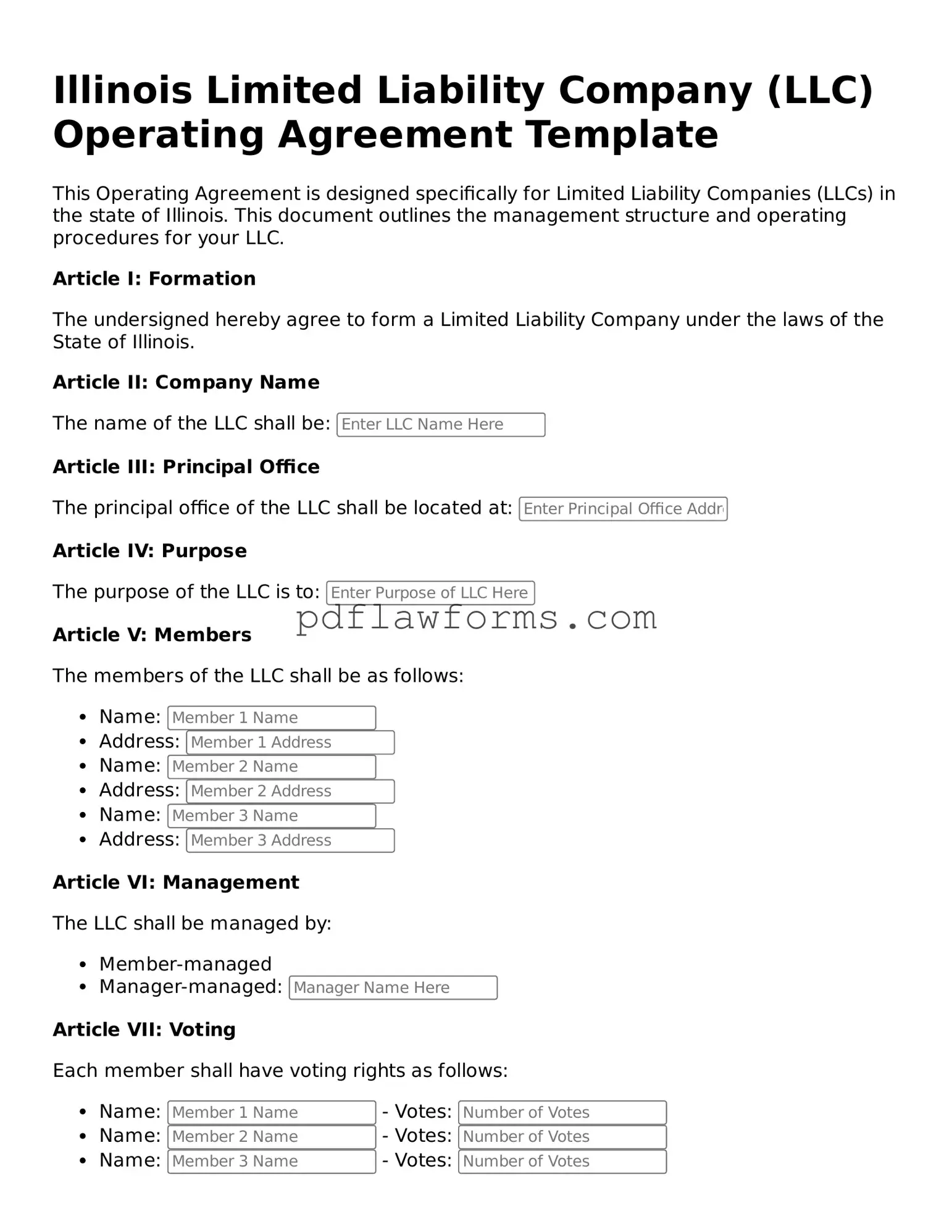

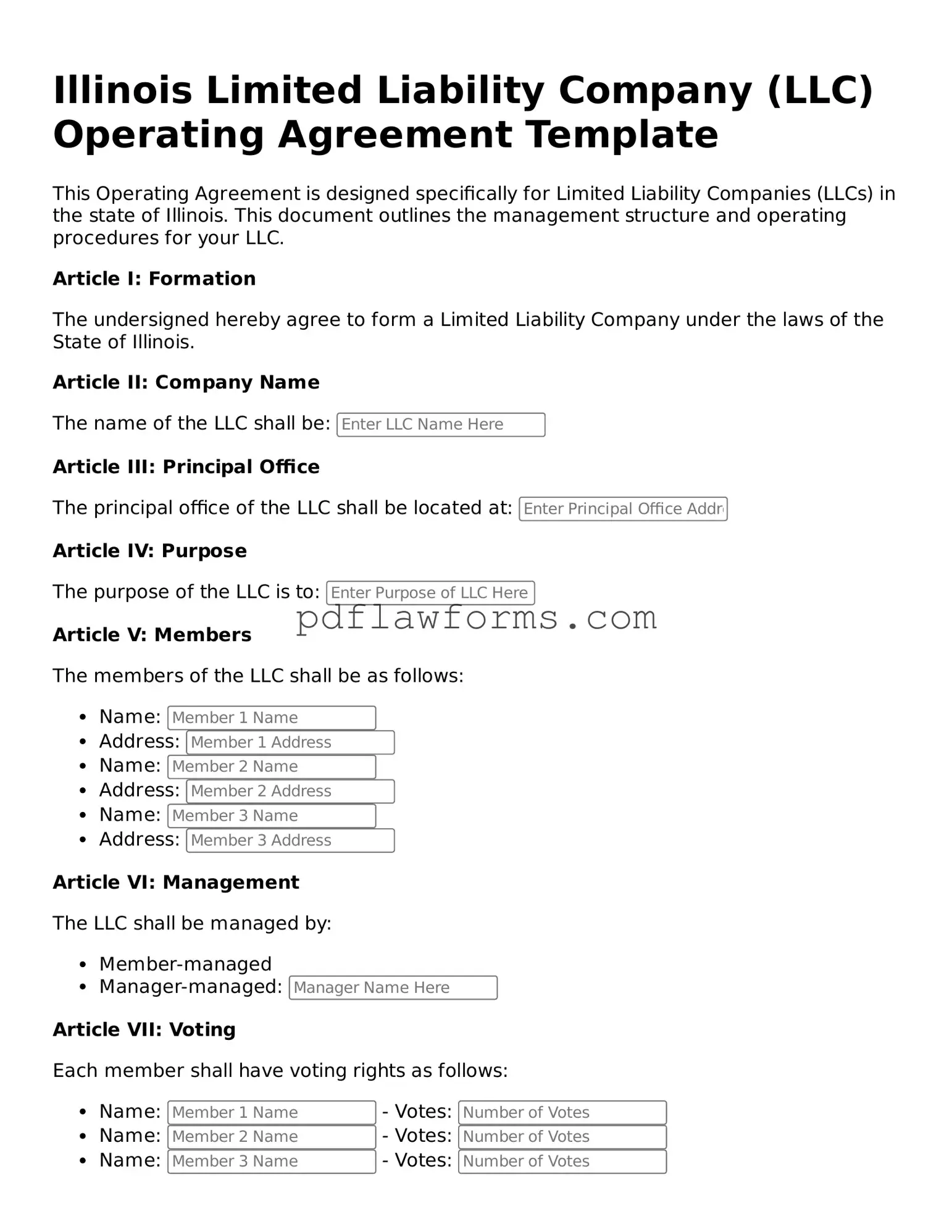

When completing the Illinois Operating Agreement form, many individuals make common mistakes that can lead to confusion or legal issues down the line. One frequent error is failing to include all members' names and addresses. Omitting even one member can create disputes over ownership and responsibilities.

Another mistake is not specifying the management structure of the LLC. Whether the business will be member-managed or manager-managed should be clearly stated. This clarity helps prevent misunderstandings about who is responsible for daily operations.

People often overlook the importance of detailing each member's capital contributions. Not documenting how much each member is contributing can lead to disagreements about ownership percentages and profit distribution later on. It's essential to be explicit about these contributions.

Additionally, many individuals neglect to outline the process for adding new members. This omission can create complications if the business grows and new members want to join. A clear procedure for admitting new members should be included to streamline future transitions.

Another common error is failing to address the distribution of profits and losses. Without a clear plan, members may have differing expectations regarding how profits will be shared. This can lead to tension and disputes among members.

Some individuals do not include a buy-sell agreement in their Operating Agreement. This agreement is crucial for outlining what happens if a member wants to leave the business or passes away. Without it, the remaining members may face uncertainty about ownership transitions.

Another mistake is not specifying the duration of the LLC. While many people assume it will exist indefinitely, stating the intended duration in the Operating Agreement can prevent future misunderstandings.

It is also common for individuals to forget to review the document for compliance with state laws. Each state has specific requirements for Operating Agreements, and failing to meet these can render the agreement ineffective.

Lastly, many people neglect to have the Operating Agreement signed by all members. A signed agreement serves as proof of the terms agreed upon and is essential for enforcing the provisions within the document. Without signatures, the agreement may not hold up in a legal context.

By being aware of these common mistakes, individuals can ensure that their Illinois Operating Agreement is thorough and effective, setting a solid foundation for their business.