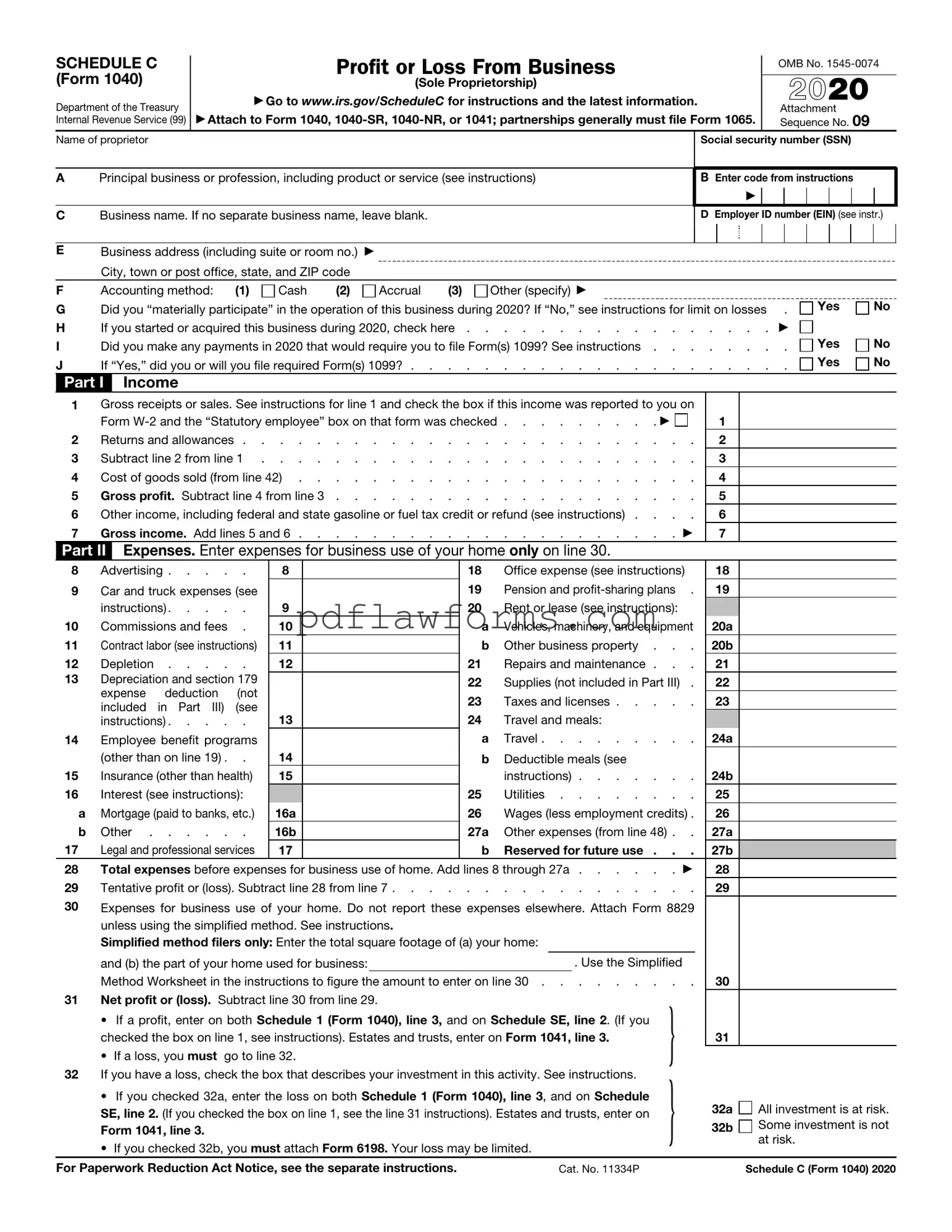

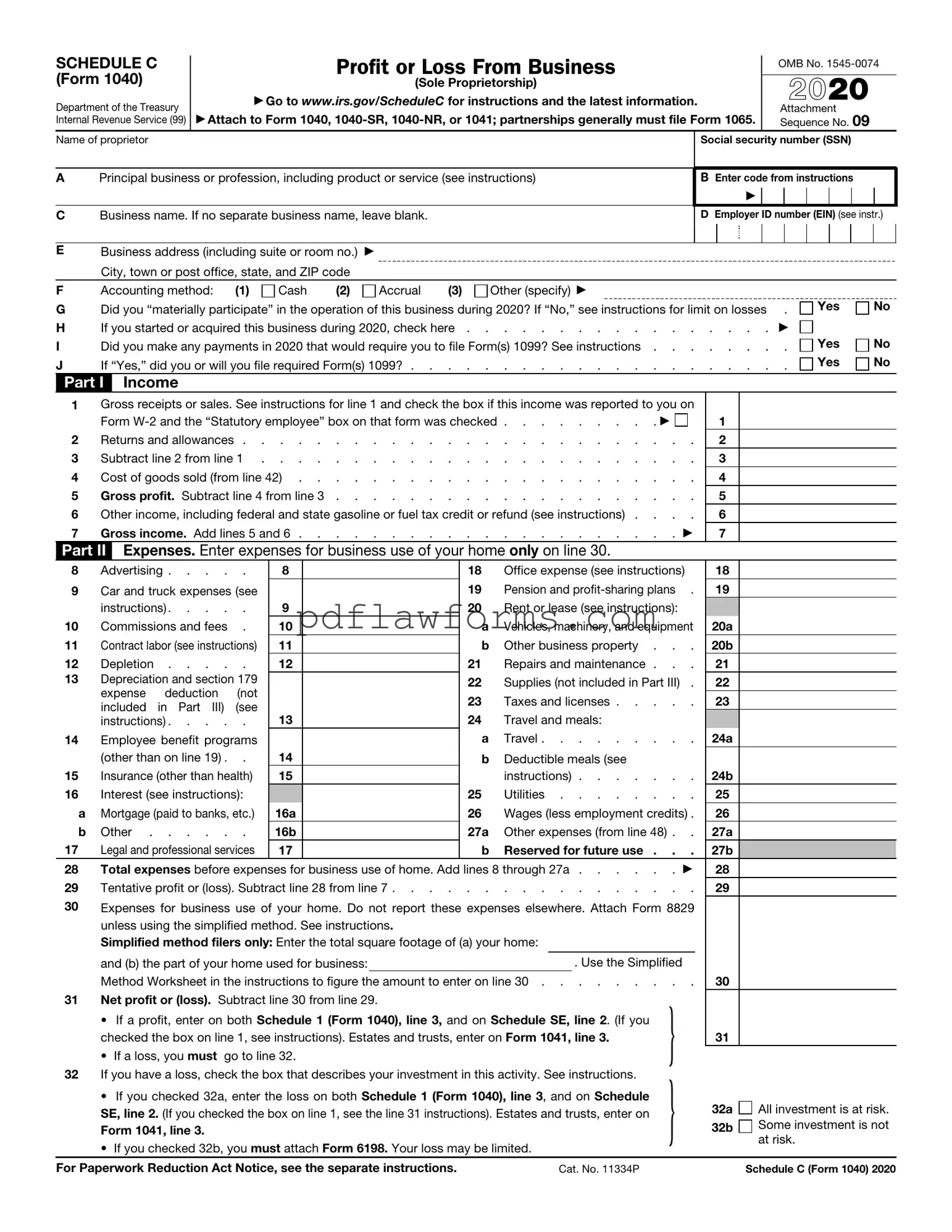

Filling out the IRS Schedule C (Form 1040) can feel overwhelming, especially for those new to self-employment or small business ownership. Mistakes on this form can lead to delays in processing your tax return or even trigger audits. Here are ten common errors to watch out for.

One frequent mistake is not keeping accurate records. Many individuals underestimate the importance of thorough documentation. Without organized records of income and expenses, it becomes challenging to report accurate figures. This can lead to overestimating or underestimating your taxable income, which can have significant consequences.

Another common pitfall is misclassifying expenses. It's essential to categorize expenses correctly. For instance, mixing personal and business expenses can create confusion and complicate your tax situation. Make sure you understand which costs are deductible and how to classify them appropriately.

Some people also forget to report all income. Every dollar earned counts, and the IRS expects you to report all sources of income. Neglecting to include certain income can lead to discrepancies that may raise red flags during audits.

Additionally, many filers fail to take advantage of deductions. There are numerous deductions available to small business owners, such as home office expenses, vehicle expenses, and business-related travel costs. Not claiming these deductions means you could be paying more in taxes than necessary.

Another mistake is overlooking the importance of the business name. If you operate under a business name, it should be clearly stated on the form. This not only helps the IRS identify your business but also ensures that your records are accurate and complete.

Some individuals neglect to complete all necessary sections of the form. Each section serves a purpose, and missing information can lead to delays or issues with your return. Take the time to review each part of the Schedule C to ensure nothing is overlooked.

Another common error is failing to sign and date the form. It may seem trivial, but an unsigned form is considered incomplete. Always double-check that you have signed and dated your return before submitting it to the IRS.

People also sometimes miscalculate their net profit or loss. It’s crucial to ensure that all calculations are accurate. A simple math error can lead to incorrect reporting, which can have serious tax implications.

Furthermore, some filers do not consult with a tax professional when needed. If you find the process confusing or if your situation is complex, seeking guidance can help avoid costly mistakes. A tax professional can provide insights and ensure that you’re maximizing your deductions.

Lastly, many forget to file on time. Procrastination can lead to penalties and interest on unpaid taxes. Mark your calendar and set reminders to ensure you meet the filing deadline.

By being aware of these common mistakes, you can approach your Schedule C with confidence. Taking the time to prepare accurately will not only ease the filing process but can also save you money and stress in the long run.