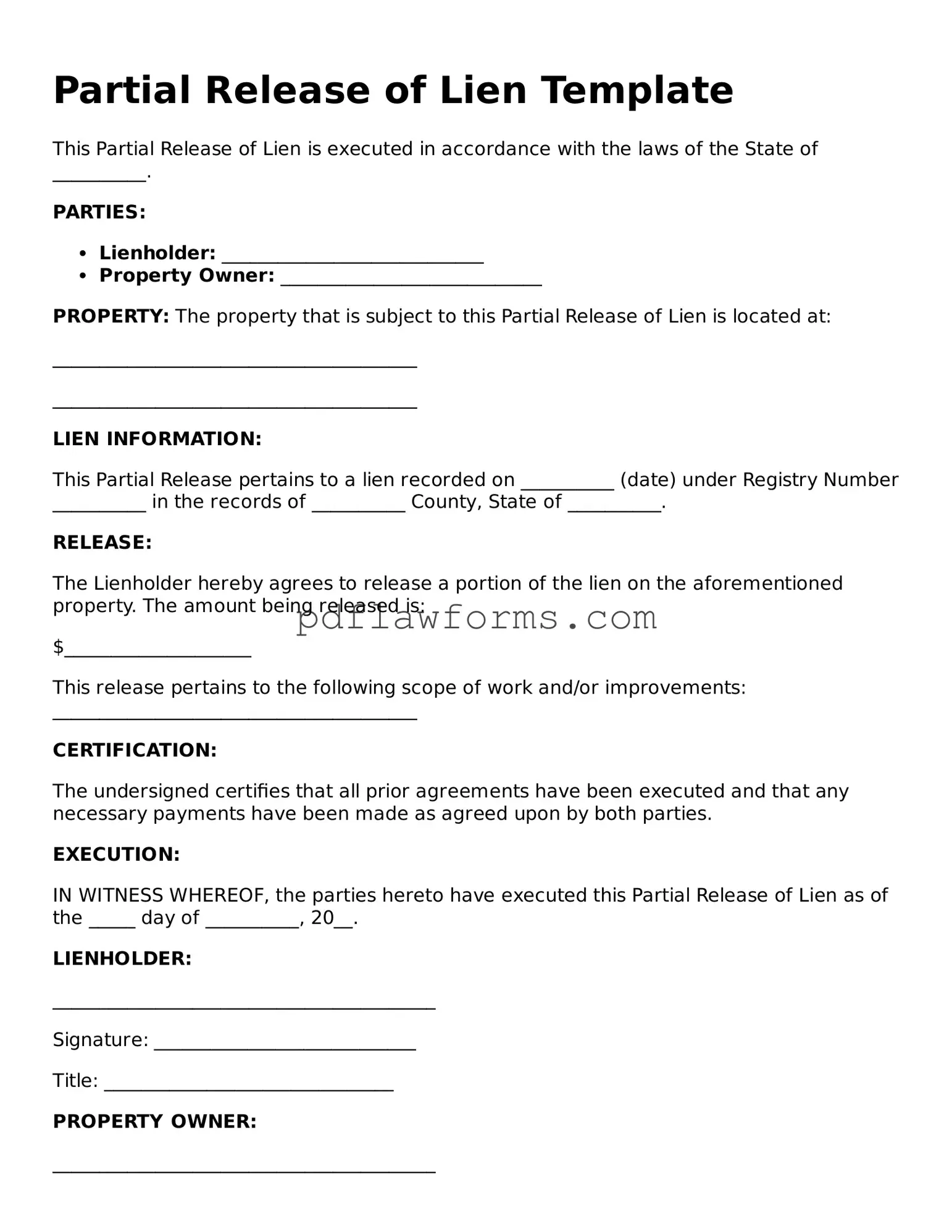

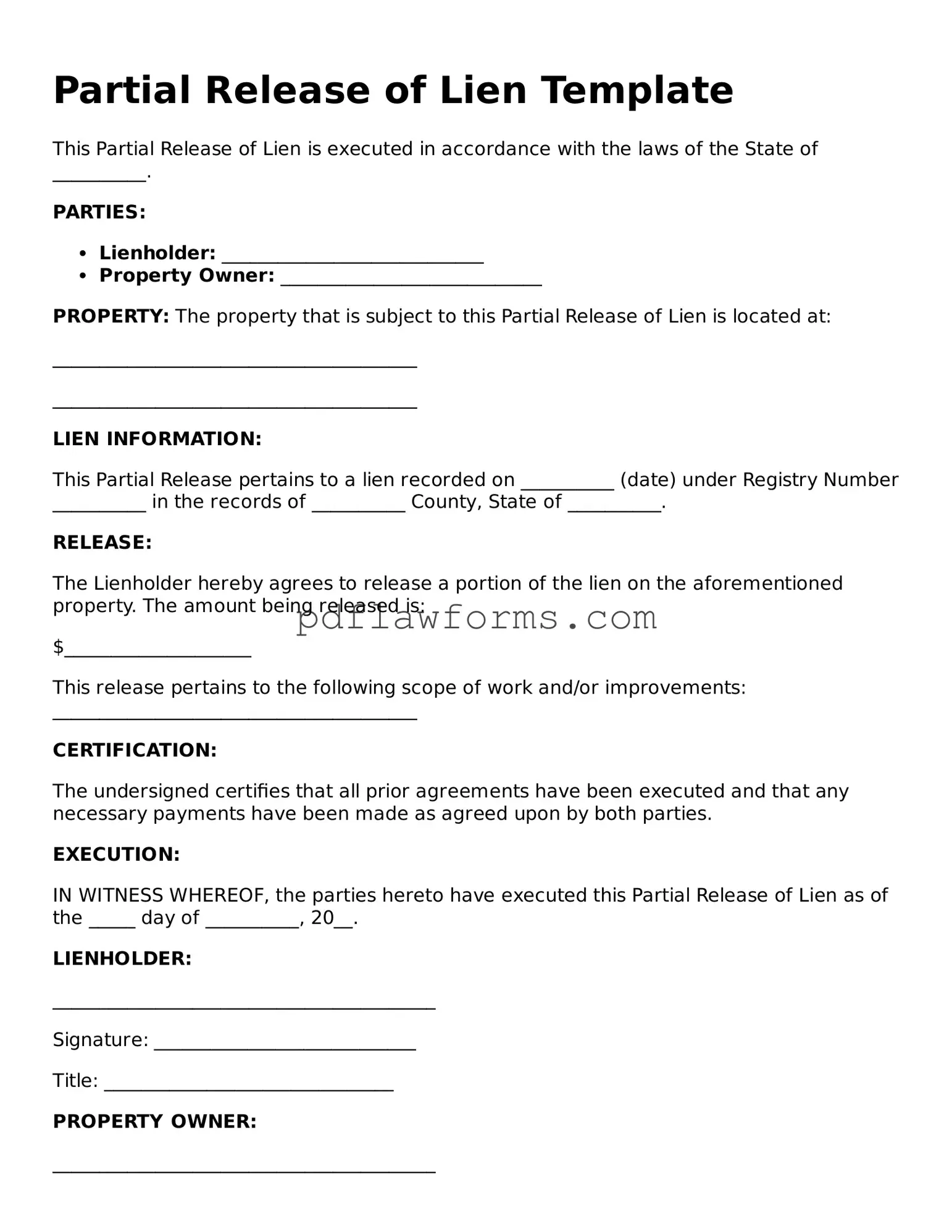

Official Partial Release of Lien Form

The Partial Release of Lien form is a legal document that allows a property owner to remove a lien on a portion of their property, often after a specific payment has been made. This form is essential for ensuring that contractors or suppliers are compensated while allowing property owners to maintain clear title to their property. To learn more about how to fill out this form, click the button below.

Make My Document Online

Official Partial Release of Lien Form

Make My Document Online

You’re halfway through — finish the form

Edit and complete Partial Release of Lien online, then download your file.

Make My Document Online

or

⇩ Partial Release of Lien PDF