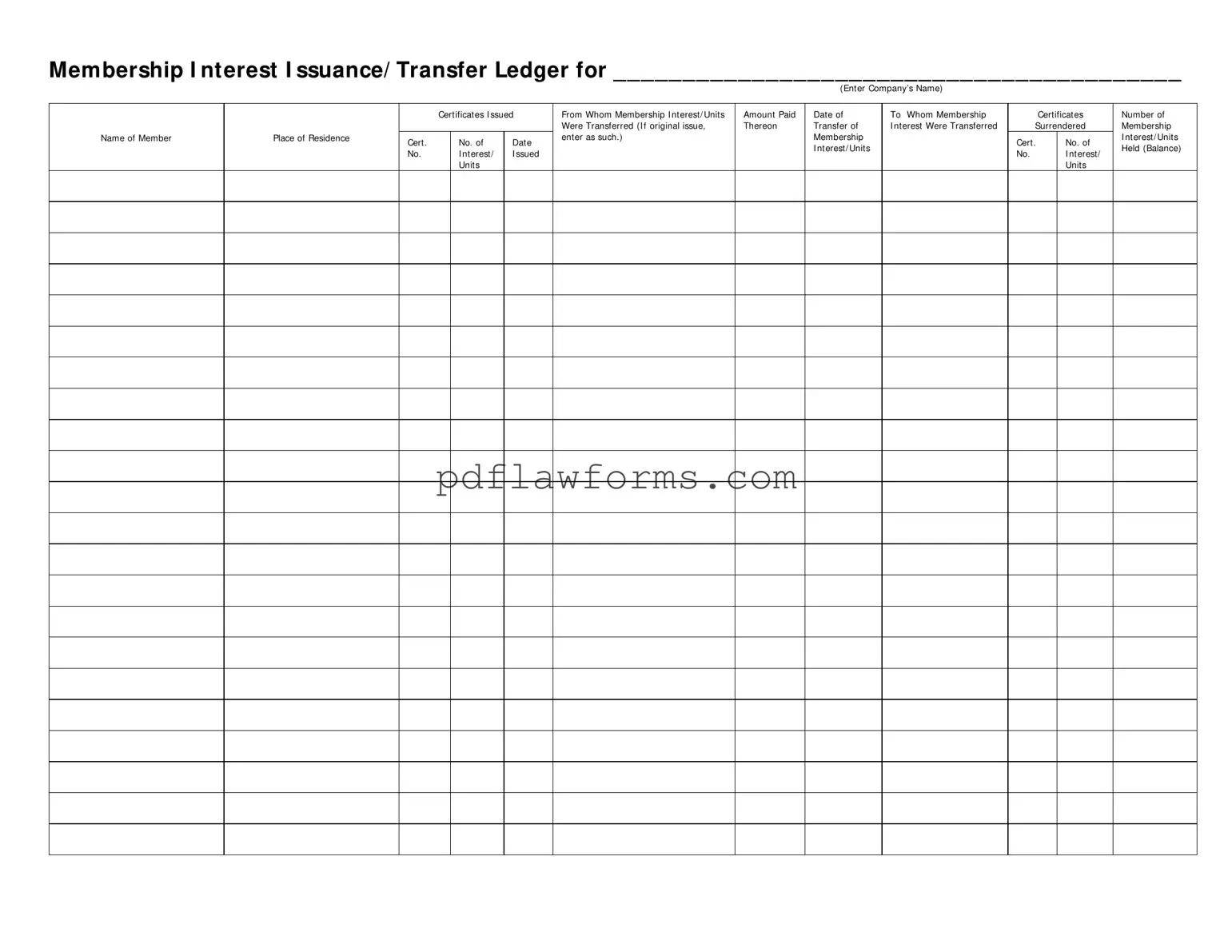

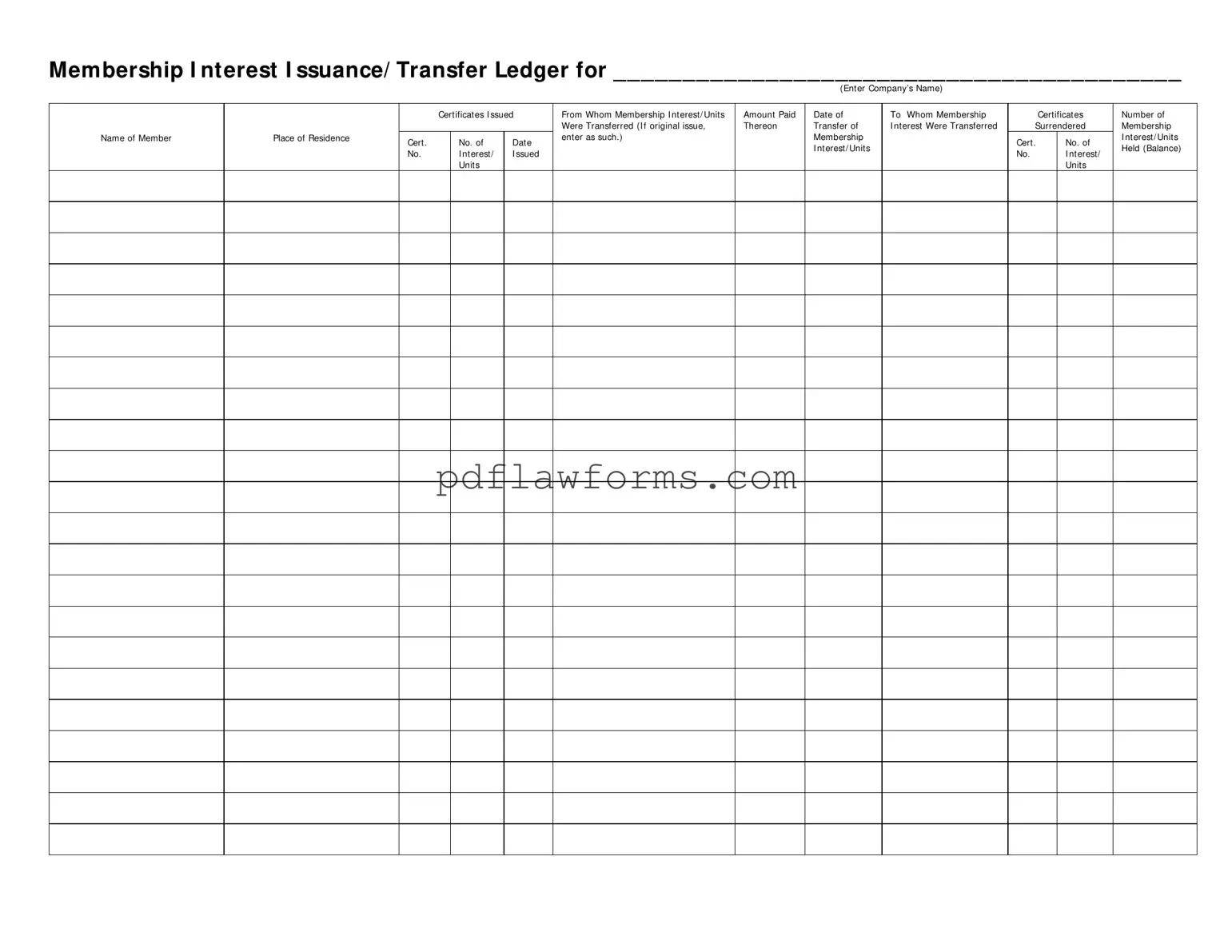

Fill Your Membership Ledger Template

The Membership Ledger form is a crucial document that tracks the issuance and transfer of membership interests within a company. It serves as a comprehensive record, detailing information such as the names of members, the amounts paid, and the dates of transfers. To ensure accurate record-keeping and compliance, it's important to fill out this form correctly; you can start by clicking the button below.

Make My Document Online

Fill Your Membership Ledger Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Membership Ledger online, then download your file.

Make My Document Online

or

⇩ Membership Ledger PDF