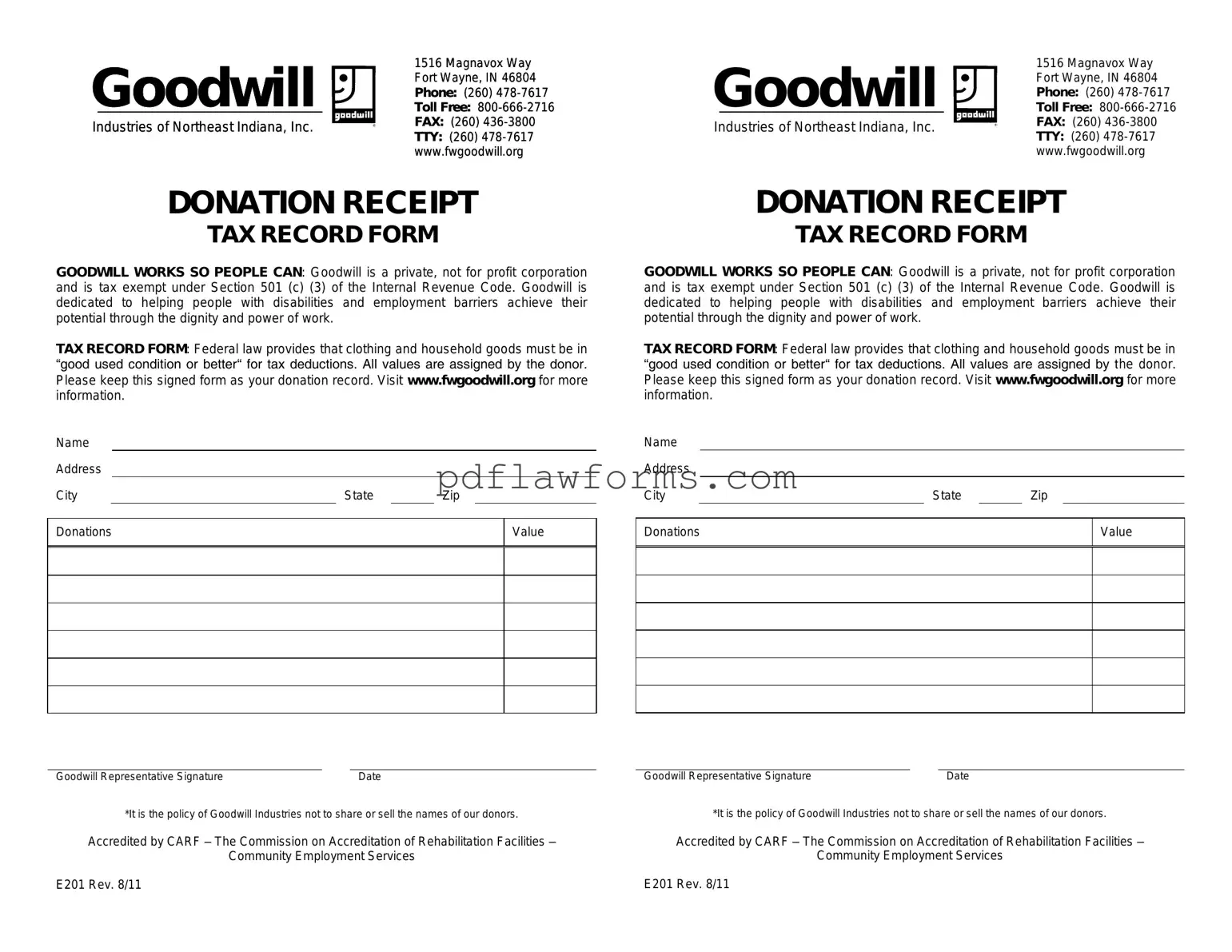

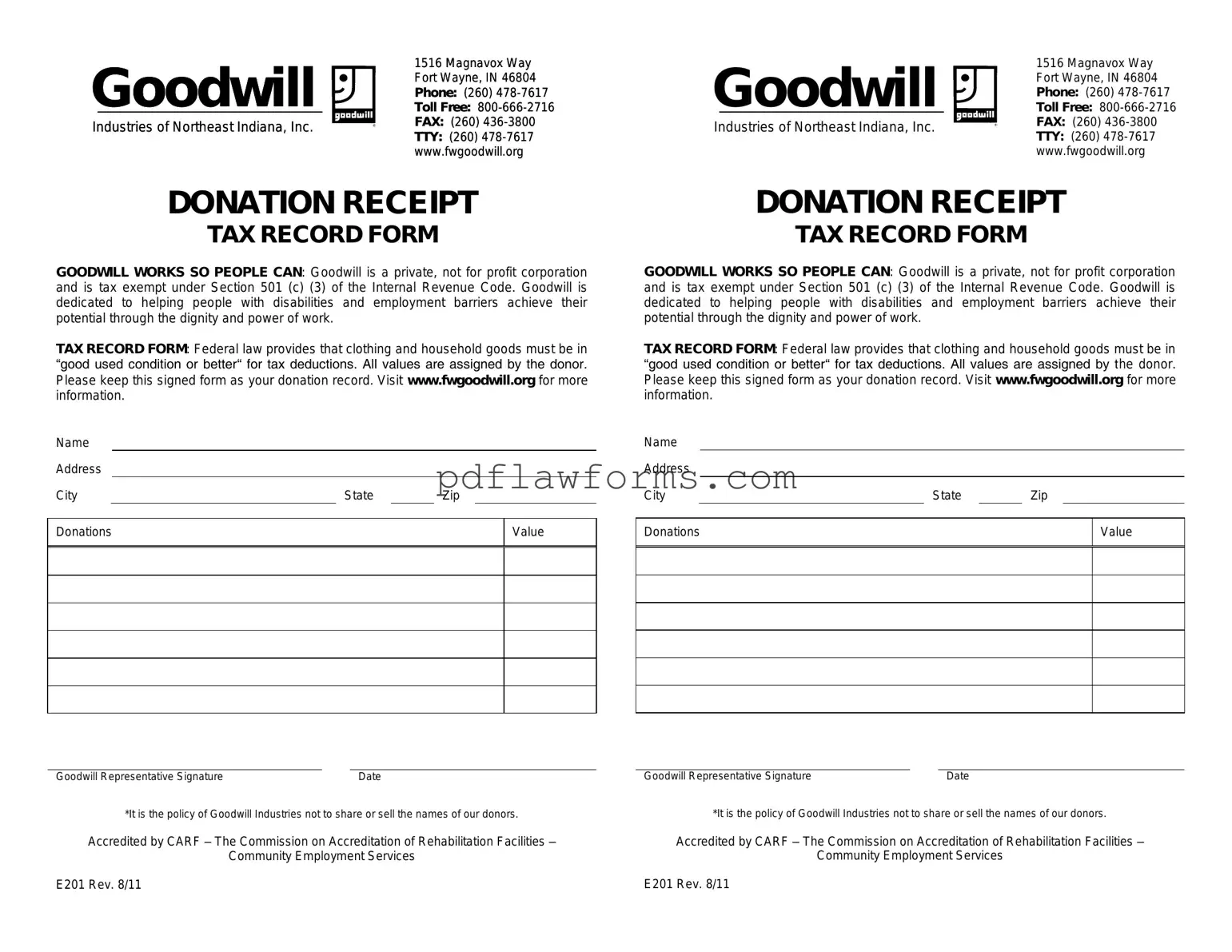

When donating items to Goodwill, many individuals overlook the importance of accurately filling out the donation receipt form. This form serves as a record of the items donated and is essential for tax purposes. Here are nine common mistakes people make when completing this form.

One frequent error is failing to list all donated items. Donors sometimes assume that they only need to note high-value items, but it’s important to include everything. Even small items can add up and contribute to your overall deduction.

Another common mistake is not estimating the fair market value of the donated goods. Donors may undervalue their items, which can lead to missed tax benefits. It’s crucial to research and determine a reasonable value for each item based on its condition and market trends.

Some individuals forget to sign and date the receipt. Without a signature, the form lacks authenticity, and the IRS may question the legitimacy of the donation. Always ensure that your receipt is properly signed and dated before submitting it with your tax return.

Inaccurate personal information is another pitfall. Donors often make mistakes with their names, addresses, or contact information. This can lead to complications in case Goodwill needs to reach out regarding the donation or if there are questions during tax preparation.

Additionally, many people neglect to keep a copy of the receipt. It’s essential to retain a copy for your records, as the IRS may request documentation to support your deductions. Without a copy, you may face challenges if you are audited.

Another mistake is not using the correct form. Goodwill has specific forms for different types of donations, and using an outdated or incorrect version can create confusion. Always ensure you have the latest version of the form to avoid any issues.

Some donors fail to describe the condition of the items accurately. Whether items are new, gently used, or in need of repair, this information is vital for both you and Goodwill. Accurate descriptions help in determining the fair market value and ensure transparency in the donation process.

Moreover, people sometimes ignore the instructions provided on the form. Each section has specific requirements, and overlooking these can lead to incomplete or incorrect submissions. Take the time to read through the instructions carefully before filling out the form.

Lastly, many individuals do not seek assistance when needed. If you are unsure about how to complete the form or have questions about valuation, don’t hesitate to ask a Goodwill employee for help. They can provide guidance to ensure your donation process goes smoothly.

By being mindful of these common mistakes, you can enhance your donation experience and maximize the benefits of your charitable contributions. Properly completing the Goodwill donation receipt form not only helps you but also supports the mission of Goodwill in your community.