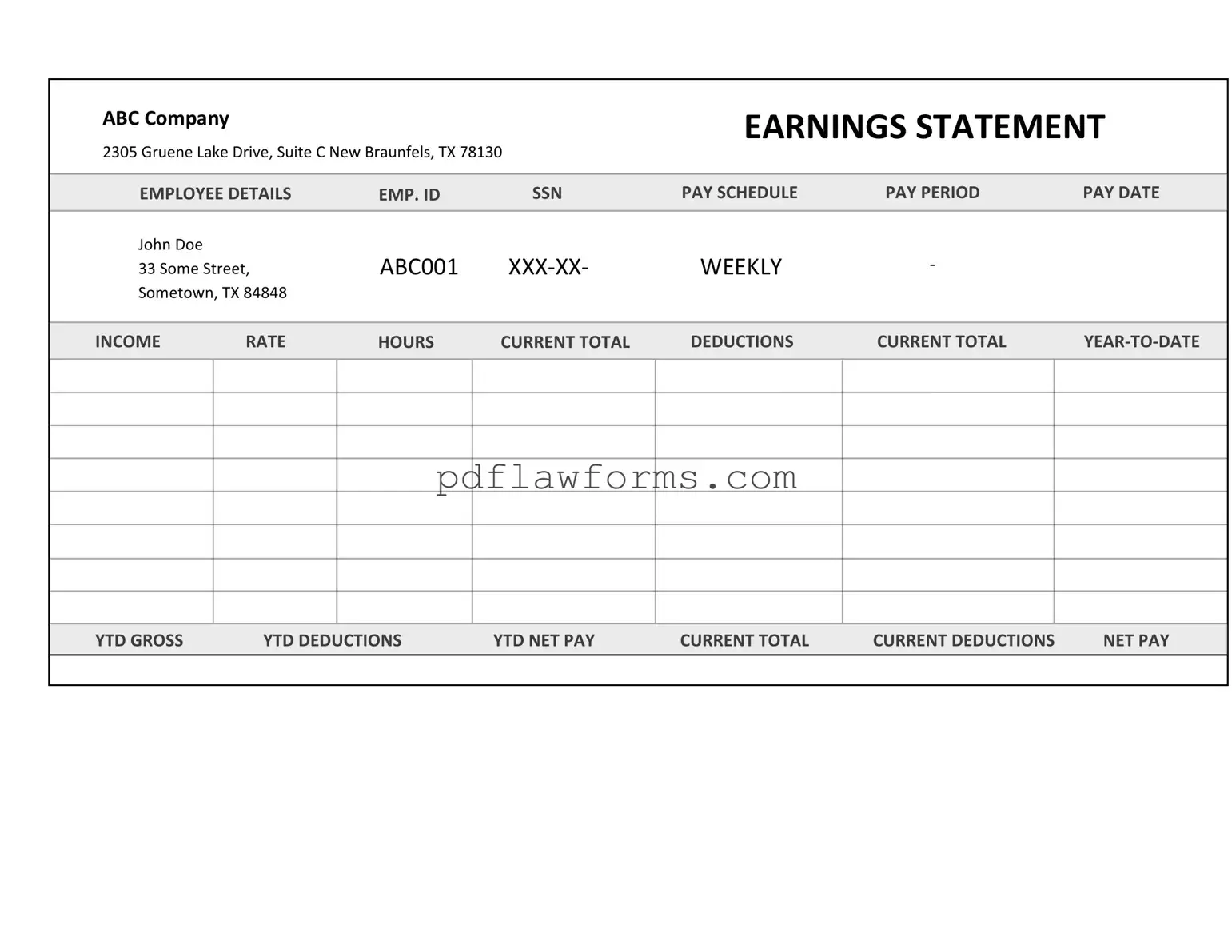

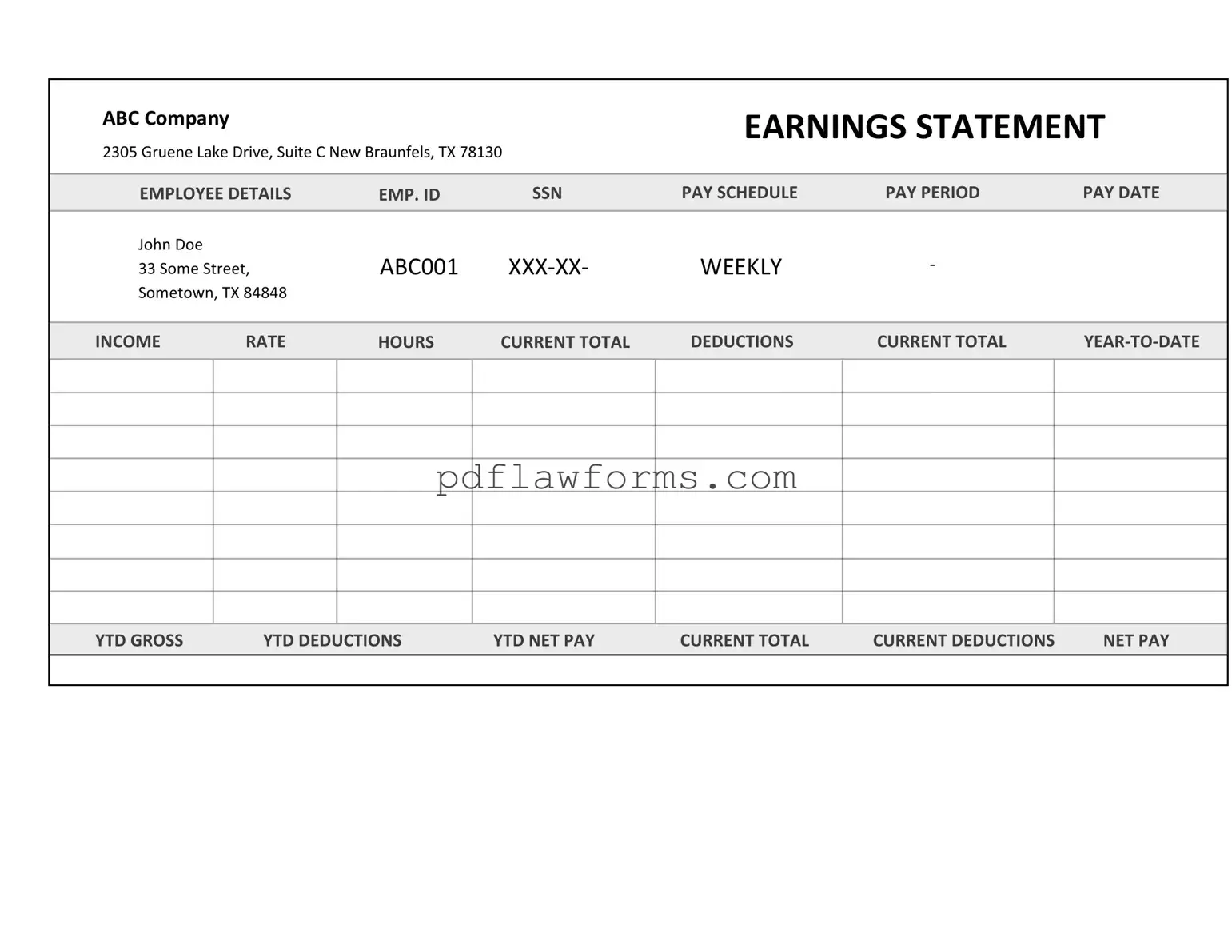

When filling out the Independent Contractor Pay Stub form, many individuals encounter common pitfalls that can lead to confusion or errors. One significant mistake is failing to include all necessary personal information. It’s crucial to provide your full name, address, and Social Security number. Omitting any of these details can delay processing and payment.

Another frequent error involves incorrect calculations of hours worked or pay rates. Contractors must ensure they accurately record the number of hours worked and the agreed-upon pay rate. Miscalculations can result in underpayment or overpayment, creating complications for both the contractor and the hiring entity.

In addition to calculations, many people neglect to itemize deductions or expenses. Independent contractors often have various expenses that can be deducted from their earnings. Not listing these can lead to paying more taxes than necessary. It’s advisable to keep detailed records of all expenses related to the contract work.

Some individuals also fail to sign the pay stub. A signature is often required to validate the document. Without it, the pay stub may not be considered official, leading to potential disputes regarding payment.

Another mistake is using outdated forms or templates. Regulations and requirements can change, so it's essential to ensure that you are using the most current version of the Independent Contractor Pay Stub form. Using an outdated form may result in missing information or failing to comply with new guidelines.

Additionally, people sometimes overlook the importance of clear communication with the hiring entity. If there are any discrepancies in the pay stub, it’s vital to address them promptly. Ignoring these issues can lead to misunderstandings and payment delays.

Many contractors also forget to keep copies of their completed pay stubs. Maintaining a record of all submitted pay stubs is essential for personal accounting and for resolving any future disputes. This documentation can serve as evidence of work completed and payments received.

Lastly, some individuals do not review their pay stubs for accuracy before submission. Taking the time to double-check all entries can prevent many of the issues mentioned above. A thorough review helps ensure that all information is correct and complete, ultimately facilitating a smoother payment process.