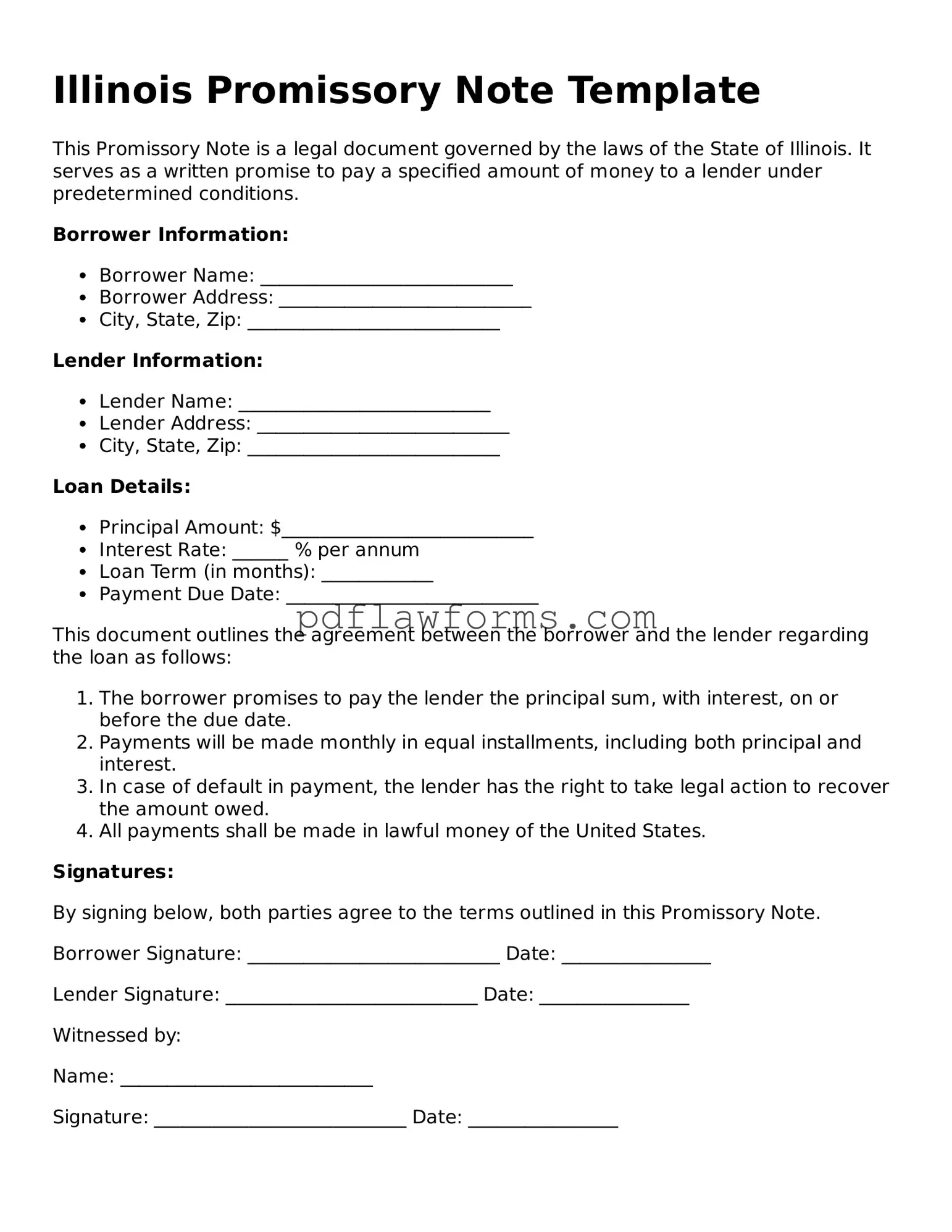

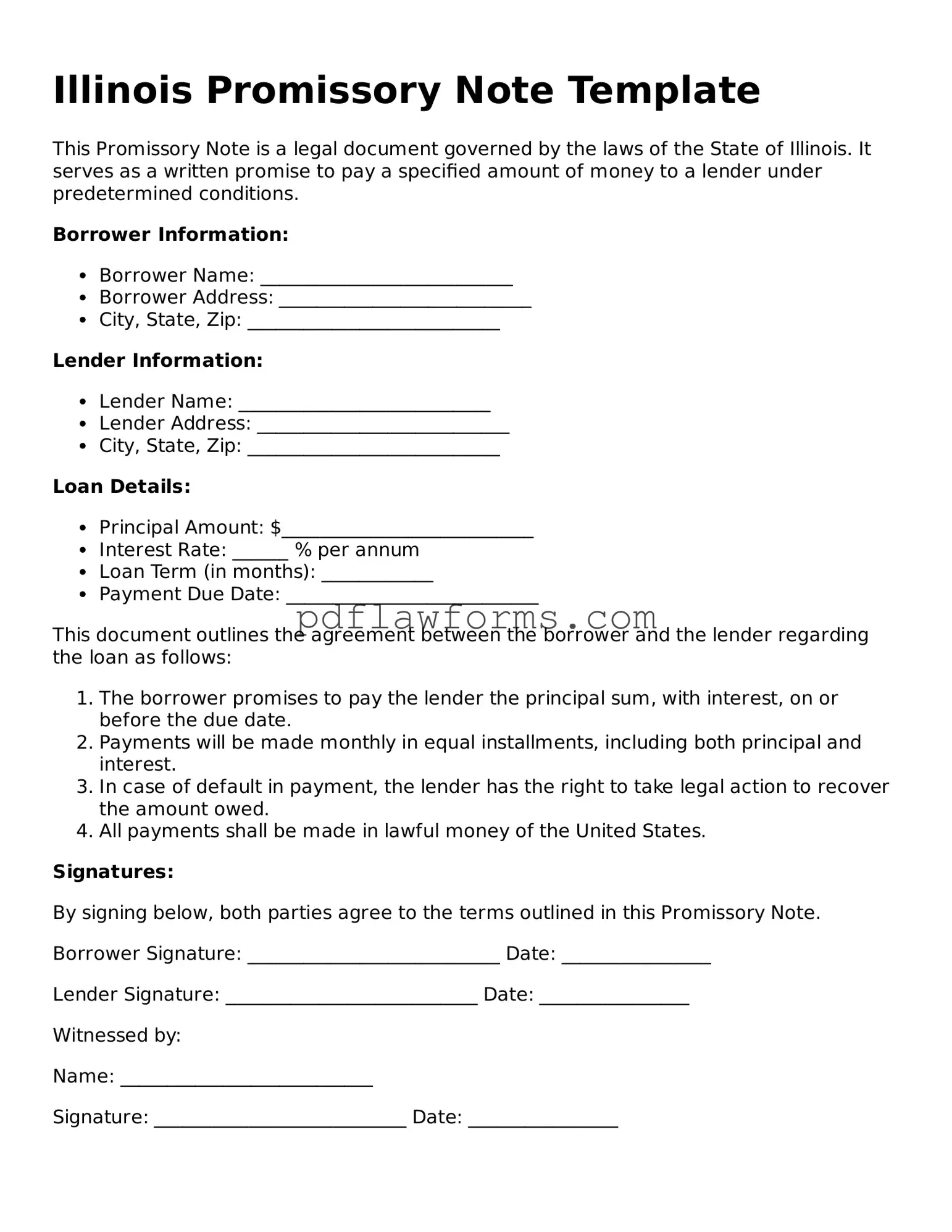

When individuals fill out the Illinois Promissory Note form, several common mistakes can lead to complications down the line. One frequent error is failing to include all necessary parties. A promissory note typically requires both a borrower and a lender. Omitting one of these parties can render the document incomplete and unenforceable.

Another common mistake involves incorrect or missing dates. The date of the agreement is crucial, as it establishes when the repayment terms begin. If this date is left blank or inaccurately filled in, it may create confusion regarding the timeline of the loan.

People often overlook the importance of clearly defining the loan amount. Writing the amount in both numeric and written form helps prevent misunderstandings. A mistake in either representation can lead to disputes about how much is actually owed.

Additionally, individuals sometimes neglect to specify the interest rate. If the note does not clearly state whether interest will accrue, it may lead to disagreements later on. Without a defined interest rate, the borrower may not understand their total financial obligation.

Another frequent error is failing to outline the repayment schedule. Whether payments are due monthly, quarterly, or on a different schedule, clarity is essential. A vague repayment structure can create confusion and potential default issues.

People may also forget to include a provision for default. This clause should detail what happens if the borrower fails to make payments. Without this information, the lender may find it challenging to enforce their rights if the borrower defaults.

Many individuals do not sign the document in the appropriate places. Both parties should sign the note to validate it. A missing signature can lead to questions about the authenticity of the agreement.

In some cases, individuals fail to have the document notarized. While notarization is not always required, having a notary public witness the signatures can add an extra layer of legitimacy to the note.

People often overlook the need for clear contact information. Including addresses and phone numbers for both parties ensures that communication can occur if issues arise. Without this information, resolving disputes may become more complicated.

Finally, individuals sometimes do not keep a copy of the signed note for their records. Retaining a copy is essential for both parties to have proof of the agreement. Without this documentation, enforcing the terms may become difficult.