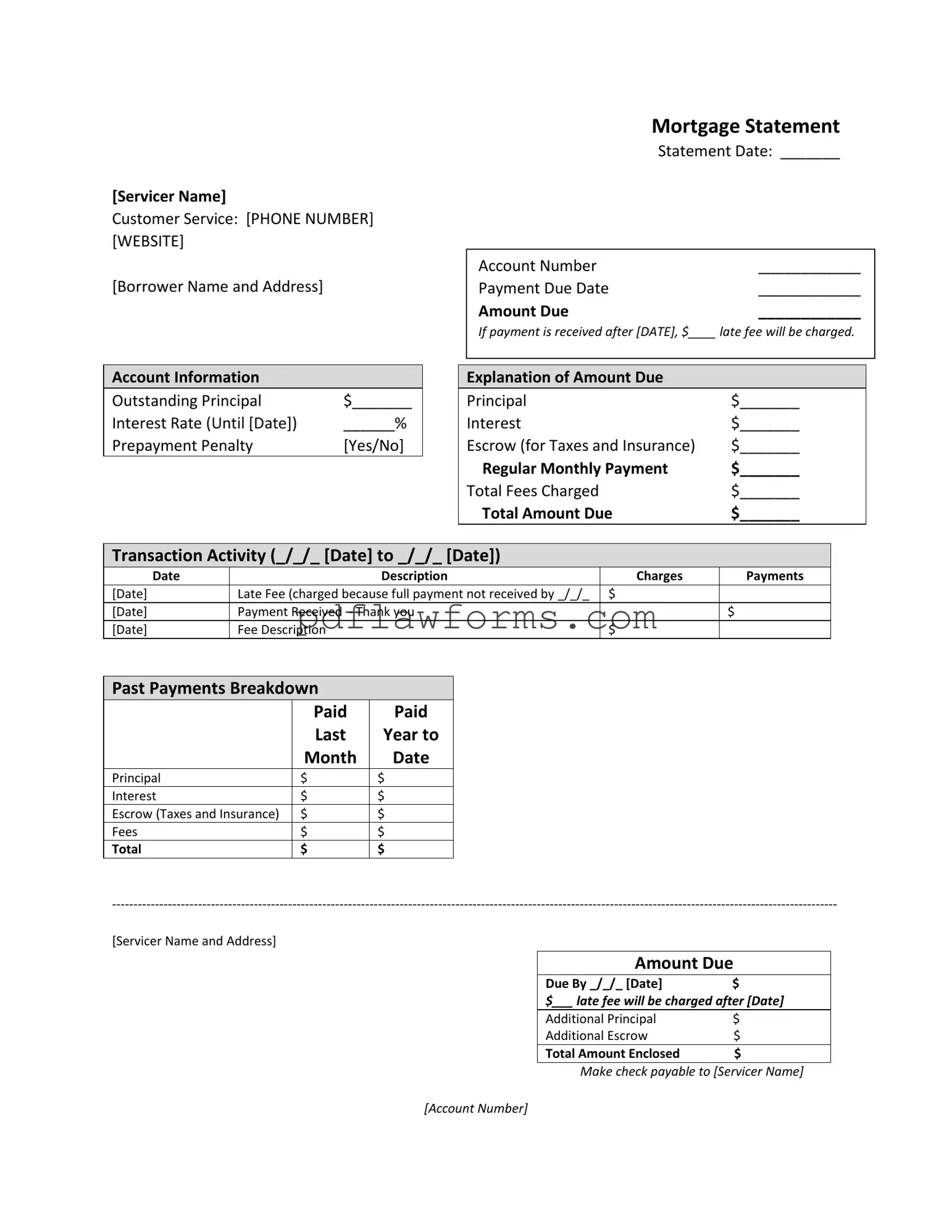

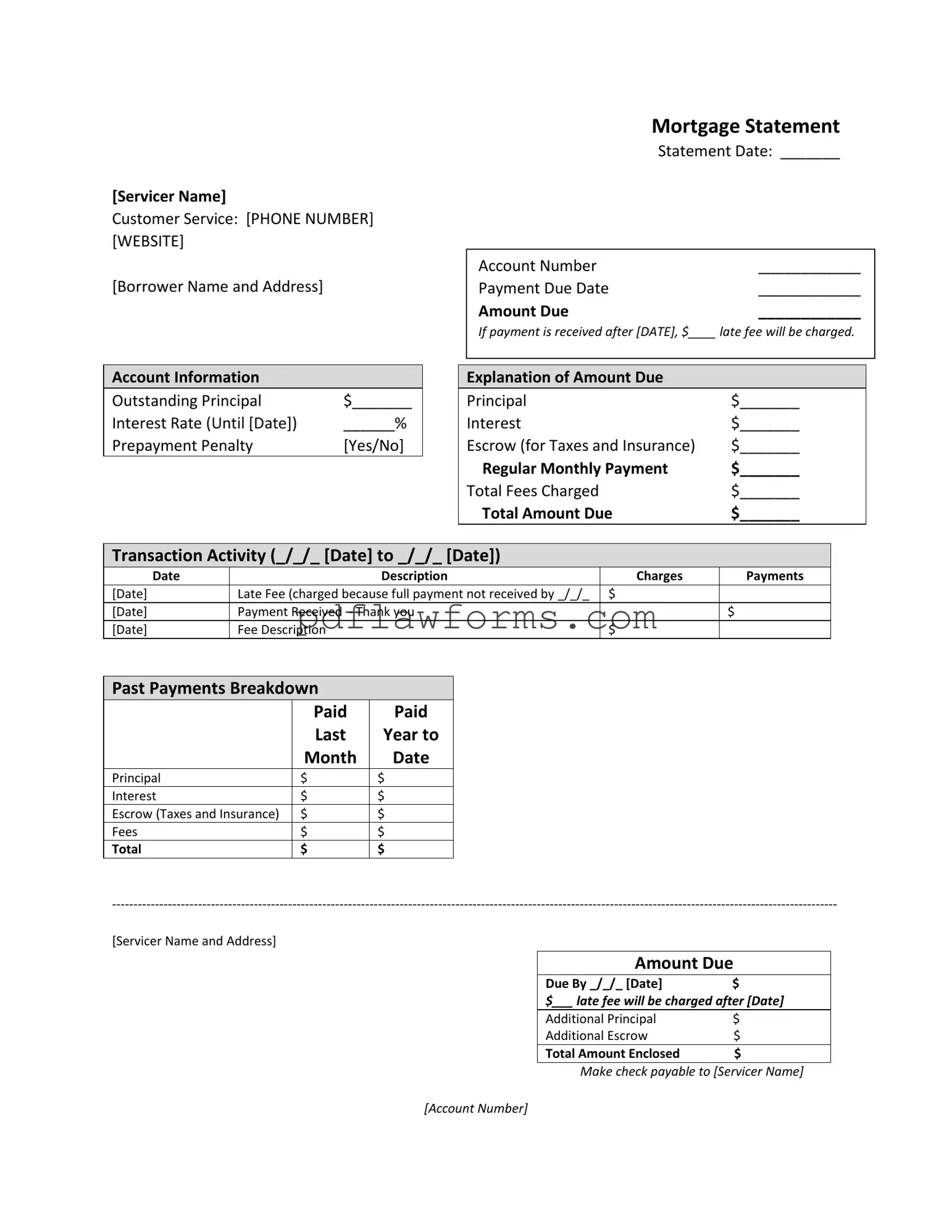

Completing a Mortgage Statement form can be a daunting task, and mistakes can lead to confusion and potential financial consequences. One common mistake is failing to provide accurate personal information. It is essential to ensure that the borrower name and address are entered correctly, as any discrepancies can delay processing and communication.

Another frequent error involves overlooking the account number. This number is crucial for identifying the loan and ensuring that payments are applied correctly. Omitting or miswriting the account number can lead to misdirected payments and unnecessary fees.

People often neglect to check the payment due date. This date is critical for avoiding late fees. If the form is filled out incorrectly, it may lead to missed payments and additional charges. Always verify the due date listed on the statement to ensure timely payments.

Many individuals also fail to review the amount due section carefully. It is important to confirm that the total amount reflects all charges, including principal, interest, and escrow. Errors in this section can result in underpayment, which may lead to penalties.

Another common mistake is misunderstanding the prepayment penalty section. Borrowers should clarify whether their mortgage includes such a penalty. Failing to understand this could result in unexpected costs if they decide to pay off their loan early.

In the transaction activity section, people often miss reviewing the charges and payments accurately. It is vital to ensure that all transactions are recorded correctly. Discrepancies can lead to confusion about the current balance and payment history.

When it comes to past payments, individuals sometimes overlook the breakdown of payments made over the last year. This information is essential for tracking payment history and ensuring that all amounts have been credited appropriately.

Another mistake involves ignoring the delinquency notice. This section provides important information about the status of the mortgage. If the notice indicates that payments are overdue, immediate action is required to avoid further penalties or foreclosure.

People frequently forget to include the total amount enclosed when sending payments. This can lead to partial payments being applied, which are not credited to the mortgage until the full amount is received. Always double-check that the total matches what is due.

Lastly, many borrowers overlook the information about financial assistance available for those experiencing difficulties. This section can provide valuable resources and support, helping individuals navigate challenging financial situations.