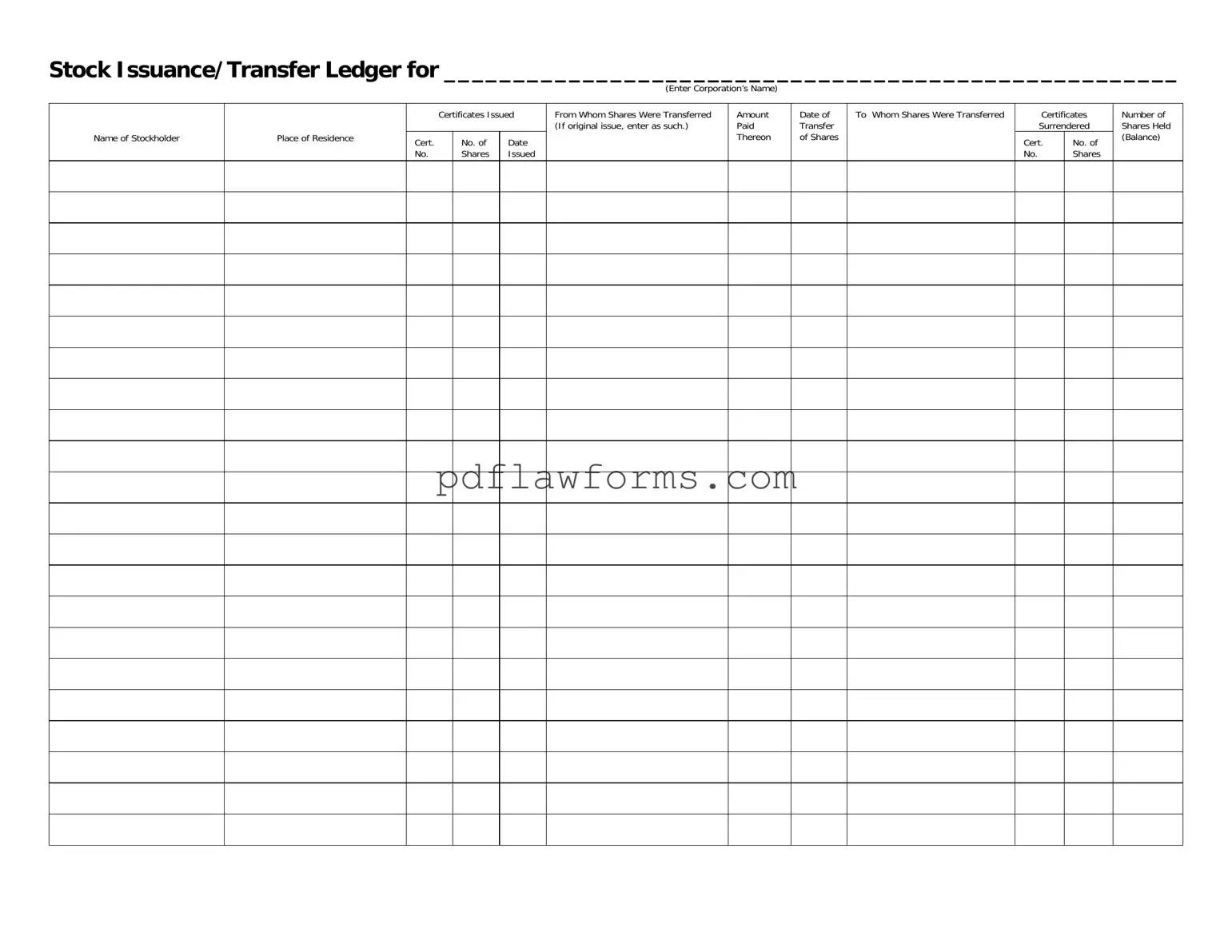

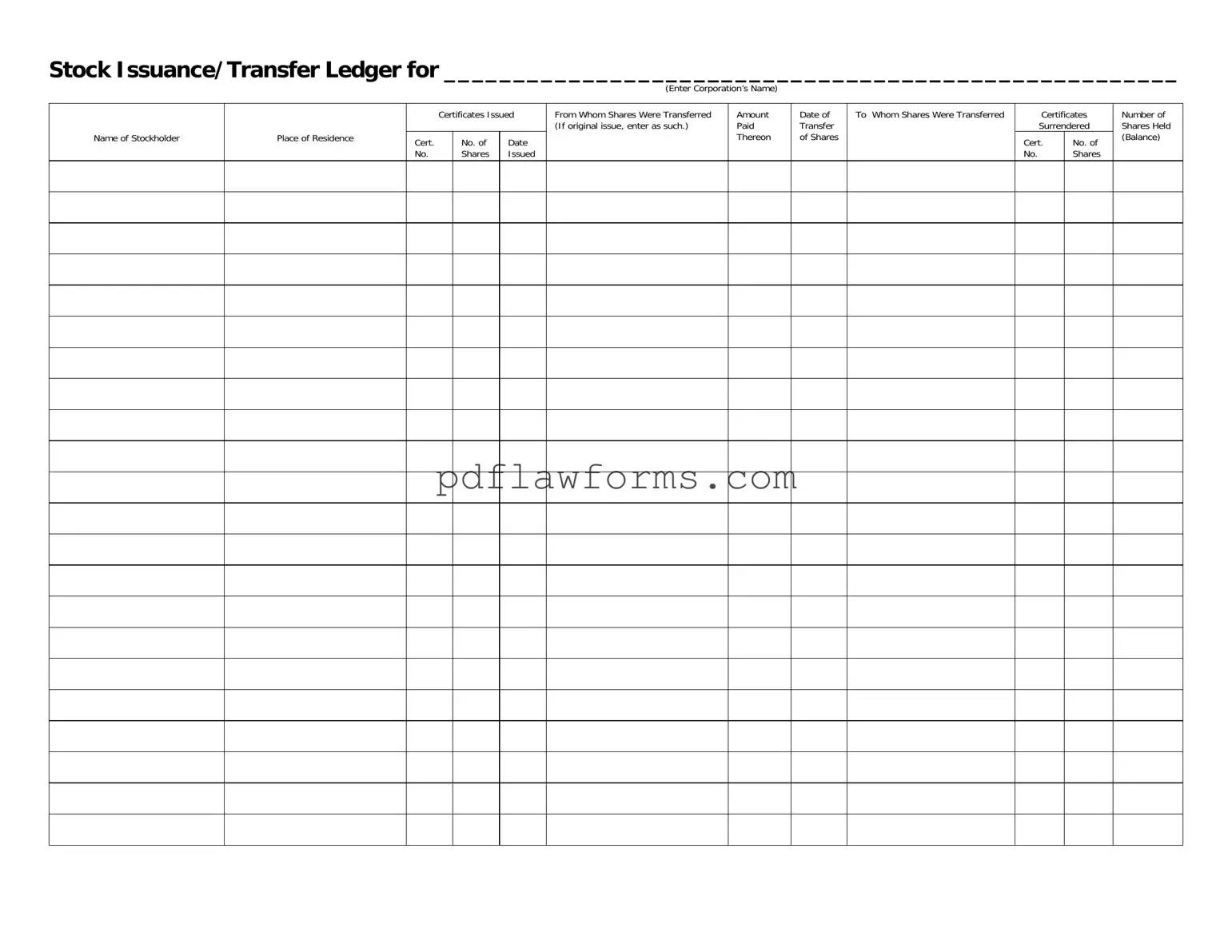

When filling out the Stock Transfer Ledger form, people often make a variety of mistakes that can lead to confusion or delays. One common error is failing to enter the corporation's name correctly. This is crucial, as the name identifies the entity involved in the stock transfer. A simple typo can create significant issues down the line.

Another frequent mistake is neglecting to provide accurate information about the stockholder's name and their place of residence. This information is essential for establishing ownership and ensuring that the correct individual is associated with the shares. Omitting or misspelling this information can complicate future transactions.

People also often overlook the section for certificates issued. Each stock certificate should be accounted for, and leaving this blank can create discrepancies in the records. It’s important to ensure that all certificates are listed and numbered correctly to maintain accurate documentation.

Additionally, individuals sometimes forget to include the date of transfer for the shares. This date is vital for tracking the timeline of ownership and can affect tax implications. Without this information, it may be difficult to determine when the transfer took place.

Another common oversight is not specifying the amount paid for the shares being transferred. This detail is necessary for establishing the value of the transaction. If this information is missing, it can lead to misunderstandings about the financial aspects of the transfer.

People might also mistakenly leave out the section that indicates to whom the shares were transferred. This is critical for ensuring that the new owner is properly recorded. Failing to fill this out can result in ownership disputes or challenges in future transactions.

Certificates surrendered should also be carefully noted. Some individuals forget to indicate the certificate numbers of the shares being surrendered. This oversight can create confusion, especially if the same shares are transferred multiple times.

Another area where mistakes often occur is in reporting the number of shares held after the transfer. This balance must reflect the correct total, accounting for any shares that have been issued or transferred. An inaccurate balance can lead to complications in ownership records.

It’s also important to remember that all fields need to be filled out completely. Leaving any sections blank can result in delays or rejections of the form. Each detail contributes to a clear and comprehensive record of the stock transfer.

Finally, individuals sometimes fail to double-check their work. A thorough review of the completed form can catch errors before submission. Taking the time to verify all entries can save a lot of trouble later on.