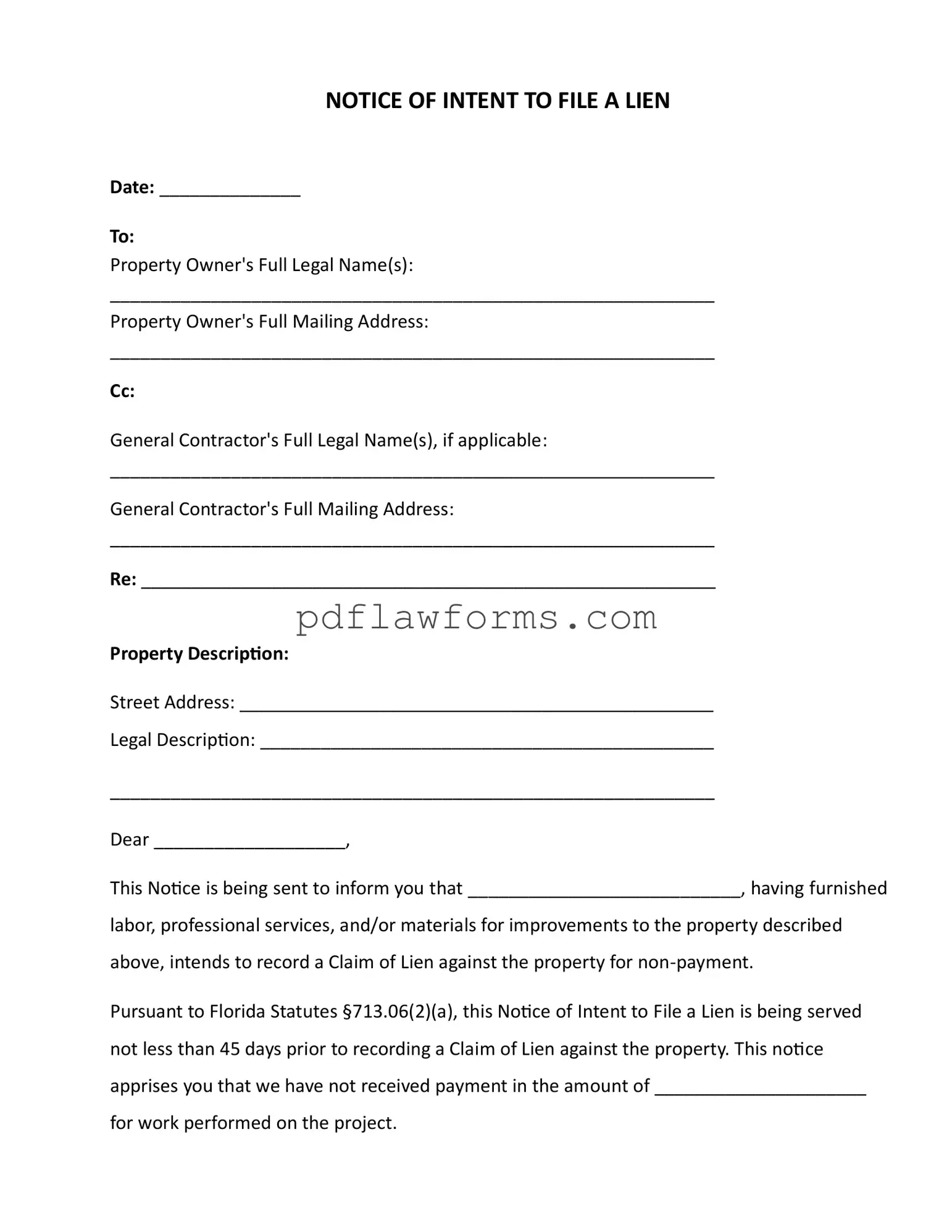

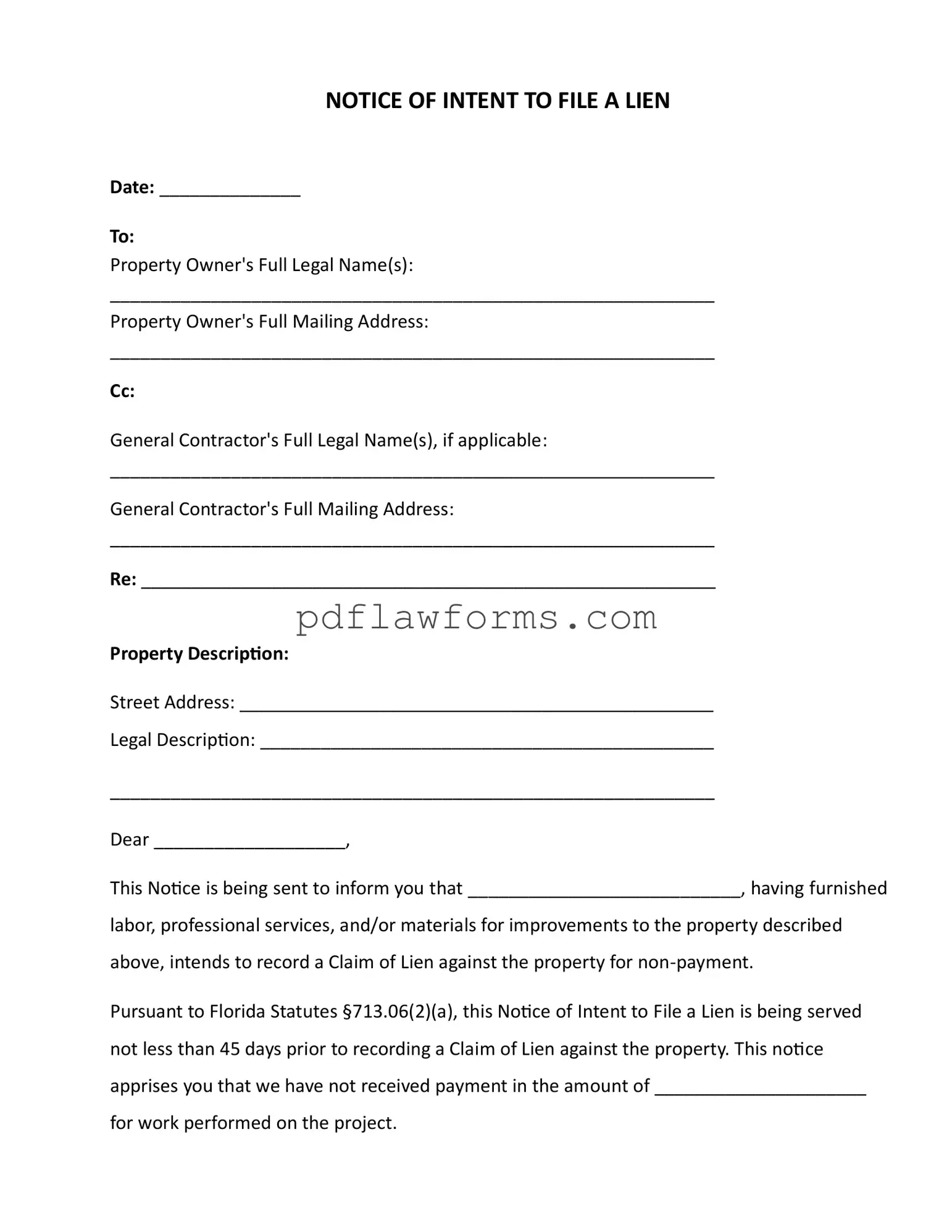

Fill Your Intent To Lien Florida Template

The Intent to Lien Florida form serves as a formal notification to property owners that a claim of lien may be filed against their property due to non-payment for services rendered. This document is essential for contractors and service providers seeking to protect their rights and ensure they receive compensation for their work. Timely completion of this form can help avoid potential legal complications, so take action now by filling out the form below.

Make My Document Online

Fill Your Intent To Lien Florida Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Intent To Lien Florida online, then download your file.

Make My Document Online

or

⇩ Intent To Lien Florida PDF