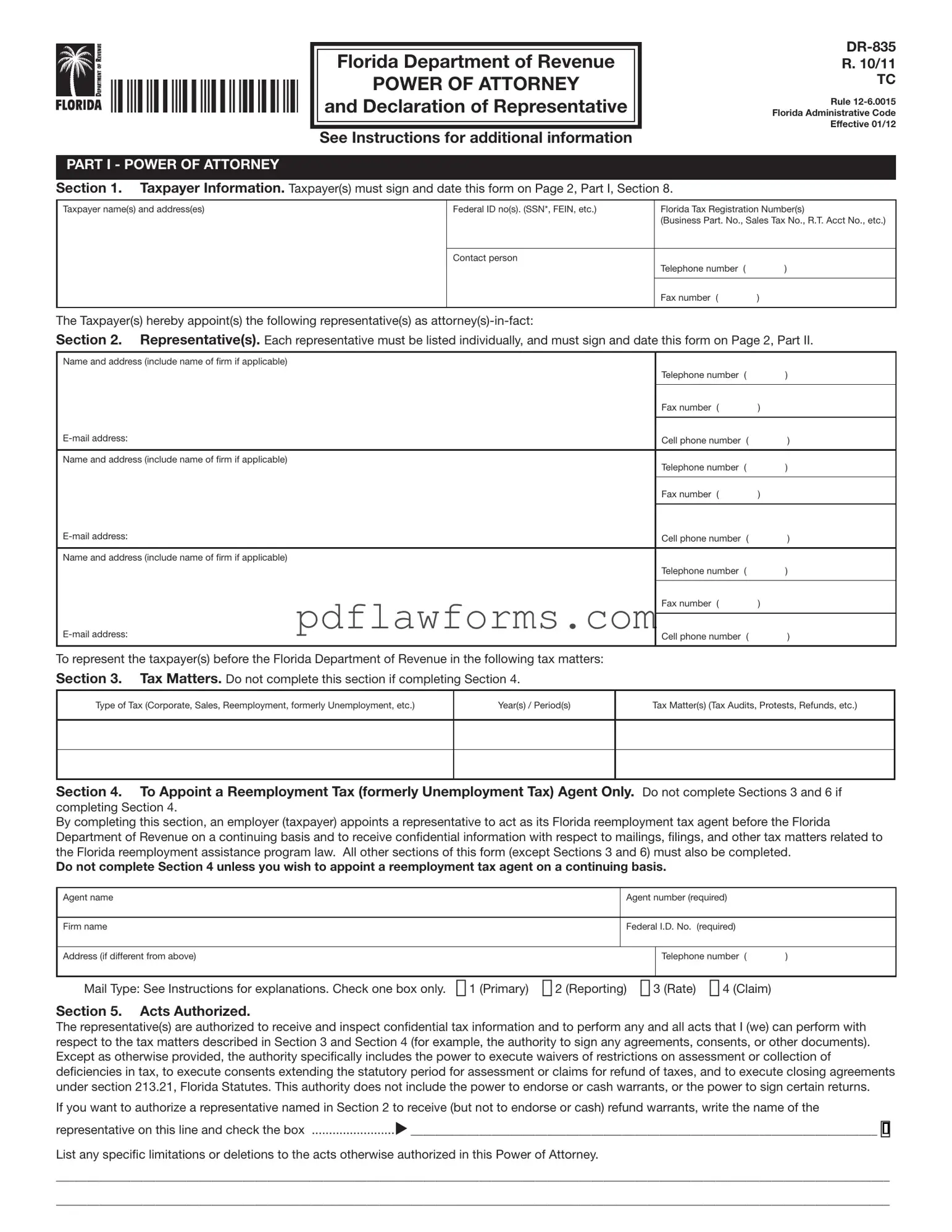

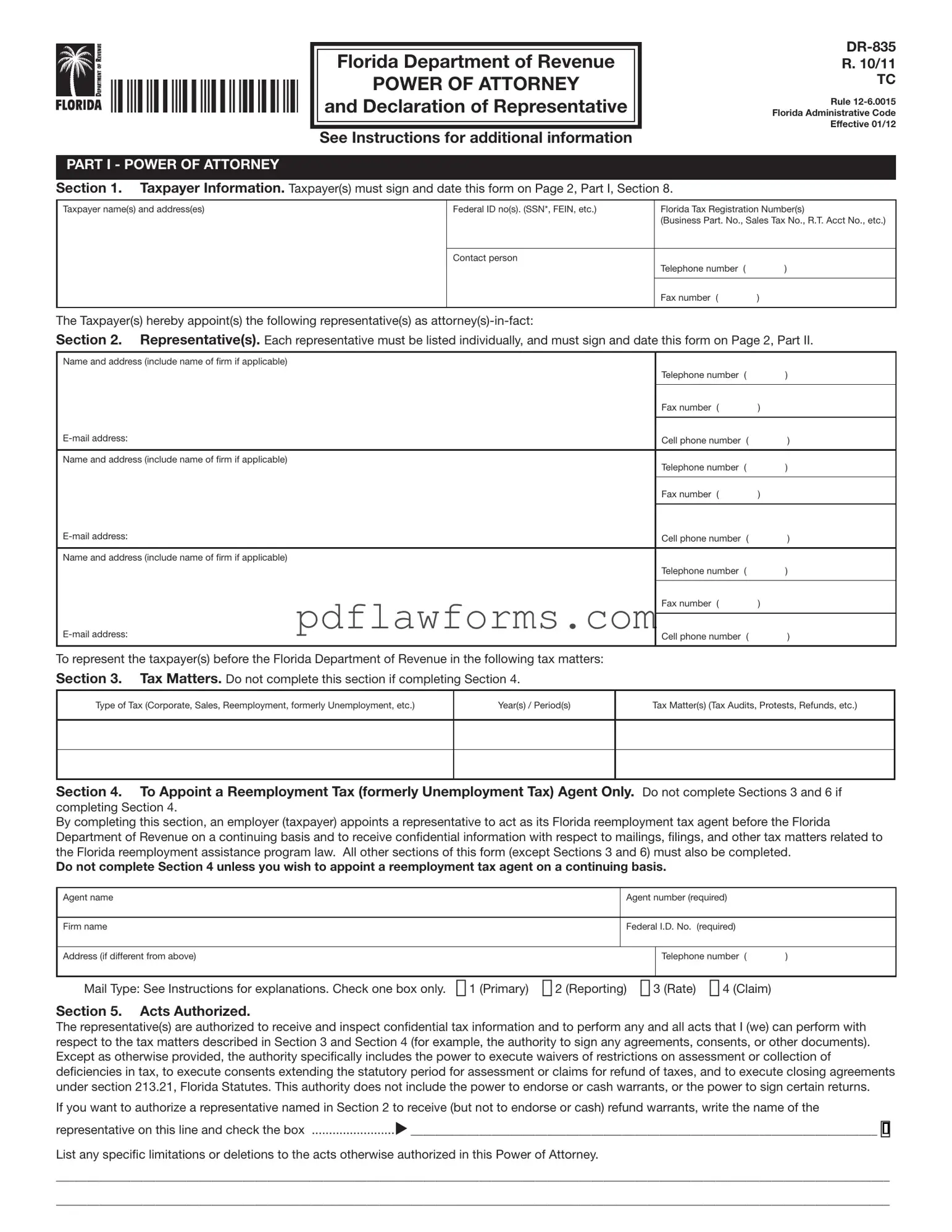

Fill Your Tax POA dr 835 Template

The Tax POA DR 835 form is a document that allows individuals to authorize someone else to represent them in tax matters before the Colorado Department of Revenue. This form is essential for ensuring that your tax issues are handled by a trusted representative. If you need to fill out the form, click the button below.

Make My Document Online

Fill Your Tax POA dr 835 Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Tax POA dr 835 online, then download your file.

Make My Document Online

or

⇩ Tax POA dr 835 PDF