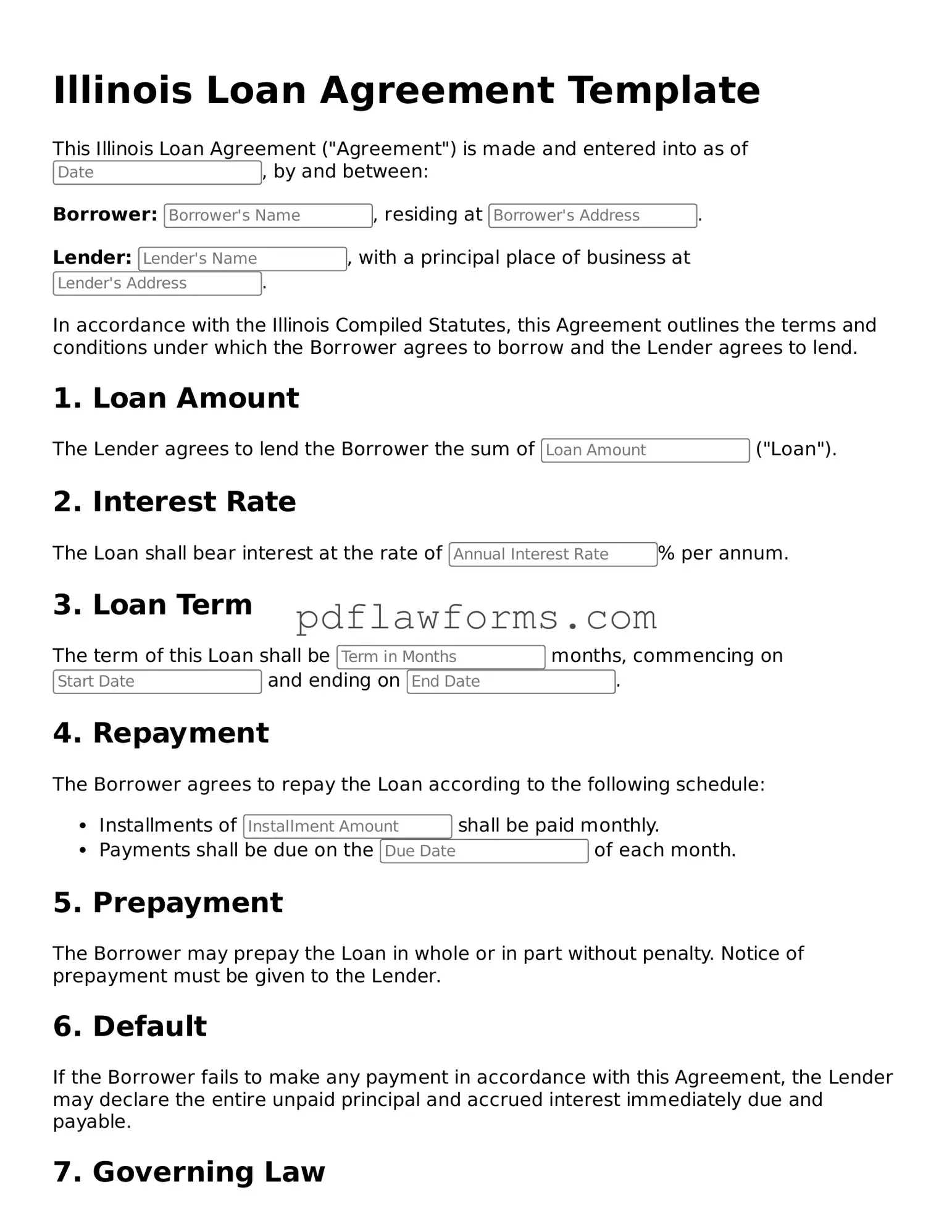

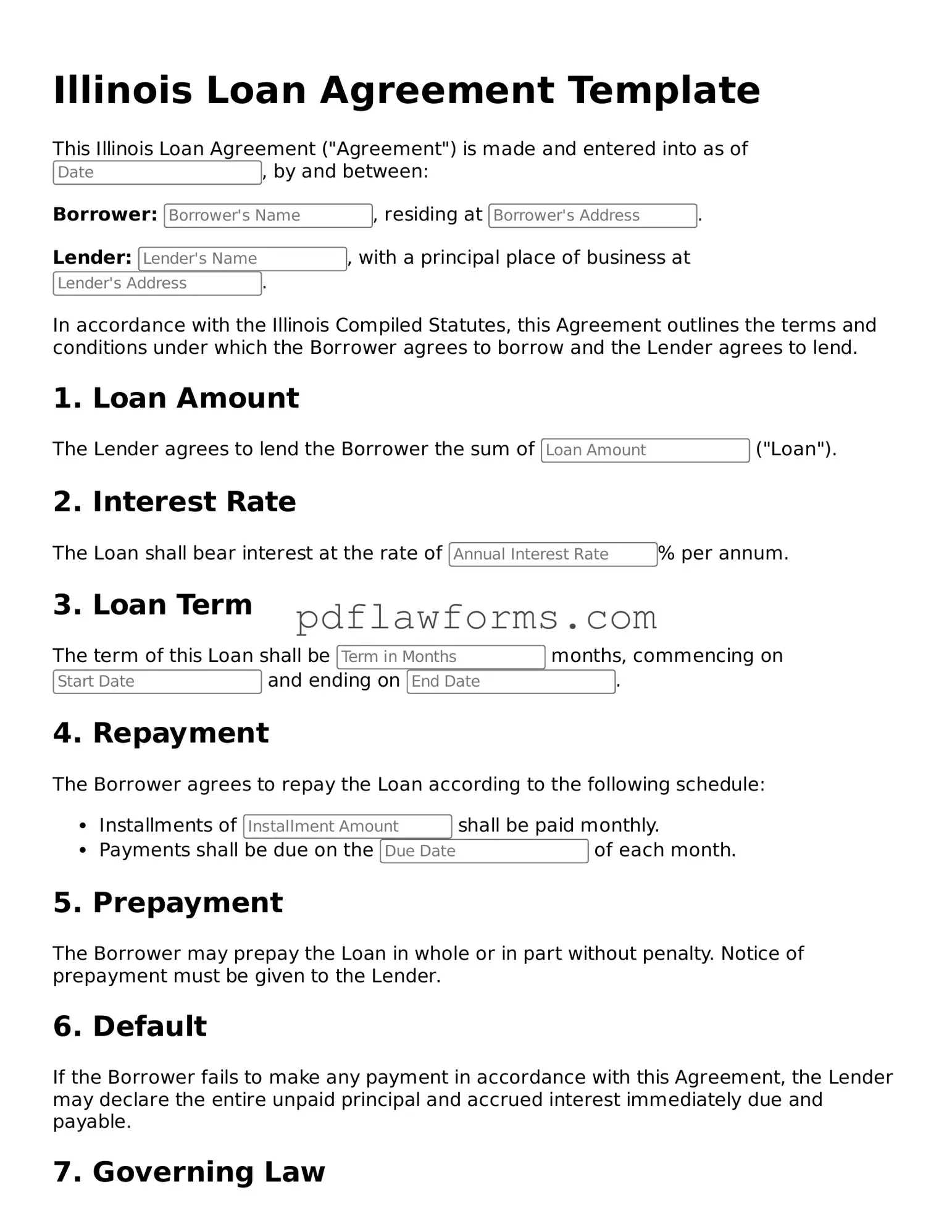

Filling out the Illinois Loan Agreement form can be a straightforward process, but several common mistakes can lead to confusion or delays. One frequent error is leaving out essential personal information. Borrowers must provide accurate details such as their full name, address, and contact information. Omitting any of these can result in the agreement being considered incomplete.

Another mistake often made is failing to specify the loan amount clearly. It's crucial to write the amount in both numerical and written form. For example, if the loan is for $5,000, it should be noted as “$5,000” and “five thousand dollars.” This helps prevent any misunderstandings regarding the amount being borrowed.

People sometimes overlook the importance of reading the terms and conditions carefully. Each section of the agreement outlines specific responsibilities and obligations for both the lender and the borrower. Not understanding these terms can lead to unexpected issues later on.

Inaccurate dates are another common pitfall. Borrowers should double-check that they have filled in the correct dates for the loan agreement, including the start date and any repayment deadlines. Errors in dates can complicate the loan process and lead to missed payments.

Additionally, signatures are vital. Some individuals forget to sign the document or neglect to have a witness sign when required. A missing signature can invalidate the agreement, causing significant delays in the loan process.

Many borrowers fail to keep a copy of the completed agreement for their records. It's essential to retain a signed copy for future reference. This can help in case there are any disputes or questions about the terms of the loan.

Another mistake involves not providing the lender with accurate financial information. Borrowers should be transparent about their income and any existing debts. Misrepresenting financial status can lead to complications in loan approval and repayment.

Some individuals may not understand the importance of including a clear repayment plan. It’s beneficial to outline how and when payments will be made. This clarity helps both parties stay on the same page regarding repayment expectations.

Moreover, failing to check for additional fees or charges can be a costly oversight. Borrowers should inquire about any potential fees associated with the loan, such as late payment penalties or processing fees. Understanding these costs upfront can prevent surprises later.

Lastly, people sometimes neglect to consult with a financial advisor or legal expert before signing the agreement. Seeking professional advice can provide valuable insights and help borrowers make informed decisions regarding their loans.