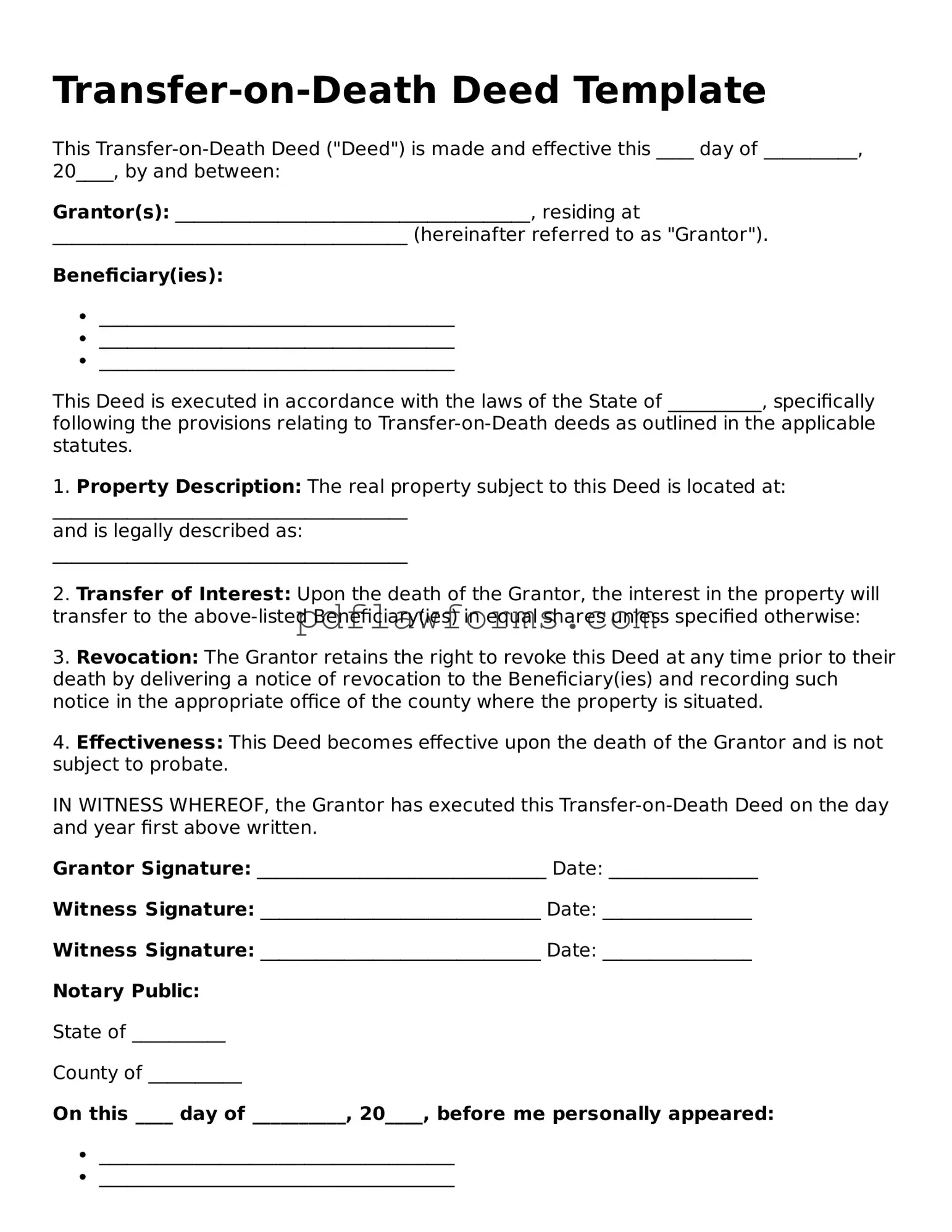

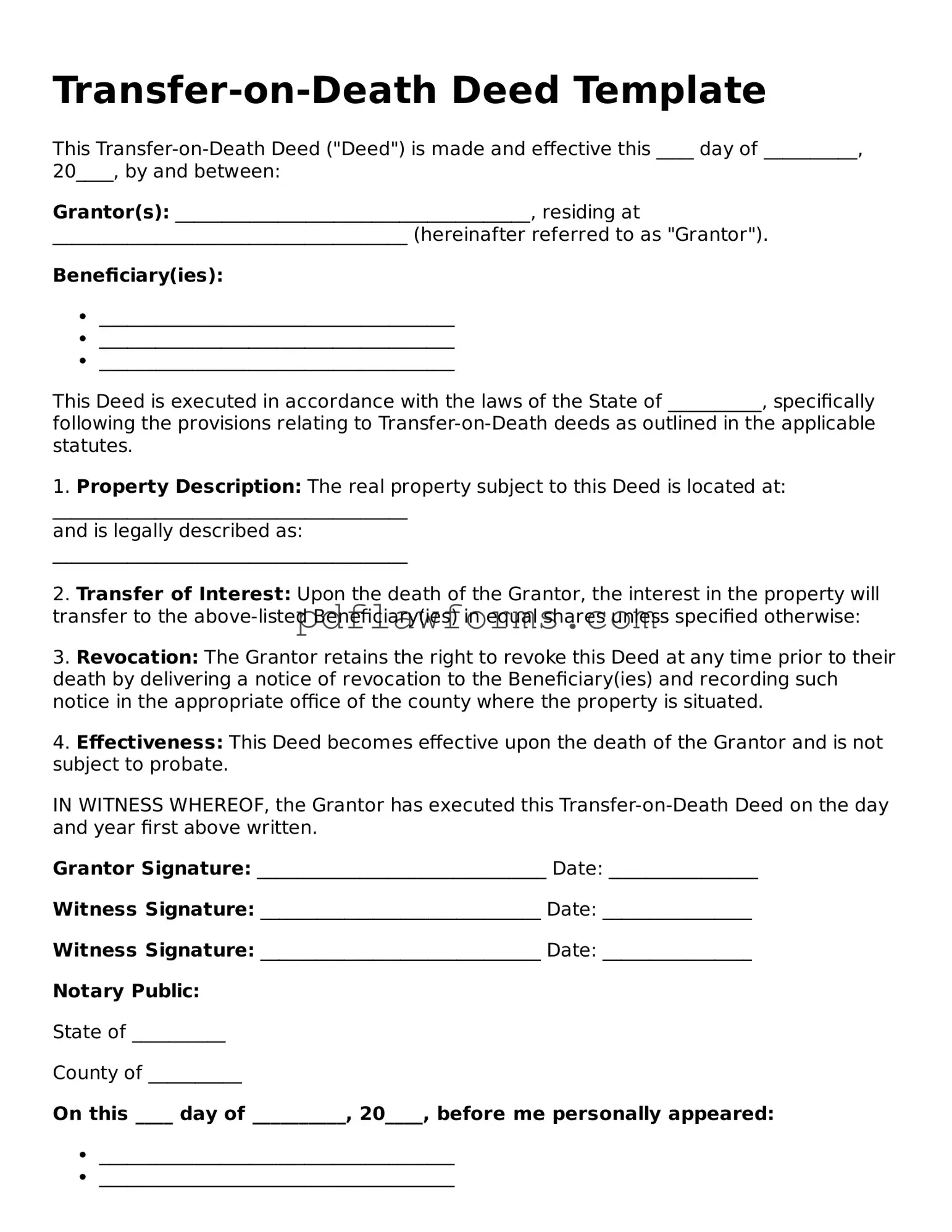

Filling out a Transfer-on-Death (TOD) Deed form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. Understanding these errors can help ensure that the transfer of property goes smoothly upon the owner’s passing.

One frequent mistake is failing to include the full legal name of the beneficiary. A nickname or shortened version can lead to confusion and potential disputes. It’s essential to use the name exactly as it appears on legal documents.

Another common error is neglecting to provide the correct property description. The deed should include a detailed description of the property, including its address and any identifying information, such as parcel numbers. Omitting these details can cause issues with the transfer process.

People often overlook the requirement for notarization. Without a notary’s signature, the TOD Deed may not be valid. This step is crucial in ensuring that the document is legally recognized and enforceable.

Some individuals forget to sign the form. A signature is necessary to validate the deed, and without it, the document is incomplete. This simple oversight can lead to significant delays in the transfer process.

Another mistake is not recording the deed with the appropriate county office. Even if the deed is filled out correctly, failing to file it can result in the property not being transferred as intended. Recording the deed is a critical step that should not be neglected.

Additionally, people sometimes assume that a TOD Deed automatically overrides a will. This is not always the case. It’s important to ensure that the TOD Deed aligns with any existing estate plans to avoid conflicts.

Some individuals may also forget to update the TOD Deed after significant life changes, such as marriage, divorce, or the death of a beneficiary. Keeping the deed current is vital to ensure that the intended person receives the property.

Another common error is failing to understand the implications of a TOD Deed on taxes. Property transferred through a TOD Deed may still be subject to estate taxes. Consulting with a tax professional can help clarify these obligations.

Lastly, people sometimes underestimate the importance of communicating their intentions with beneficiaries. Without clear communication, heirs may be unaware of the deed, leading to confusion and potential disputes after the owner’s death.

By being aware of these common mistakes, individuals can take the necessary steps to ensure that their Transfer-on-Death Deed is filled out correctly and serves its intended purpose, providing peace of mind for both themselves and their beneficiaries.