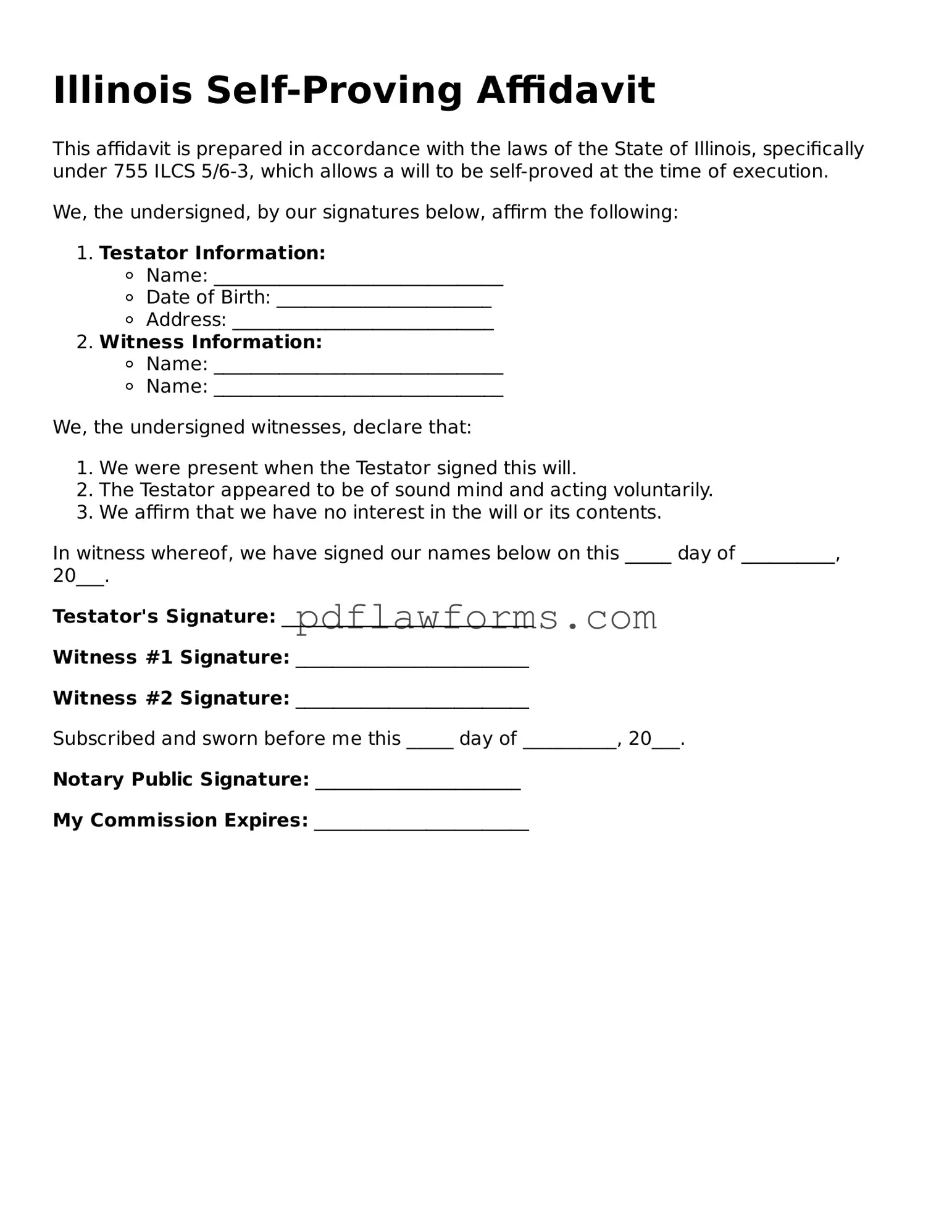

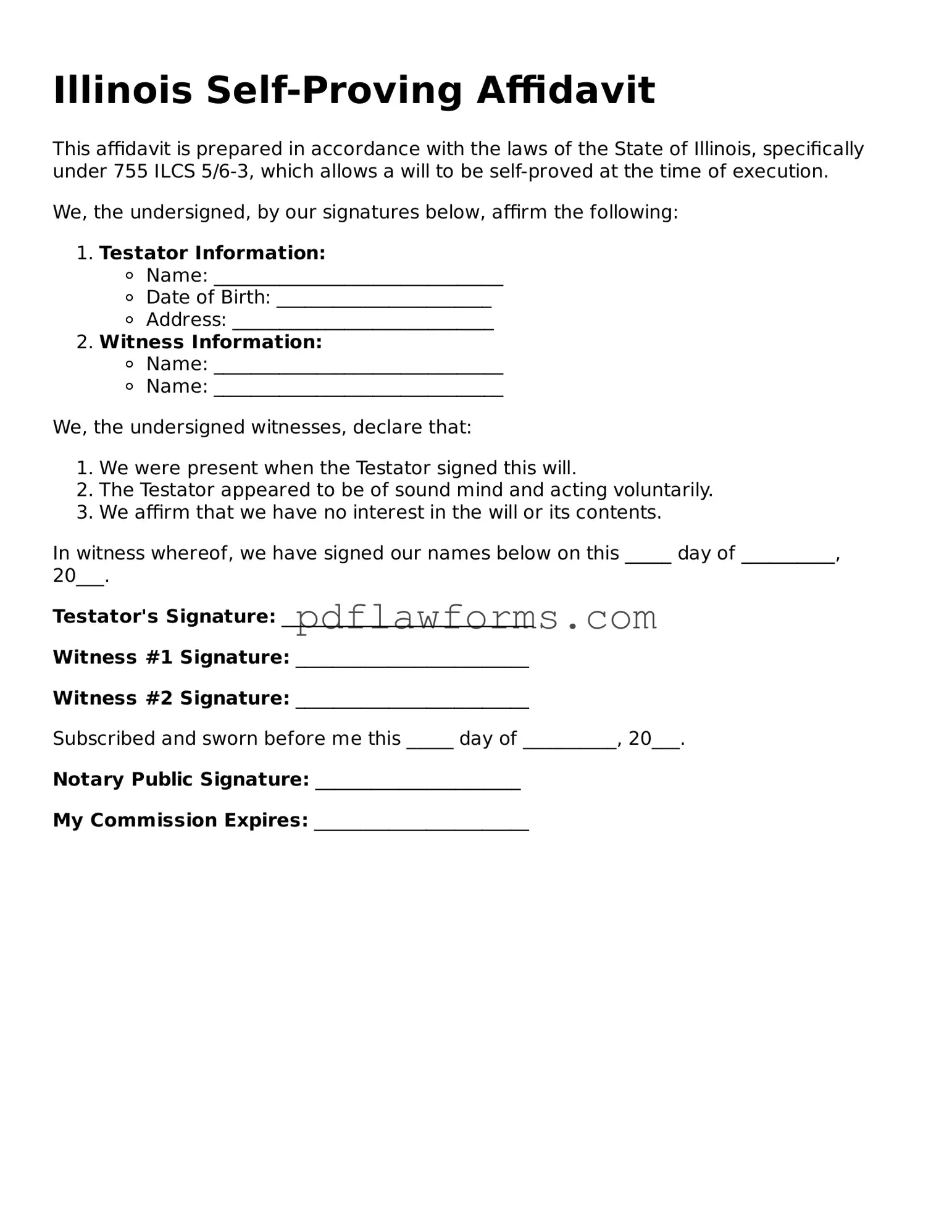

Self-Proving Affidavit Form for the State of Illinois

The Illinois Self-Proving Affidavit is a legal document that allows a testator's will to be accepted in court without requiring witnesses to testify about its validity. This form simplifies the probate process by affirming that the will was properly signed and witnessed. To ensure your estate is handled according to your wishes, consider filling out the form by clicking the button below.

Make My Document Online

Self-Proving Affidavit Form for the State of Illinois

Make My Document Online

You’re halfway through — finish the form

Edit and complete Self-Proving Affidavit online, then download your file.

Make My Document Online

or

⇩ Self-Proving Affidavit PDF