Fill Your Sample Tax Return Transcript Template

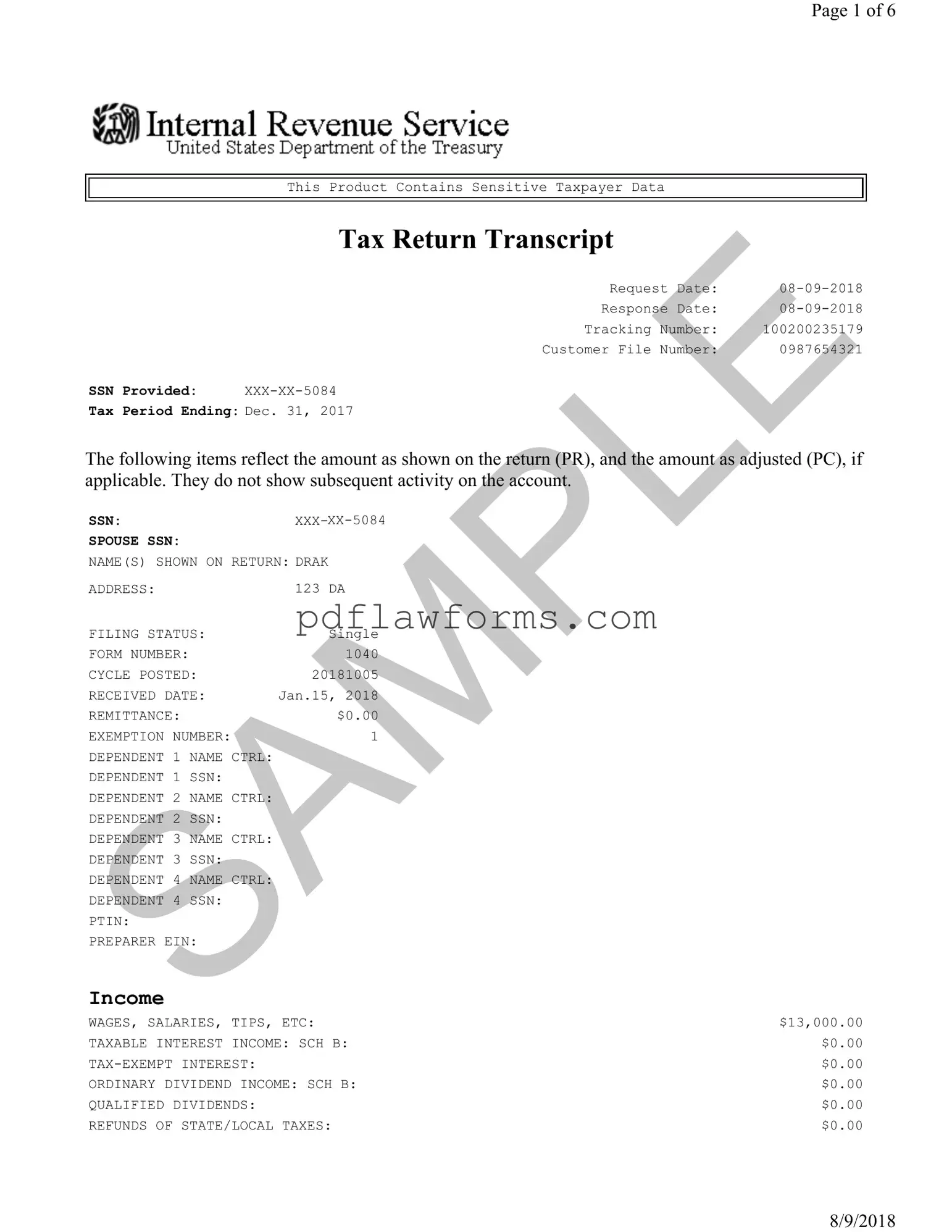

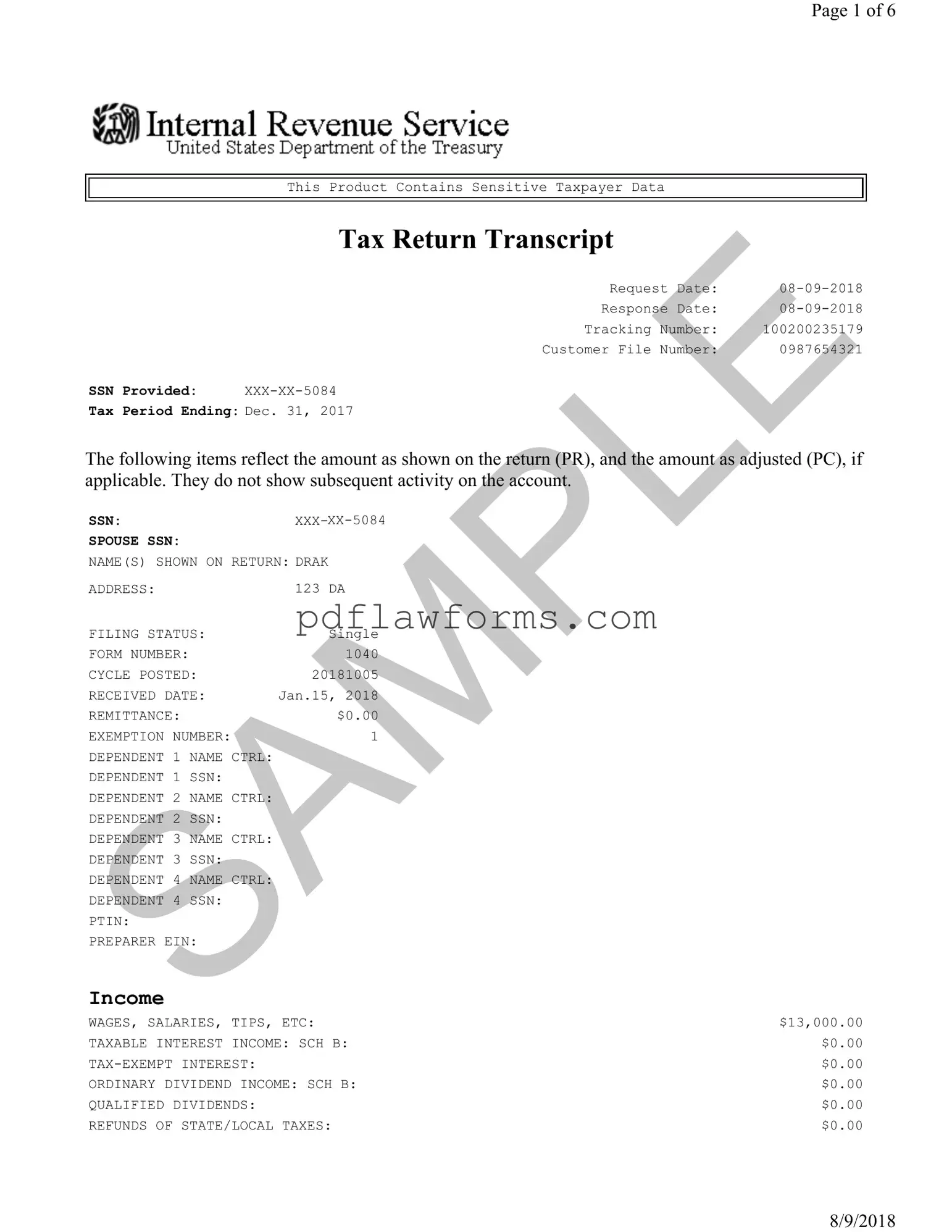

A Sample Tax Return Transcript is an official document that summarizes key information from your tax return. It provides a snapshot of your income, deductions, and tax credits as reported to the IRS. Understanding this form can be essential for various financial tasks, such as applying for loans or verifying income.

If you need to fill out the Sample Tax Return Transcript form, click the button below to get started.

Make My Document Online

Fill Your Sample Tax Return Transcript Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Sample Tax Return Transcript online, then download your file.

Make My Document Online

or

⇩ Sample Tax Return Transcript PDF