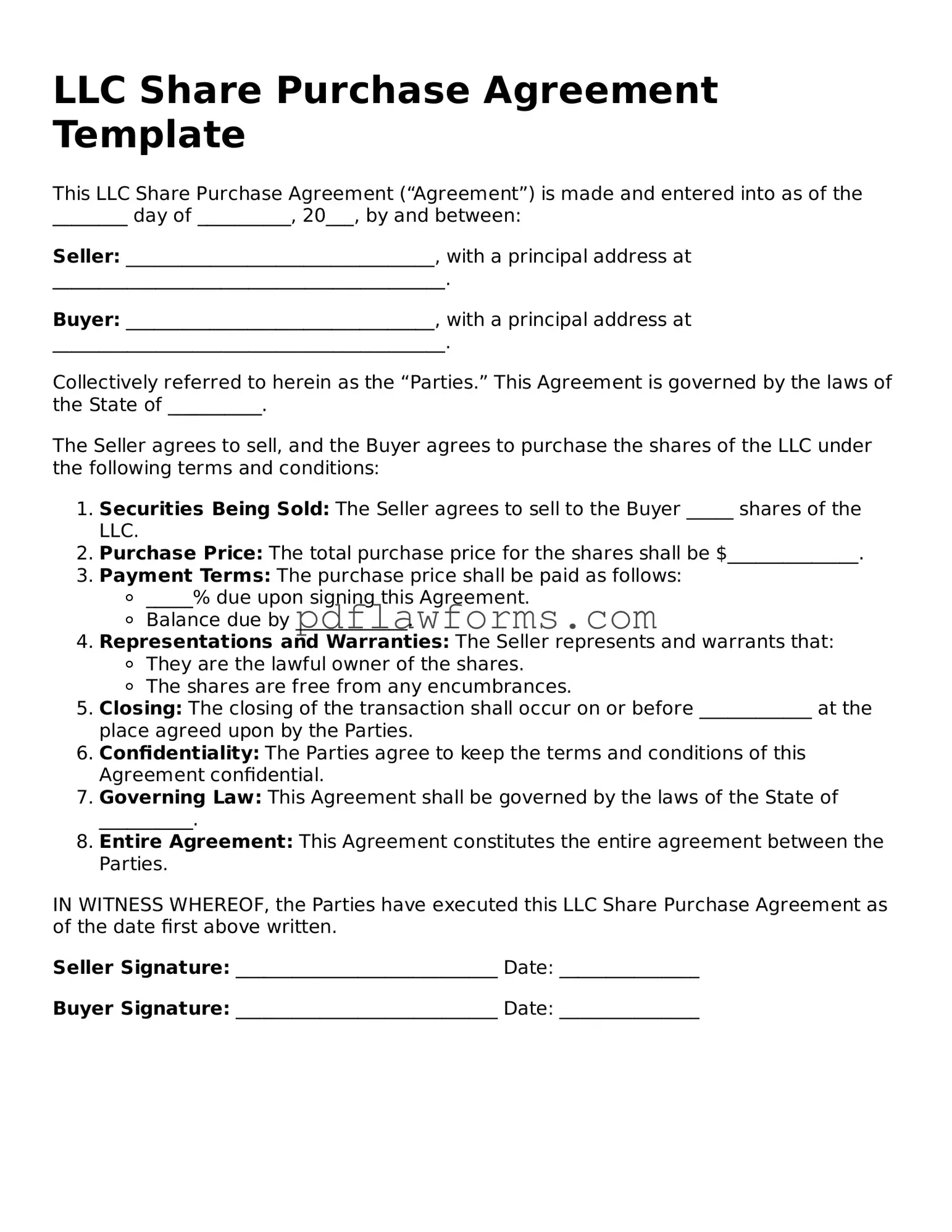

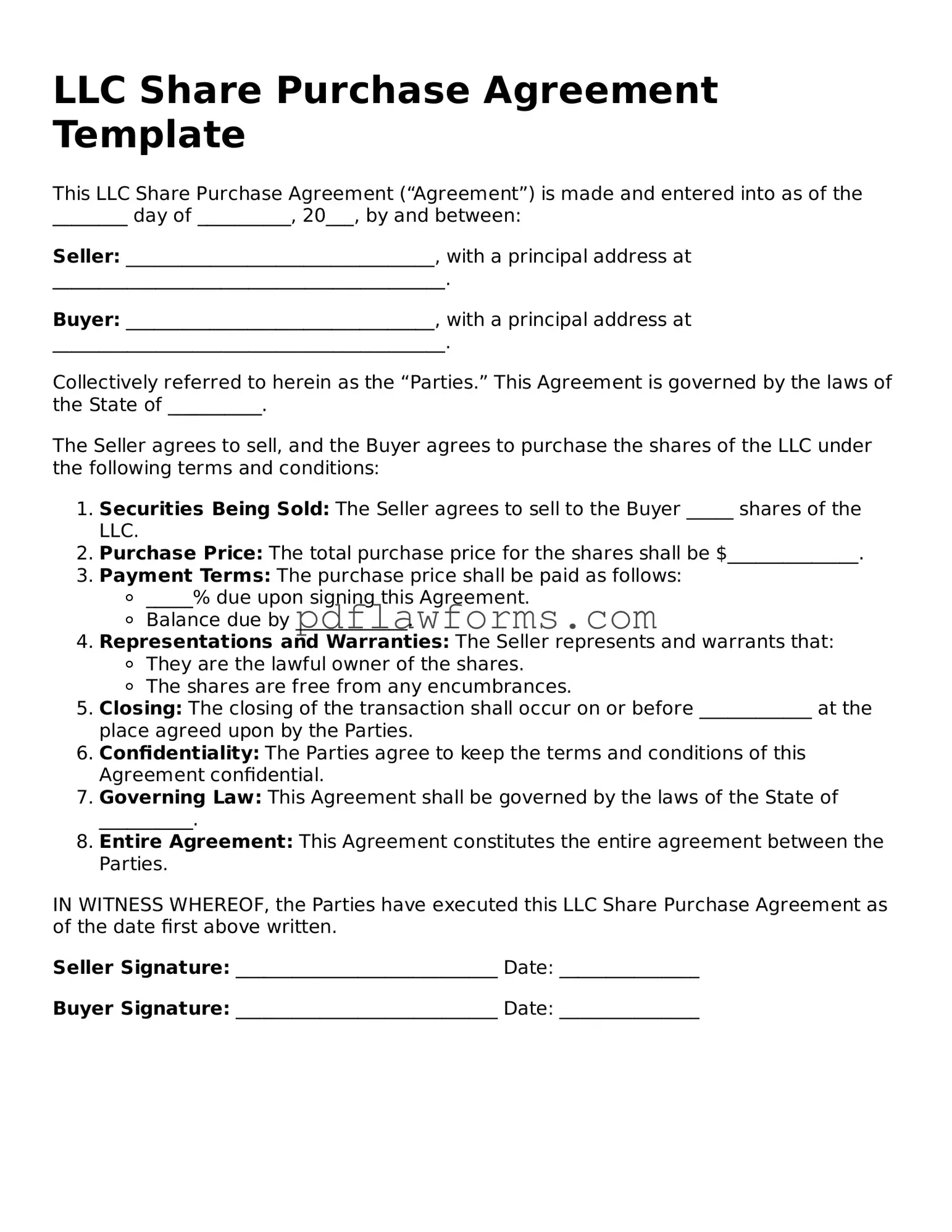

When individuals fill out the LLC Share Purchase Agreement form, they often overlook critical details that can lead to complications down the line. One common mistake is failing to accurately identify the parties involved. This includes not only the buyer and seller but also the LLC itself. Missing or incorrect names can create confusion and potentially invalidate the agreement.

Another frequent error involves the description of the shares being sold. Buyers and sellers may neglect to specify the class of shares, the number of shares, or any restrictions on transferability. This lack of clarity can result in disputes about ownership and rights associated with the shares.

People often misinterpret the payment terms as well. It is essential to clearly outline the purchase price and the method of payment. If these details are vague or incomplete, it may lead to misunderstandings regarding when and how payment should be made.

Additionally, individuals sometimes forget to include contingencies in the agreement. Contingencies protect both parties by outlining conditions that must be met for the sale to proceed. Without them, buyers may find themselves in a position where they have committed to a purchase without adequate protections.

Another pitfall is the failure to address the closing process. The agreement should specify when and where the closing will take place, as well as any necessary documents that need to be exchanged. Omitting these details can create logistical challenges and delays.

People also tend to overlook the importance of including representations and warranties. These statements assure the buyer about the seller's authority to sell the shares and the condition of the LLC. Without these assurances, the buyer may face unexpected liabilities.

In some cases, individuals might neglect to consult legal counsel before finalizing the agreement. This can lead to significant oversights and potential legal issues. Having a lawyer review the document can help ensure that all necessary terms are included and that the agreement complies with state laws.

Lastly, individuals often fail to keep a copy of the signed agreement for their records. This oversight can create difficulties if disputes arise in the future. Maintaining a clear record is crucial for both parties to ensure that they can reference the agreement as needed.