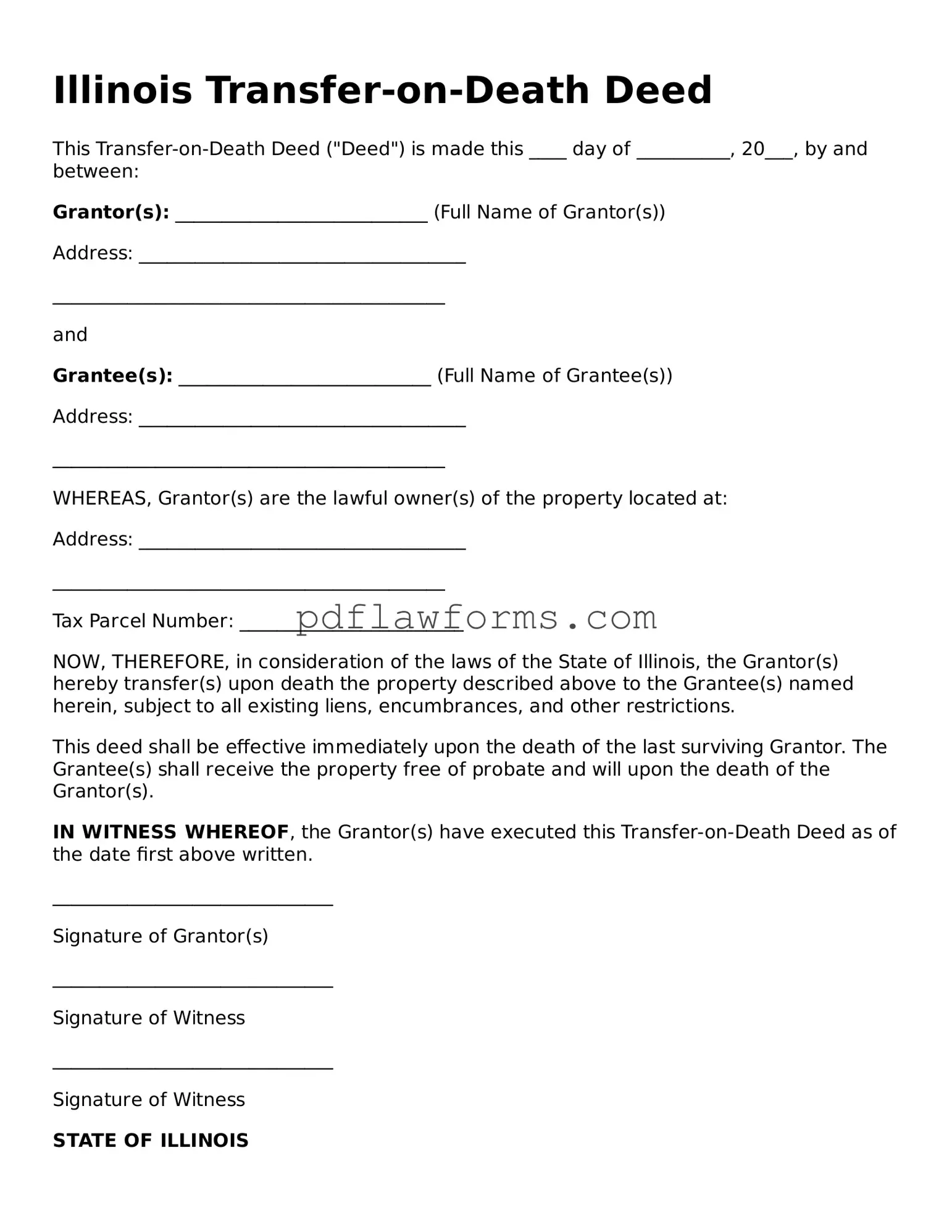

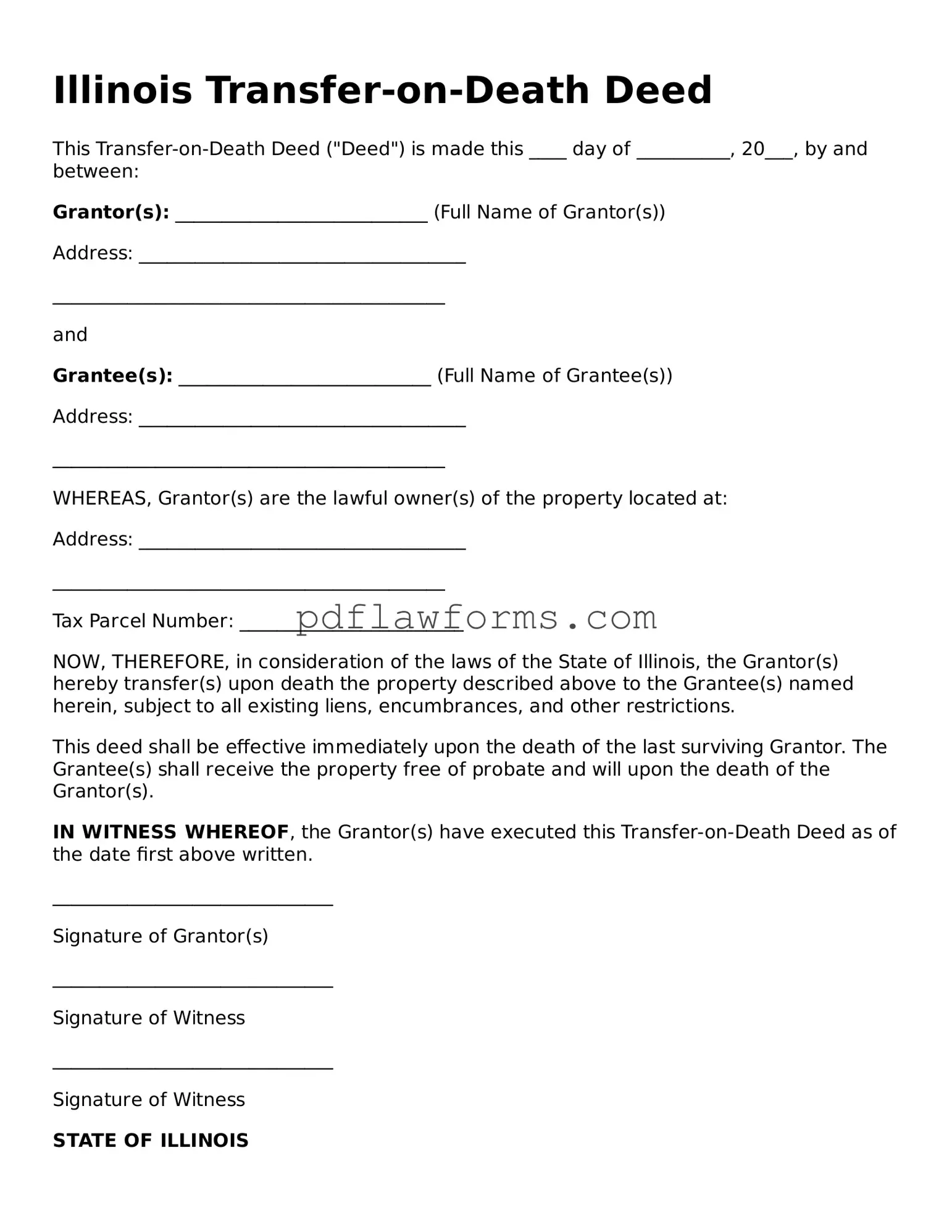

Filling out the Illinois Transfer-on-Death Deed form can seem straightforward, but many individuals make common mistakes that can lead to complications down the road. One frequent error is failing to include all necessary information. It’s essential to provide complete details about both the property and the beneficiaries. Omitting even a small piece of information can result in delays or even invalidate the deed.

Another mistake often made is not properly identifying the property. The deed must describe the property with precision, including the legal description. Relying solely on the address can lead to confusion, especially if there are multiple properties with similar names. Ensuring that the legal description is accurate is crucial for the deed’s effectiveness.

Many people also overlook the importance of signatures. The Illinois Transfer-on-Death Deed requires the signature of the property owner, but it must also be notarized. Neglecting to have the document notarized can render it unenforceable. Always double-check that the signature and notarization are complete before submitting the deed.

In addition, individuals sometimes forget to consider the implications of naming multiple beneficiaries. While it may seem convenient to list several people, it’s vital to understand how this can affect the distribution of the property. Without clear instructions, disputes may arise among beneficiaries, complicating the intended transfer.

Another common oversight involves failing to record the deed in a timely manner. Once the Transfer-on-Death Deed is completed, it must be recorded with the county recorder's office. If this step is delayed or forgotten, the deed may not take effect as intended, and the property could be subject to probate.

People often neglect to review the deed after completion. It’s easy to assume that everything is correct, but errors can slip through unnoticed. Taking the time to review the document thoroughly can help catch mistakes before they lead to problems.

Additionally, some individuals do not keep a copy of the recorded deed. Having a personal copy is essential for future reference and can help resolve any disputes or questions that may arise later. It’s wise to store this important document in a safe place.

Not understanding the tax implications of a Transfer-on-Death Deed can also lead to mistakes. While this type of deed allows for a smooth transfer of property without going through probate, it’s important to consult with a tax professional to understand any potential tax consequences for the beneficiaries.

Finally, many people fail to update the deed after significant life changes, such as marriage, divorce, or the death of a beneficiary. Keeping the deed current is crucial to ensure that it reflects the property owner’s wishes. Regularly reviewing and updating the deed can prevent misunderstandings and ensure a smooth transfer of property.