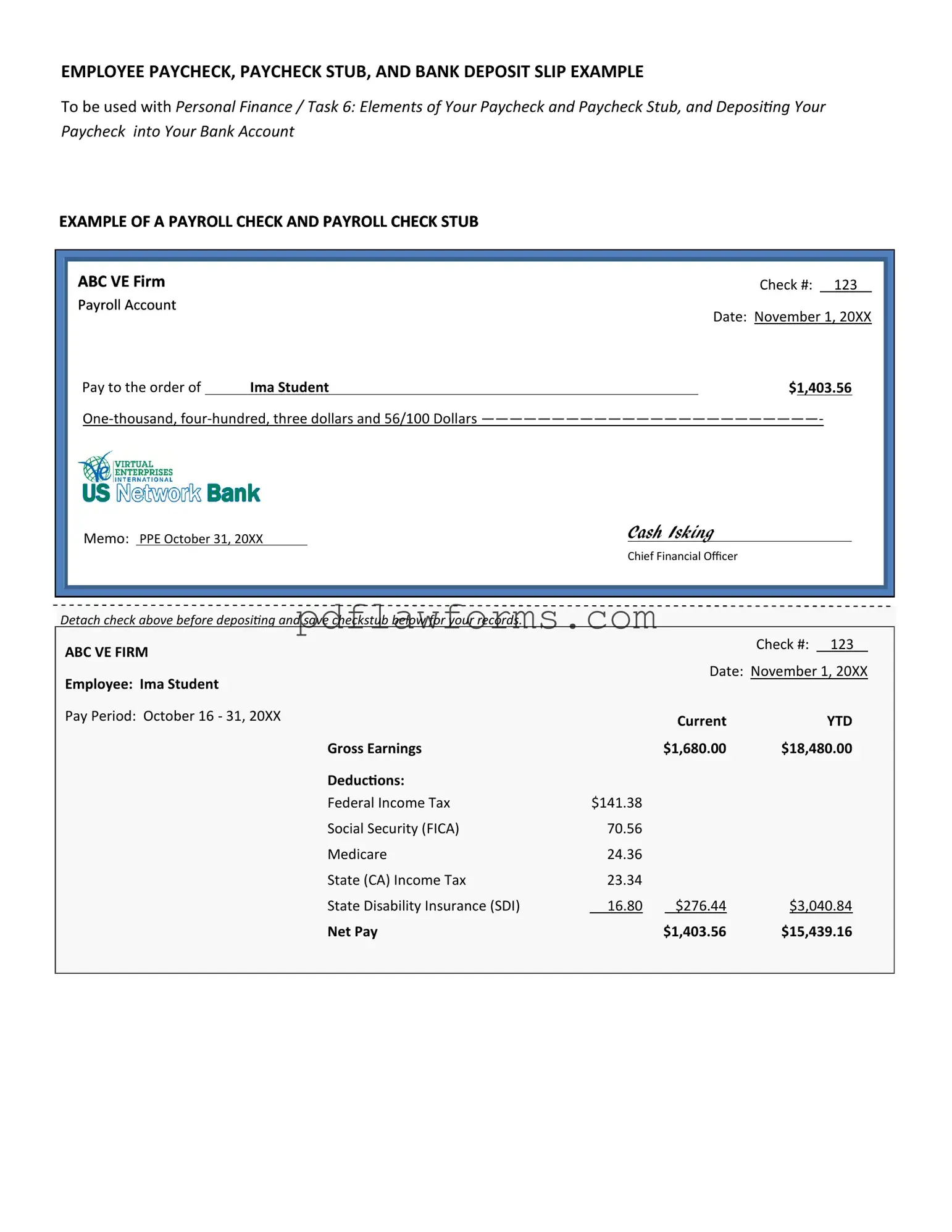

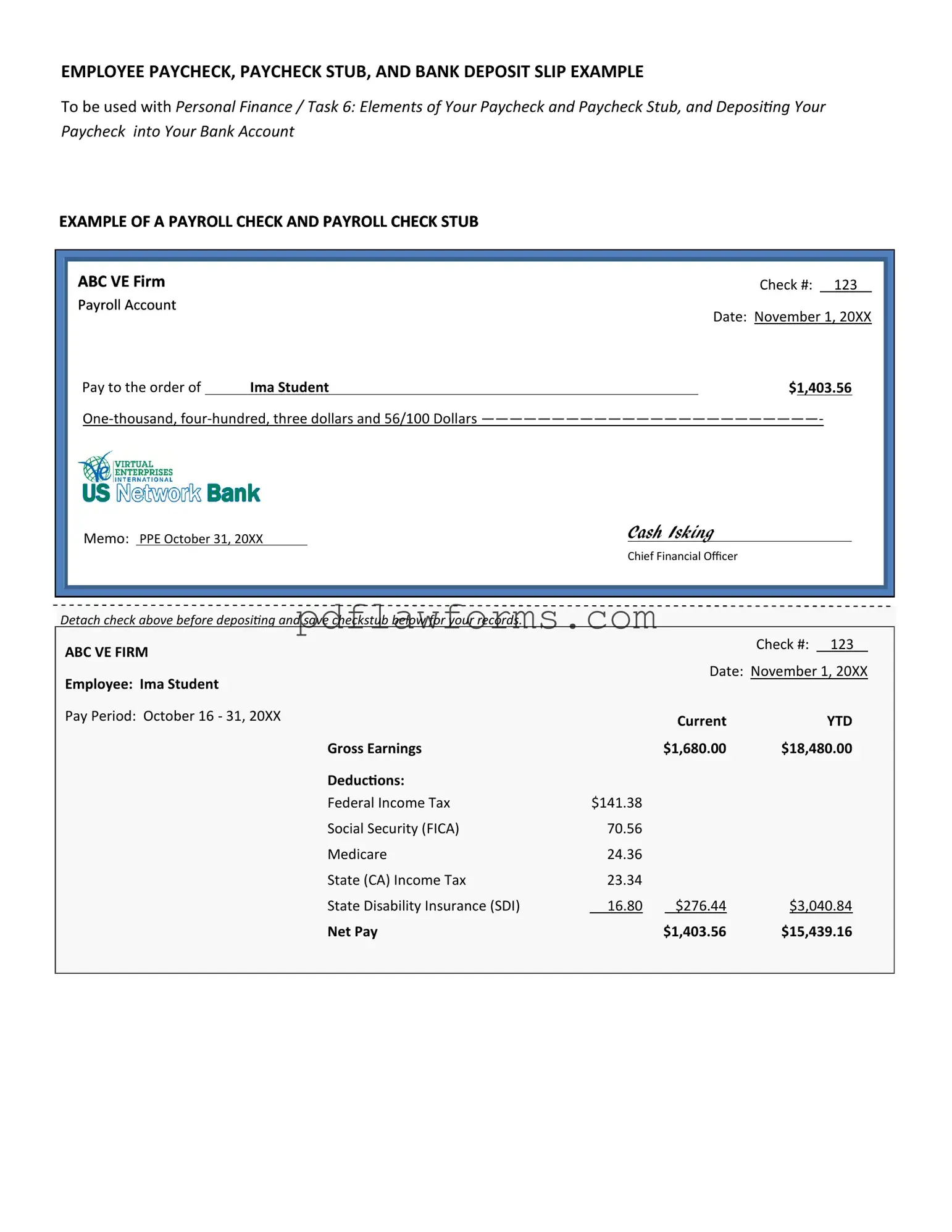

Many individuals also forget to account for deductions. Taxes, benefits, and other deductions must be accurately reflected on the form. If these are overlooked, the employee may receive an incorrect net pay amount, which can lead to dissatisfaction and confusion.

Using the wrong pay rate is another mistake that can occur. Employees should verify their hourly wage or salary before submitting the form. An incorrect pay rate can lead to significant discrepancies in payment, affecting budgeting and financial planning.

Additionally, some people neglect to sign the Payroll Check form. A signature is often required to authorize the payment. Without it, the form may be deemed invalid, causing delays in the processing of payroll.

Another oversight is failing to update personal information. Changes in address, phone number, or banking information should be communicated promptly. If this information is outdated, it can lead to issues with payment delivery.

In some cases, individuals may not provide enough detail regarding the nature of the payment. Clearly specifying whether the payment is for regular hours, overtime, or bonuses helps in maintaining accurate records and ensures proper classification of payments.

Lastly, submitting the form late can create problems. Each payroll cycle has specific deadlines. Late submissions can result in employees not receiving their pay on time, which can lead to frustration and financial difficulties.

By avoiding these common mistakes, employees and employers can ensure a smoother payroll process. Careful attention to detail can save time and prevent potential issues down the line.