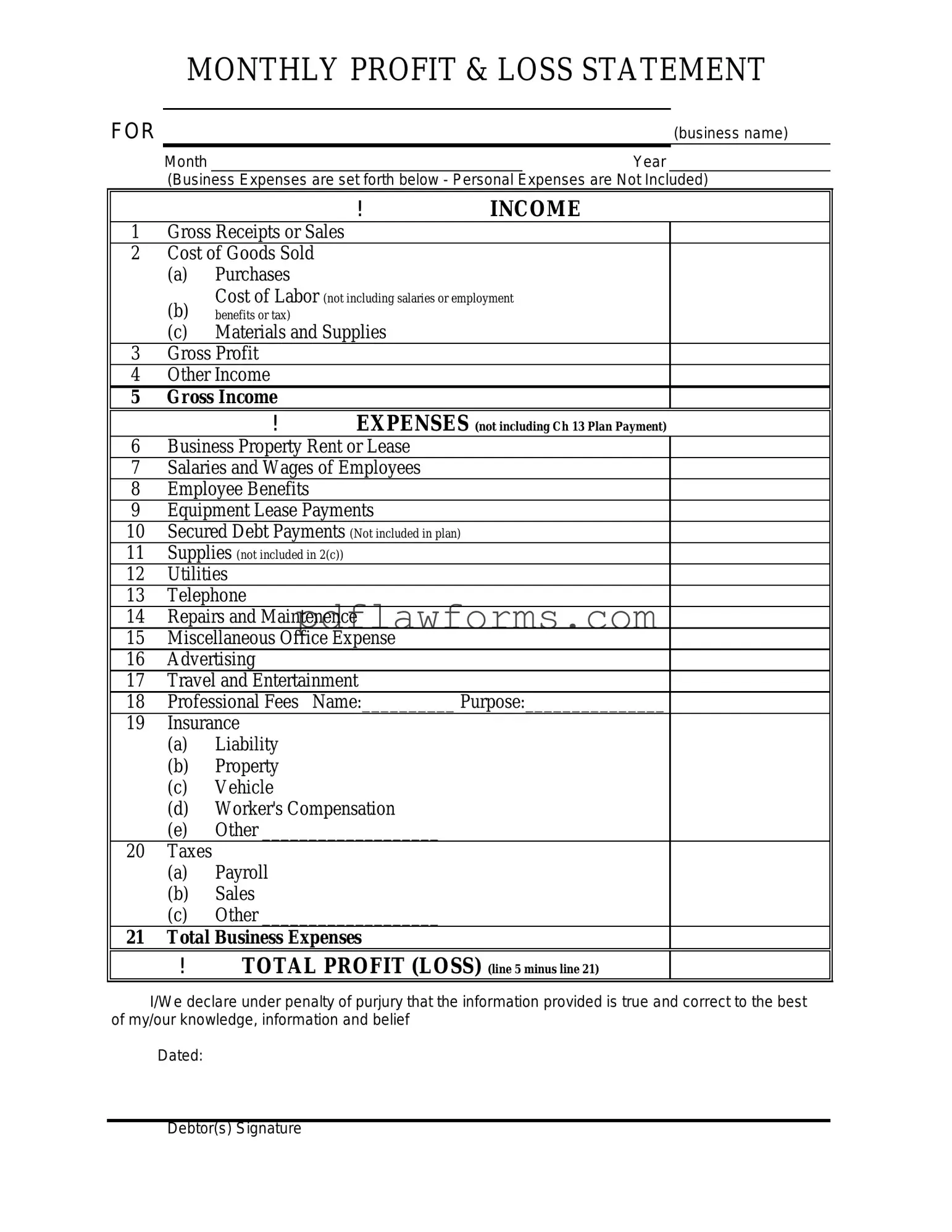

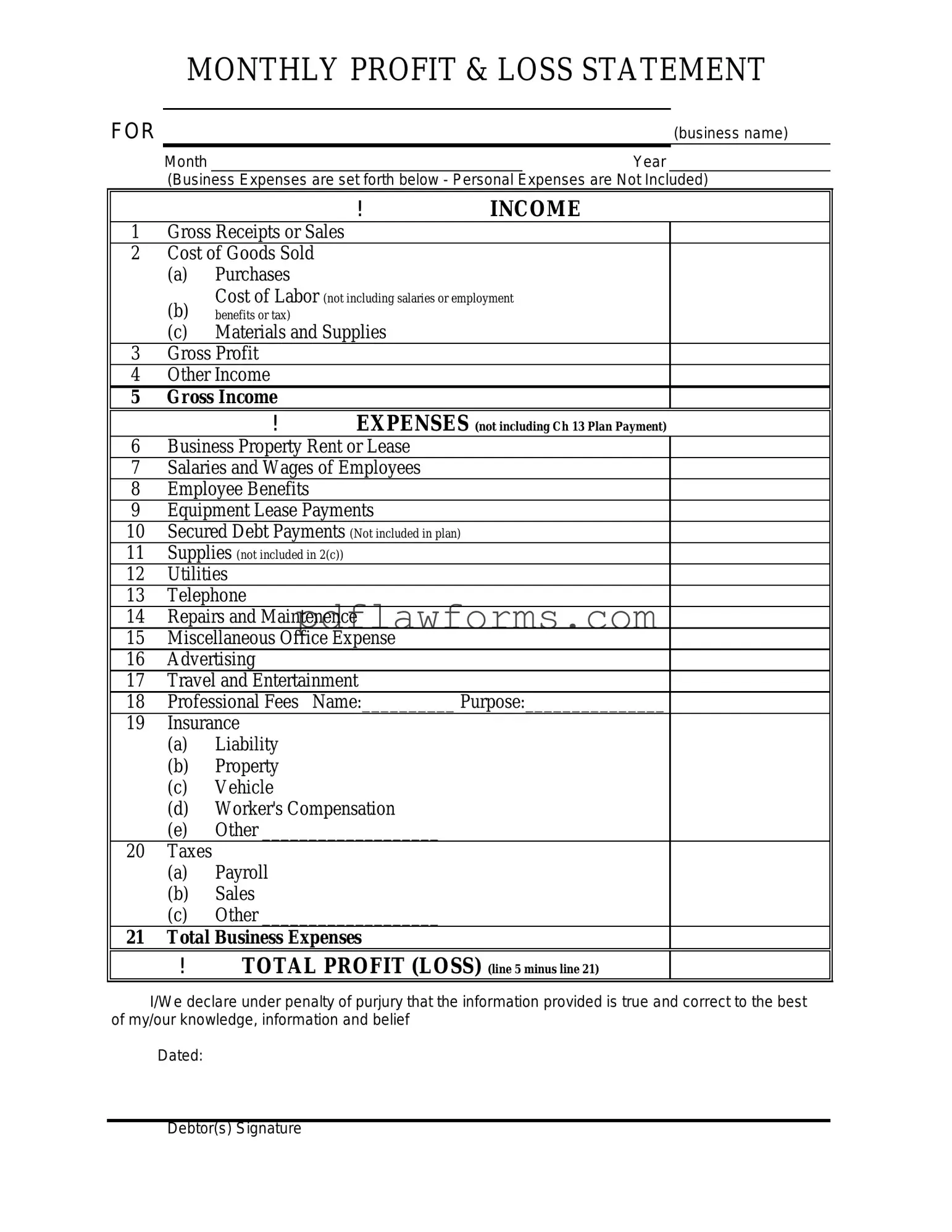

Fill Your Profit And Loss Template

The Profit and Loss form is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period. This form helps businesses understand their financial performance and make informed decisions. Ready to take control of your finances? Fill out the form by clicking the button below.

Make My Document Online

Fill Your Profit And Loss Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Profit And Loss online, then download your file.

Make My Document Online

or

⇩ Profit And Loss PDF