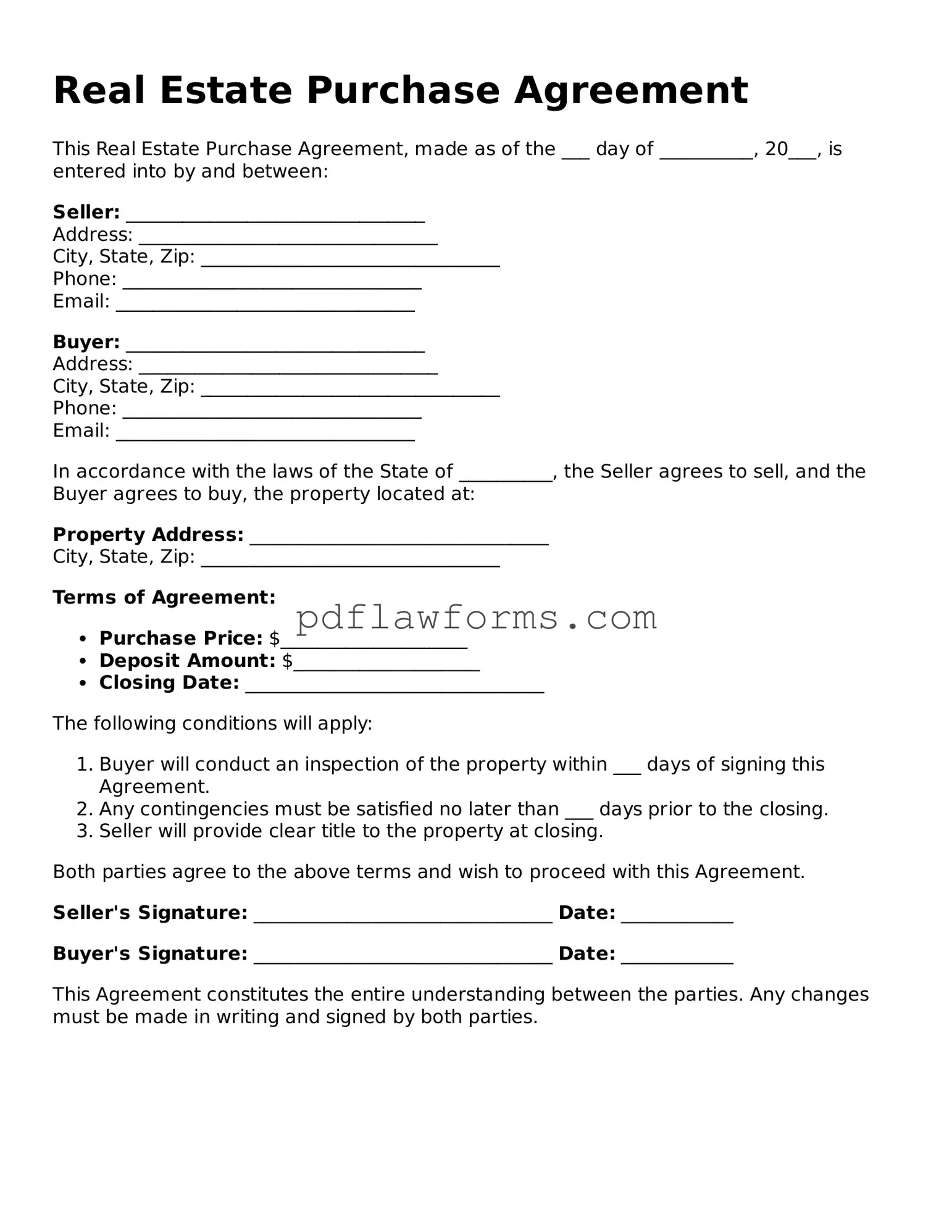

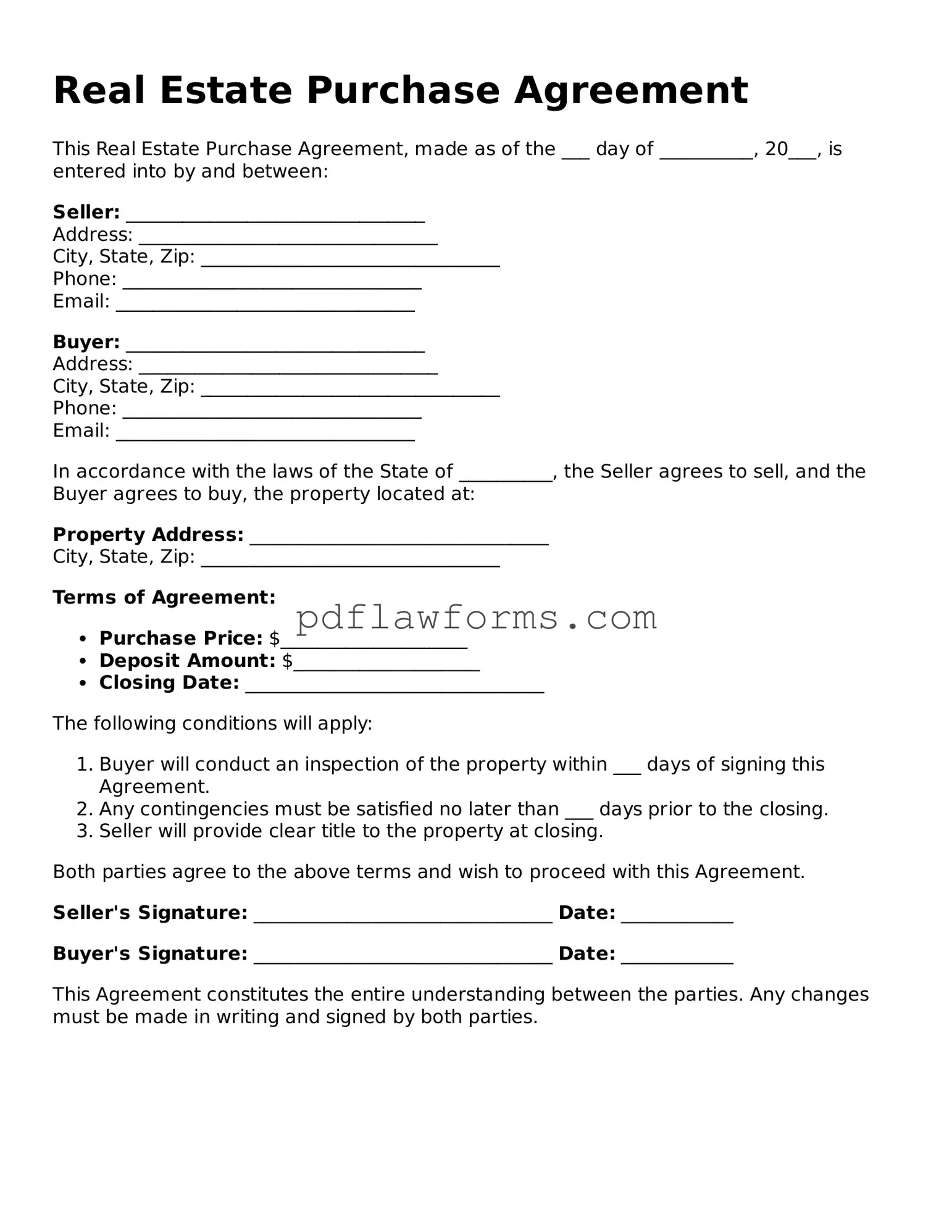

Official Real Estate Purchase Agreement Form

A Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of a property sale between a buyer and a seller. This essential form details the obligations of both parties, ensuring a smooth transaction process. To get started on your real estate journey, fill out the form by clicking the button below.

Make My Document Online

Official Real Estate Purchase Agreement Form

Make My Document Online

You’re halfway through — finish the form

Edit and complete Real Estate Purchase Agreement online, then download your file.

Make My Document Online

or

⇩ Real Estate Purchase Agreement PDF