Fill Your P 45 It Template

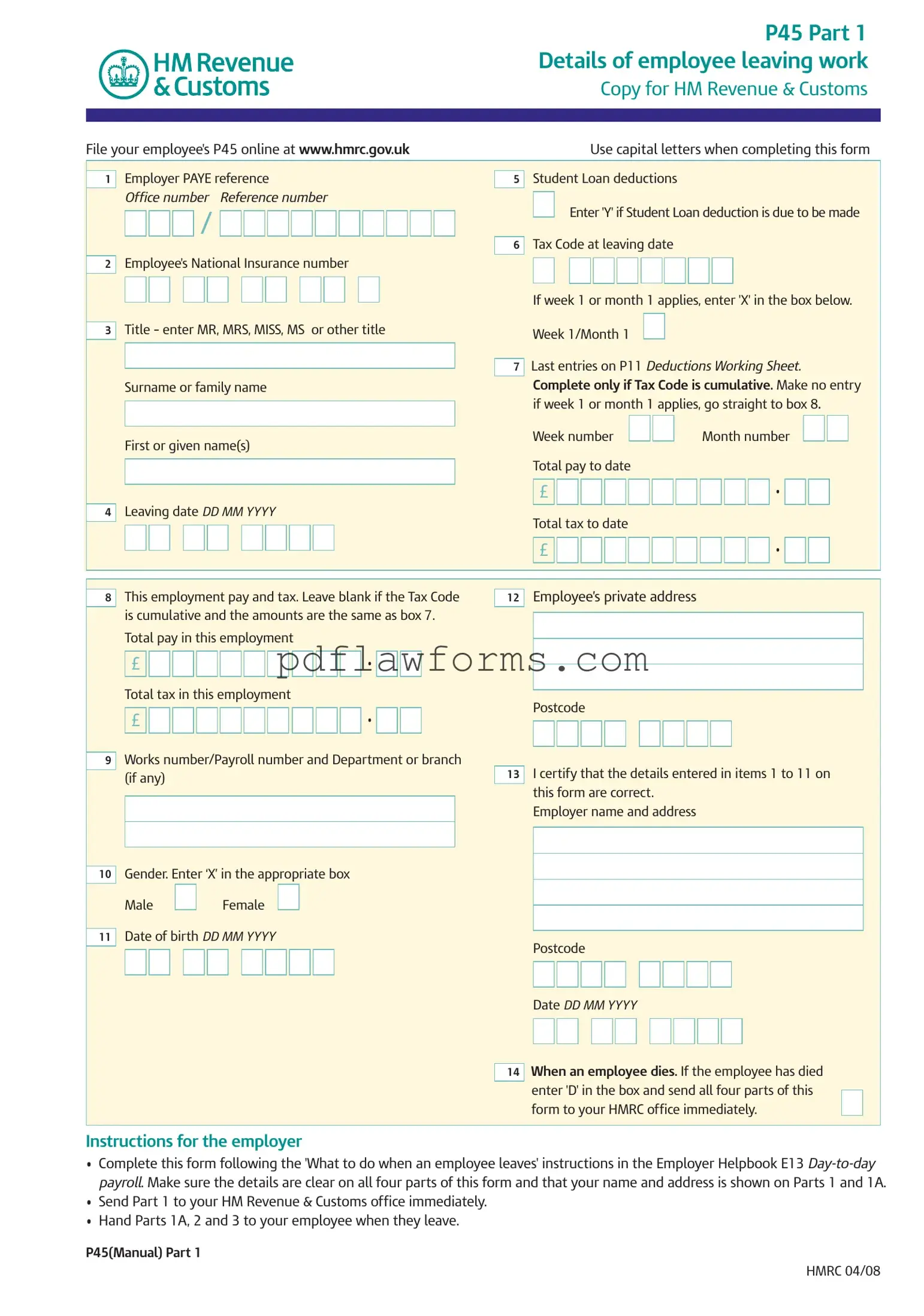

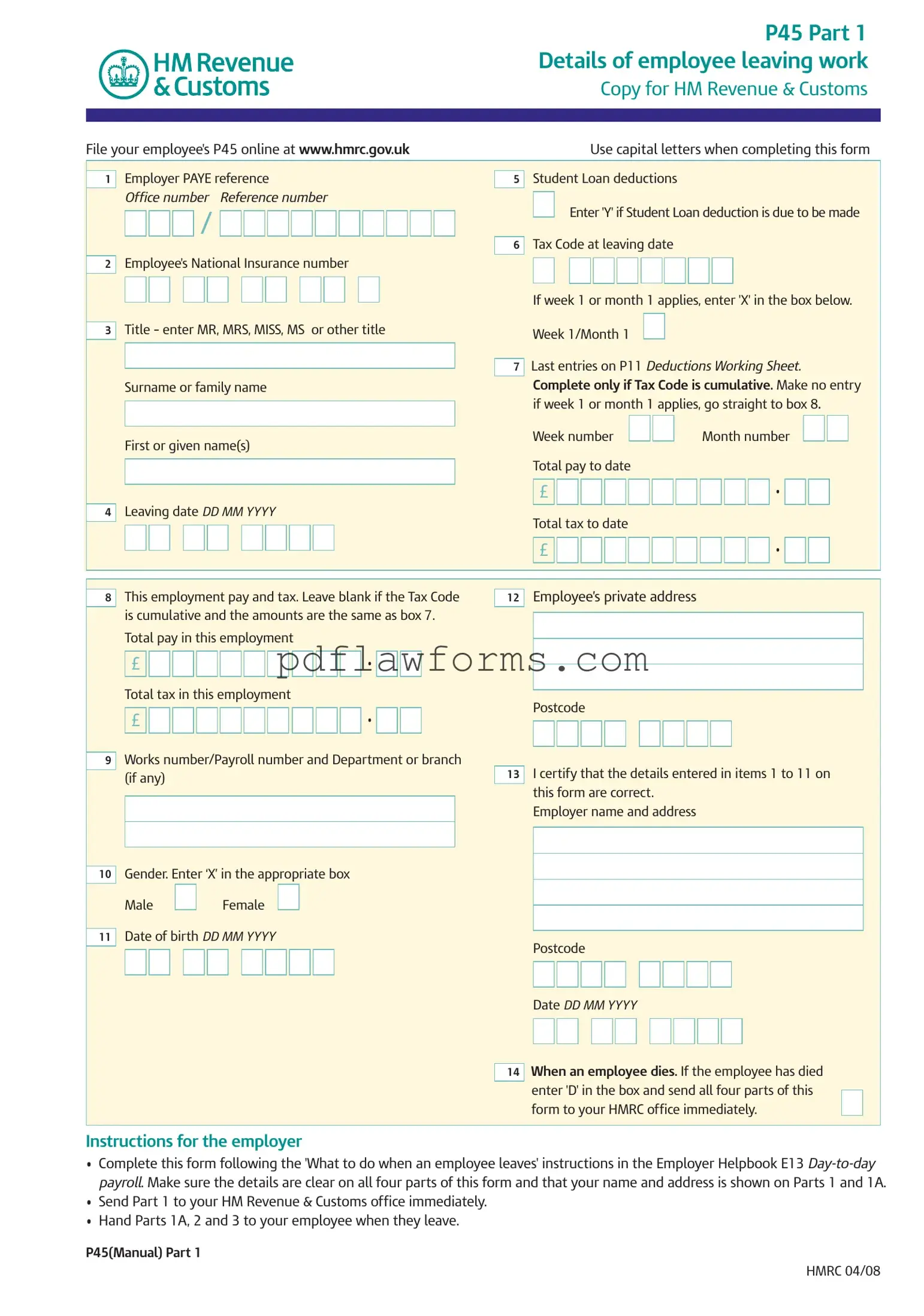

The P45 form is a crucial document issued when an employee leaves a job, detailing their pay and tax contributions. This form is divided into three parts, with each part serving specific purposes for the employer, employee, and new employer. It is essential to complete and submit the P45 accurately to ensure proper tax handling and compliance with HM Revenue & Customs.

To fill out the P45 form, please click the button below.

Make My Document Online

Fill Your P 45 It Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete P 45 It online, then download your file.

Make My Document Online

or

⇩ P 45 It PDF