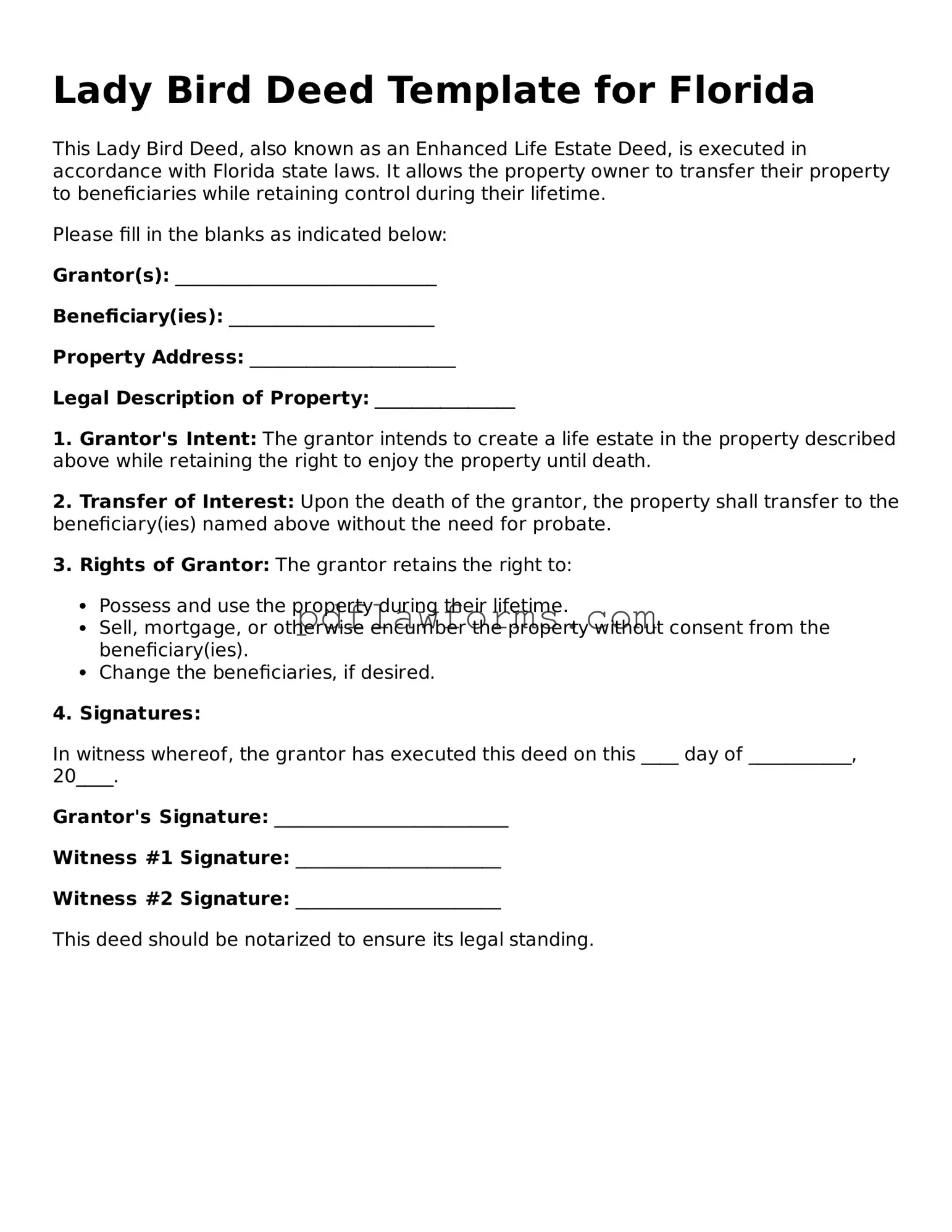

Filling out a Lady Bird Deed form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to include all required information. Each section of the form must be completed accurately, including the names of the grantor and grantee, property description, and any specific terms. Omitting even a small detail can render the deed invalid.

Another mistake involves the use of incorrect names. It's essential to ensure that the names of the individuals involved are spelled correctly and match their legal documents. Any discrepancies can cause issues when the deed is executed or later challenged. Additionally, using nicknames instead of legal names can lead to confusion and potential legal disputes.

People often overlook the importance of property descriptions. The property must be described in a way that clearly identifies it. This usually means including the legal description, which can be found in previous deeds or property tax records. Relying on vague descriptions can lead to misunderstandings about what property is actually being transferred.

Not having the deed notarized is another common error. A Lady Bird Deed requires notarization to be legally binding. Failing to get the necessary signatures from a notary public can invalidate the deed, leaving the property transfer unrecognized by the courts.

Some individuals mistakenly believe that they can fill out the form without any assistance. While it may seem simple, consulting with a legal professional can help ensure that all aspects of the deed are handled correctly. Ignoring this step may lead to more significant issues later on.

Another pitfall is not understanding the implications of the Lady Bird Deed itself. Many people fill out the form without fully grasping how it affects their estate planning. It's crucial to understand that this deed allows for the transfer of property while retaining certain rights, which can impact tax implications and eligibility for government benefits.

In some cases, people forget to include contingencies or specific conditions. If there are any particular wishes regarding the property or the transfer process, they should be clearly stated in the deed. Leaving these details out can create confusion or disputes among heirs.

Moreover, failing to review the completed form before submission is a common oversight. Double-checking all entries for accuracy can save time and prevent issues. A simple review can catch mistakes that might otherwise go unnoticed.

Another mistake involves not recording the deed after it has been signed and notarized. Once the Lady Bird Deed is complete, it must be filed with the appropriate county office to be legally recognized. Neglecting this step can lead to complications when the time comes to transfer ownership.

Lastly, some individuals may not consider the tax implications of using a Lady Bird Deed. Understanding how this type of deed affects property taxes and potential capital gains taxes is essential. Failing to account for these factors can result in unexpected financial consequences later.