When filling out the Illinois Durable Power of Attorney form, individuals often make several common mistakes that can lead to complications in the future. Understanding these pitfalls can help ensure that the document serves its intended purpose effectively.

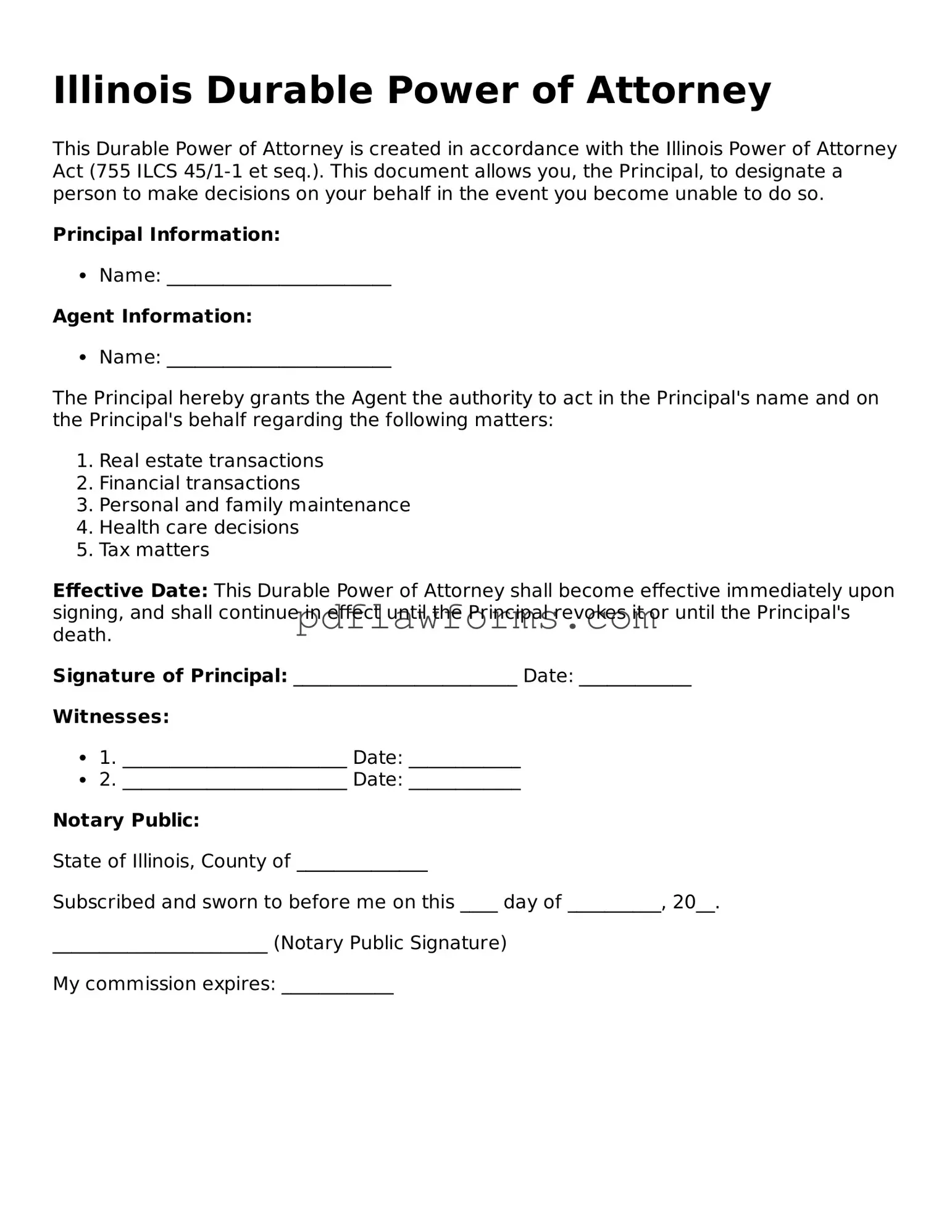

One frequent error is failing to specify the powers granted to the agent. The form allows for a broad range of authorities, but if these powers are not clearly defined, it may create confusion or limit the agent's ability to act when needed. It is crucial to outline the exact powers, whether they relate to financial decisions, healthcare, or other areas.

Another mistake involves not selecting an alternate agent. If the primary agent is unavailable or unable to perform their duties, having a backup can prevent delays in decision-making. Omitting this step can leave individuals in a vulnerable position during critical times.

Many people overlook the importance of signing the document in the presence of a notary public or witnesses. In Illinois, notarization is required for the form to be legally valid. Without this step, the document may not hold up in legal situations, potentially undermining the intentions behind it.

Additionally, individuals sometimes forget to review and update the document periodically. Life circumstances can change, and so can relationships. Regularly reassessing the Durable Power of Attorney ensures that it reflects current wishes and relationships.

Some people may not consider the implications of granting broad powers. While it can be tempting to give an agent extensive authority, doing so without careful thought can lead to potential misuse. It is advisable to balance the powers granted with appropriate safeguards.

Another common issue is neglecting to discuss the decision with the chosen agent beforehand. Open communication can clarify expectations and ensure that the agent is willing and prepared to take on the responsibilities outlined in the document.

People sometimes fail to provide copies of the signed document to relevant parties. Sharing the Durable Power of Attorney with healthcare providers, financial institutions, and family members can facilitate smoother decision-making when the time comes.

Some individuals do not take the time to understand the differences between a Durable Power of Attorney for healthcare and one for finances. Each serves a distinct purpose, and confusing the two can lead to significant issues in critical situations.

Lastly, failing to seek professional advice can be a significant oversight. Legal nuances can be complex, and consulting with a knowledgeable professional can help individuals navigate the process and avoid common mistakes. Taking this step can provide peace of mind and ensure that the document aligns with personal wishes and legal requirements.