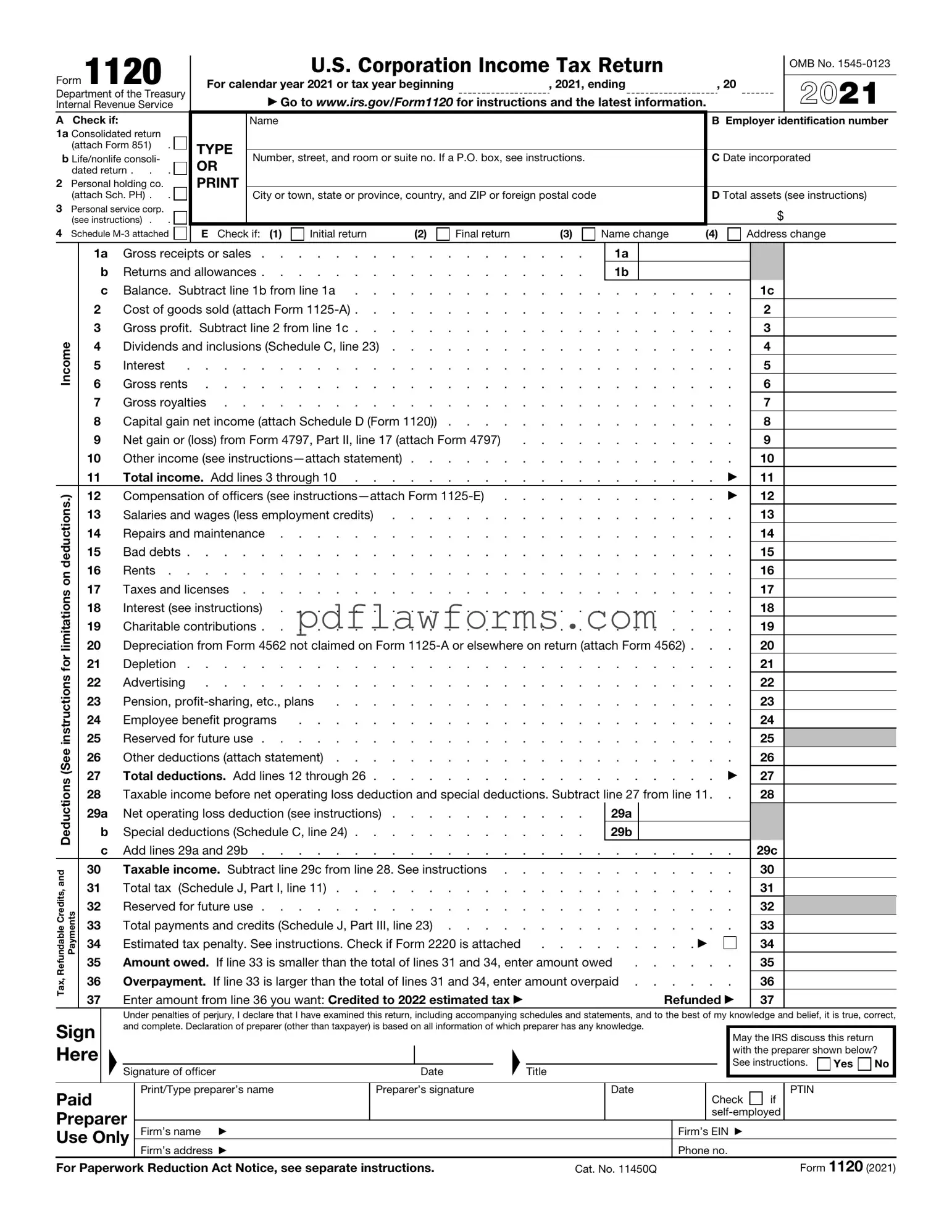

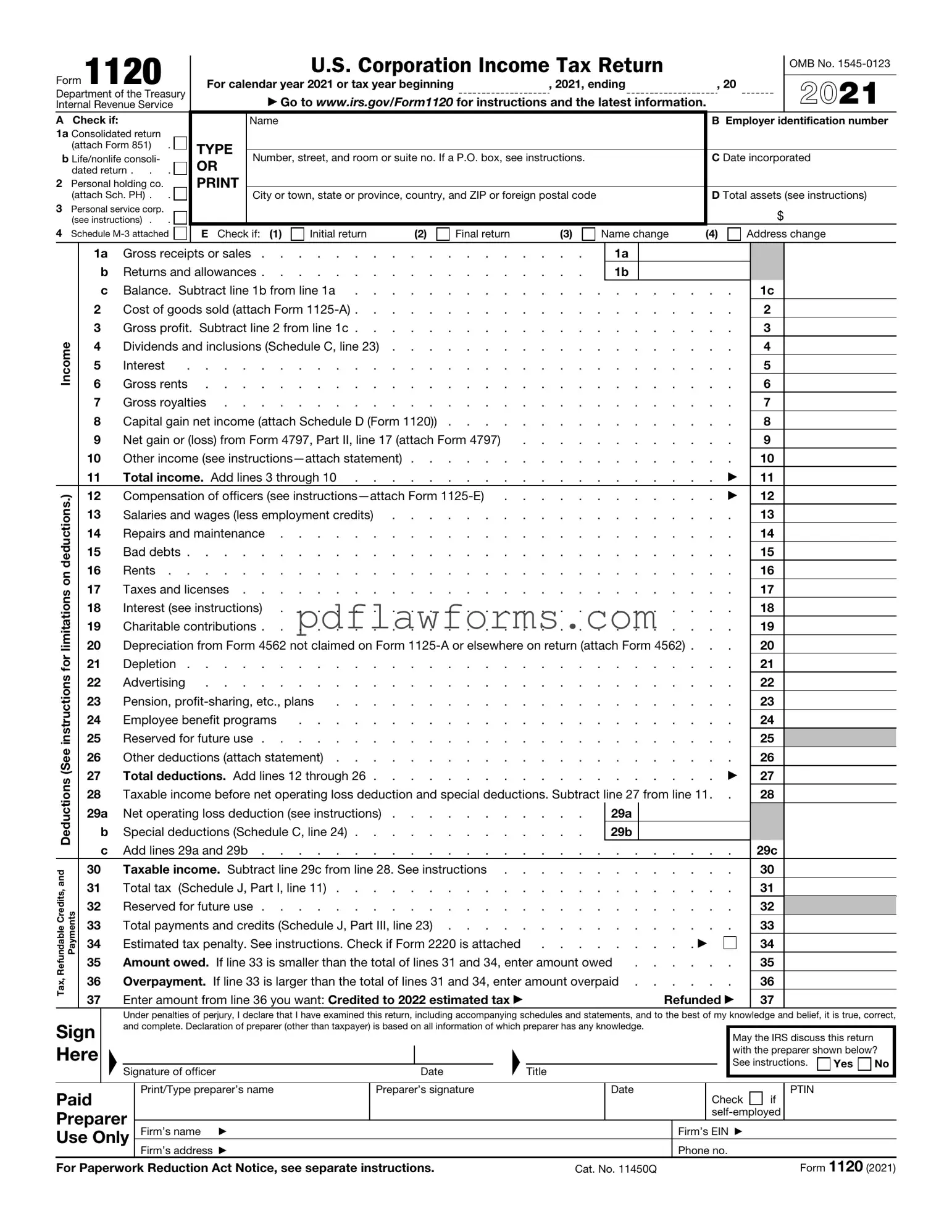

Filing the IRS Form 1120 can be a daunting task for many business owners. This form is essential for corporations to report their income, gains, losses, deductions, and credits. However, mistakes are common and can lead to penalties or delayed processing. One frequent error is failing to report all income. It's crucial to include every source of revenue, as the IRS has access to various financial records. Omitting even a small amount can raise red flags and potentially lead to an audit.

Another common mistake is misclassifying expenses. Corporations can deduct certain business expenses, but they must be categorized correctly. For instance, mixing personal and business expenses can result in disallowed deductions. This misclassification not only complicates the filing process but can also lead to an inaccurate tax liability.

Many individuals overlook the importance of accurate calculations. Mathematical errors, whether in totaling income or calculating deductions, can create significant discrepancies. Such mistakes may lead to either overpayment or underpayment of taxes, both of which have consequences. Double-checking calculations or using tax software can help mitigate this risk.

Additionally, failing to sign and date the form is a surprisingly common oversight. A signed form is legally required; without it, the IRS may consider the submission incomplete. This can delay processing and lead to further complications. It’s a simple step, but one that is easily forgotten in the rush to file.

Another issue arises when corporations neglect to keep proper documentation. The IRS requires supporting documents for many deductions claimed on Form 1120. Without adequate records, businesses may struggle to justify their expenses in the event of an audit. Maintaining organized financial records is not just a best practice; it’s essential for compliance.

Finally, many filers fail to be aware of the deadlines. Missing the filing deadline can lead to penalties and interest on unpaid taxes. It’s vital to mark important dates on a calendar and plan ahead to ensure timely submission. Understanding the timeline can save businesses from unnecessary stress and financial burdens.