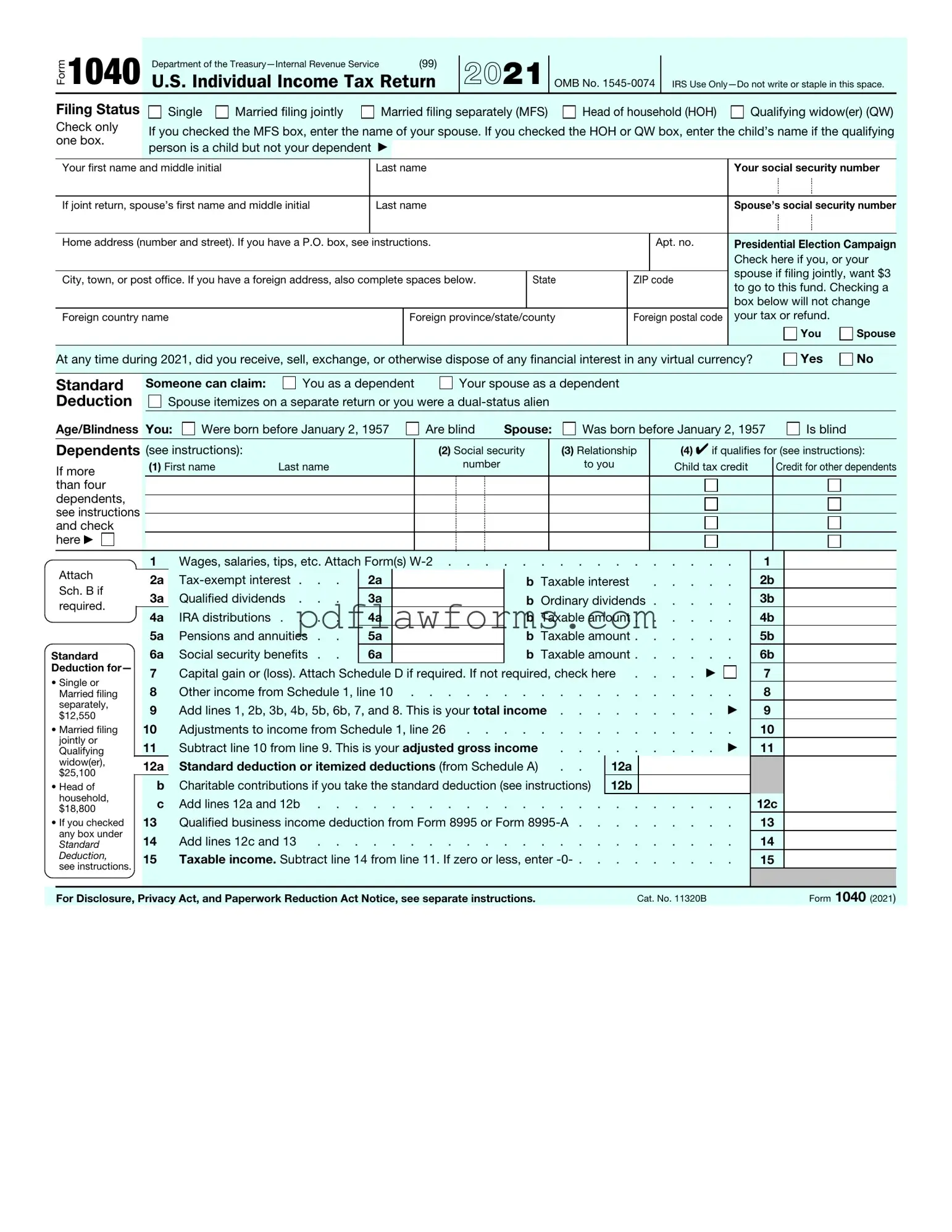

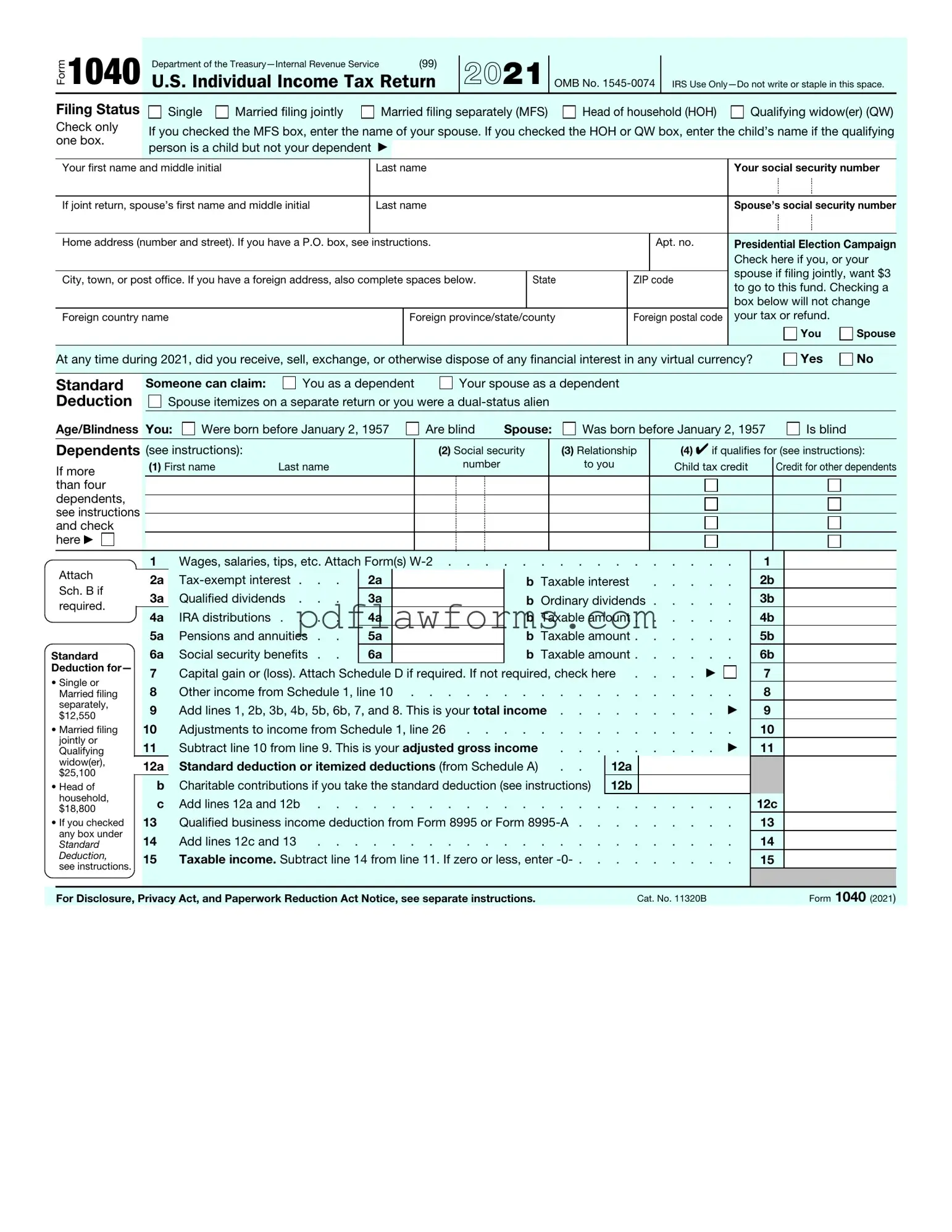

Filling out the IRS 1040 form can be a daunting task for many individuals. Mistakes can lead to delays in processing your tax return or, worse, an audit. One common error occurs when taxpayers forget to sign and date their forms. A signature is crucial; without it, the IRS may not accept your return. Always double-check that you’ve signed and dated your form before submitting it.

Another frequent mistake involves incorrect personal information. People often miswrite their Social Security numbers or misspell their names. Such inaccuracies can create significant issues, including delays and potential penalties. Always verify that your personal details match those on your Social Security card.

Many taxpayers also overlook the importance of reporting all sources of income. This includes wages, dividends, and any freelance earnings. Failing to report all income can lead to underpayment penalties. Make sure to gather all necessary documents, such as W-2s and 1099s, to ensure you’re capturing everything accurately.

Using the wrong filing status is another common pitfall. Whether you are single, married, or head of household, your filing status can significantly impact your tax liability. Choosing the incorrect status may result in paying more taxes than necessary or missing out on valuable deductions. Take the time to understand which status applies to your situation.

Some individuals make the mistake of not claiming all eligible deductions and credits. The tax code is filled with opportunities for savings, but many taxpayers are unaware of them. Deductions for student loan interest, medical expenses, and education credits can substantially reduce your taxable income. Research or consult a tax professional to identify what you can claim.

Another area where mistakes frequently occur is in the math. Simple addition or subtraction errors can lead to incorrect calculations of taxable income or tax owed. Always double-check your figures or use tax software that can help minimize these errors. Even a small mistake can have a big impact on your final tax liability.

Failing to keep proper documentation is yet another error that can haunt taxpayers. The IRS recommends retaining records for at least three years in case of an audit. Keep all receipts, W-2s, and any other supporting documents organized and accessible. This practice not only helps with accuracy but also provides peace of mind.

Lastly, many people submit their forms without considering electronic filing options. E-filing can streamline the process and reduce the likelihood of errors. The IRS has made it easier than ever to file electronically, and many taxpayers receive their refunds faster when they e-file. Consider this option to simplify your tax preparation experience.