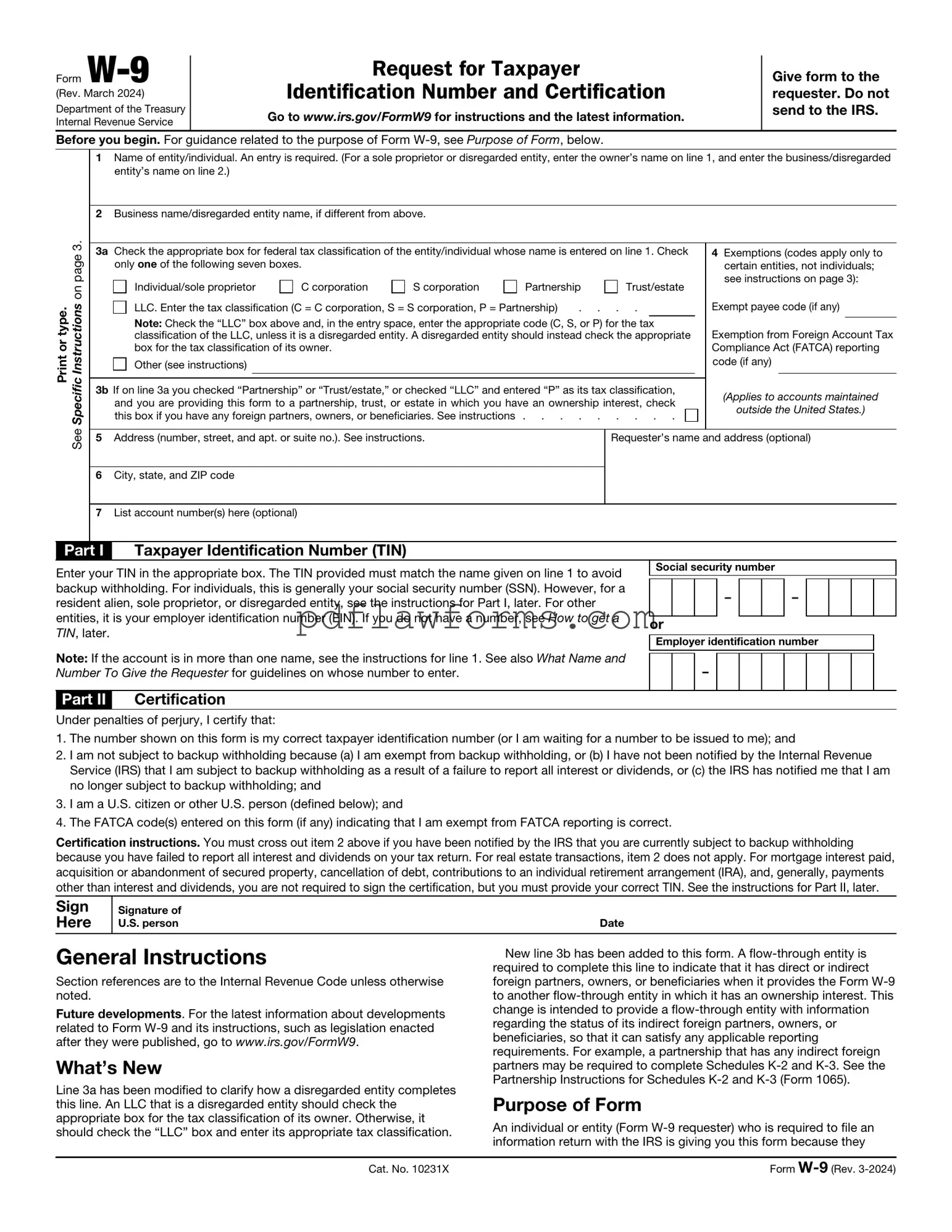

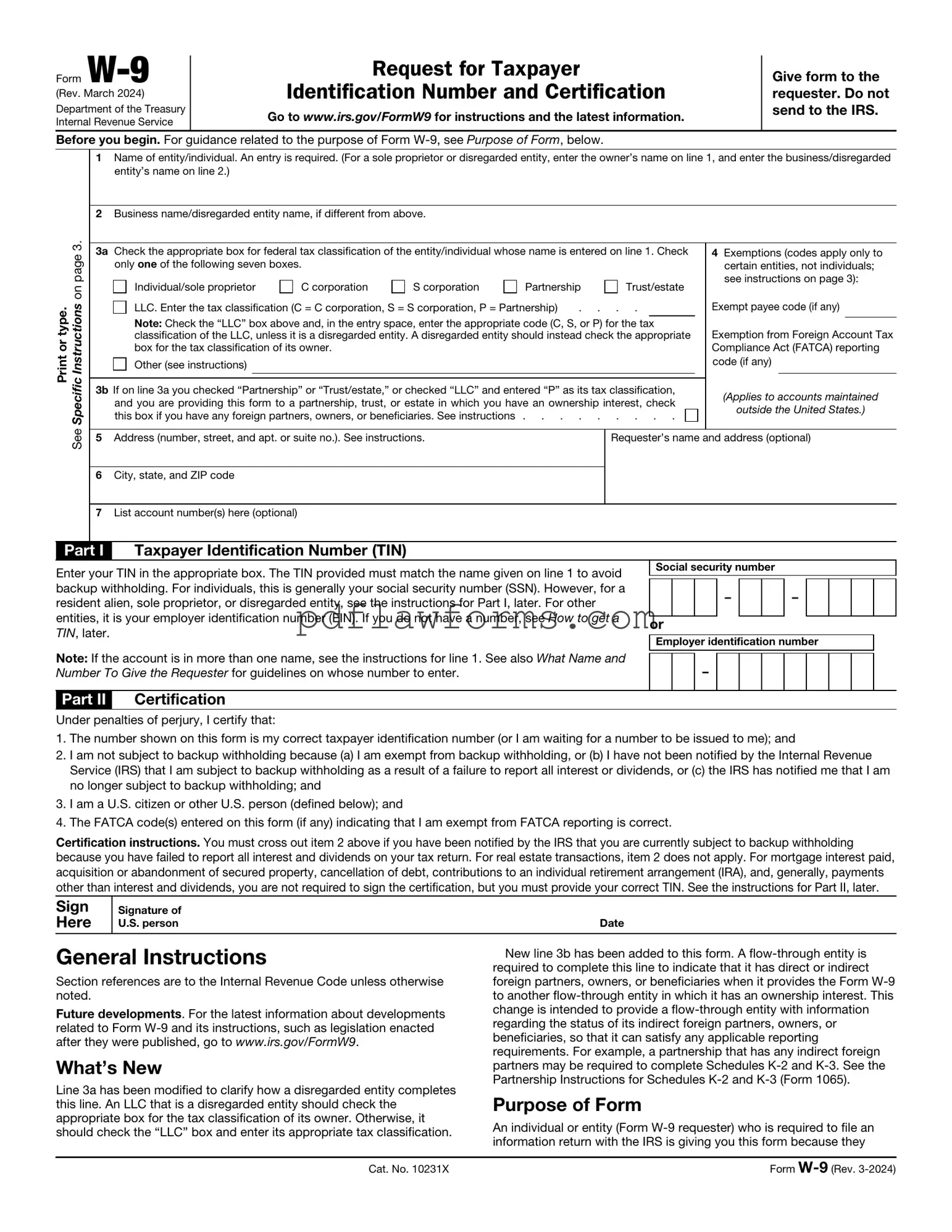

Filling out the IRS W-9 form can seem straightforward, but many individuals make mistakes that can lead to delays or complications. One common error is providing incorrect or incomplete personal information. This includes not only your name but also your business name if applicable. Always ensure that the name matches the one on your tax return. If you are a sole proprietor, use your personal name, but if you have a business entity, list the business name as well.

Another frequent mistake is misidentifying the type of taxpayer. The W-9 form requires you to check the appropriate box for your tax classification, such as individual, corporation, or partnership. Failing to select the right category can lead to confusion and may result in incorrect tax reporting. Take a moment to review your classification before submitting the form.

People often overlook the importance of providing the correct Taxpayer Identification Number (TIN). This number can be your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your situation. Double-check that you enter the number accurately. A simple typo can cause significant issues, including delays in payment processing.

Another mistake is neglecting to sign and date the form. The W-9 is not just a formality; it requires your signature to certify that the information provided is accurate. Without your signature, the form is incomplete and may be rejected. Remember to include the date as well, as this indicates when you completed the form.

Some individuals fail to provide the necessary backup documentation. While the W-9 itself does not require additional documents, the requesting party may need to verify your identity or tax status. Be prepared to provide any requested documentation promptly to avoid delays in processing.

In addition, people sometimes submit the W-9 form to the wrong entity. It's essential to send the form directly to the person or organization that requested it, not to the IRS. Misrouting the form can lead to unnecessary complications and delays in payment.

Finally, many overlook the importance of keeping a copy of the completed W-9 for their records. This document serves as proof of the information you provided and can be valuable in case of any discrepancies in the future. Always maintain a personal record to ensure you have access to this information when needed.