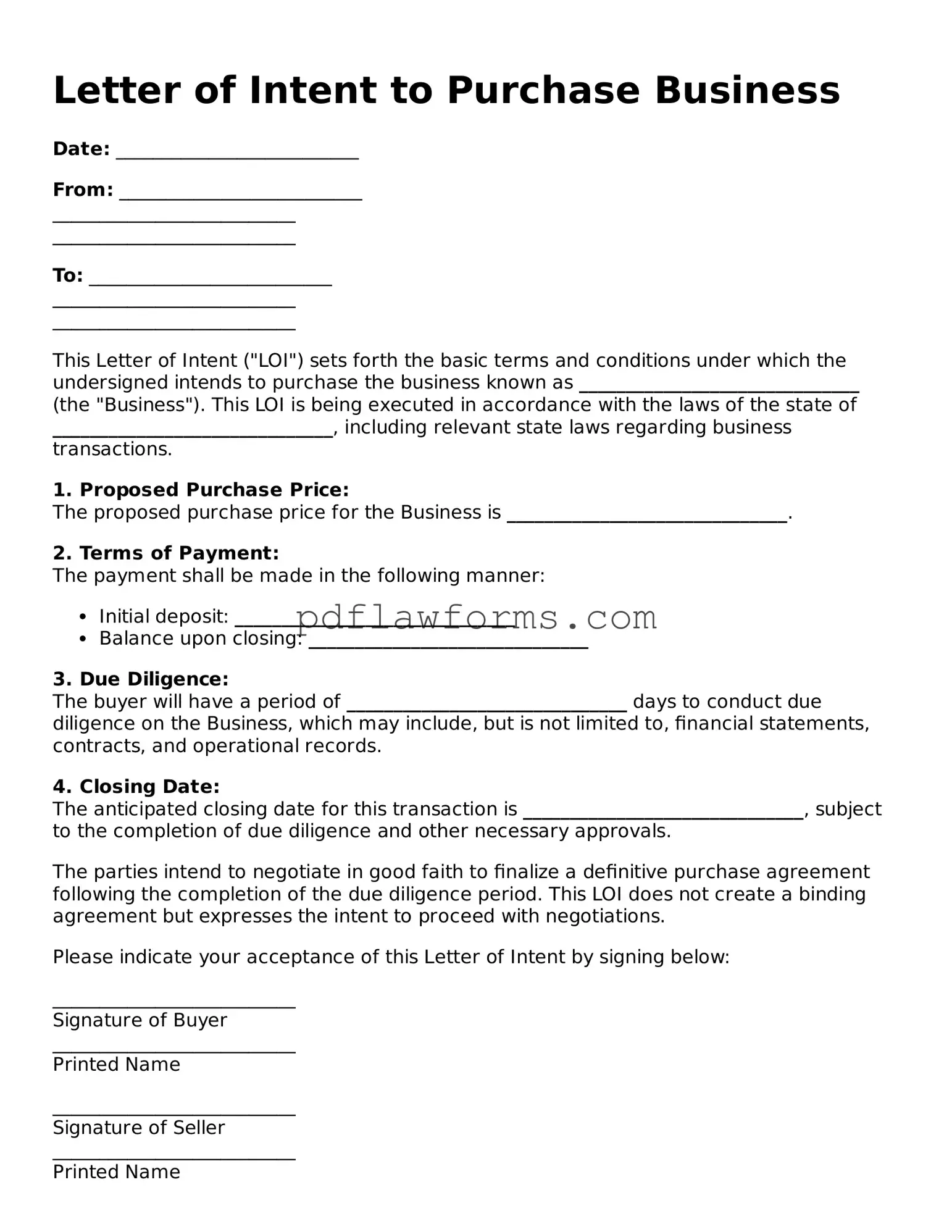

Official Letter of Intent to Purchase Business Form

A Letter of Intent to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller regarding the sale of a business. This form serves as a foundation for negotiating terms and conditions before finalizing the sale. Understanding its importance can help ensure a smoother transaction process.

Ready to take the next step? Fill out the form by clicking the button below.

Make My Document Online

Official Letter of Intent to Purchase Business Form

Make My Document Online

You’re halfway through — finish the form

Edit and complete Letter of Intent to Purchase Business online, then download your file.

Make My Document Online

or

⇩ Letter of Intent to Purchase Business PDF