Fill Your Gift Letter Template

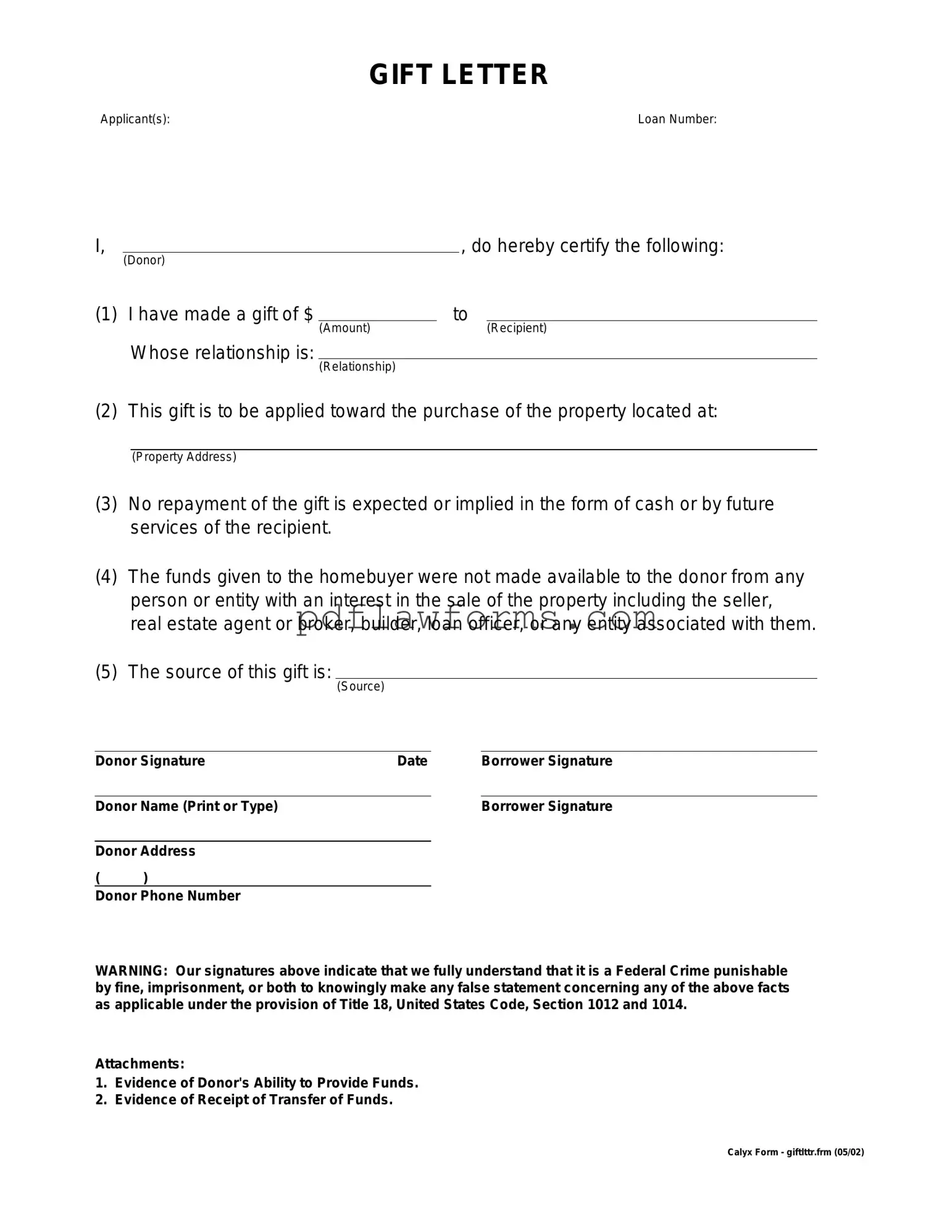

The Gift Letter form is a document used to outline the details of a monetary gift, typically given to help someone purchase a home. This form serves as proof that the funds are a gift and not a loan, ensuring clarity and transparency in financial transactions. Understanding how to properly fill out this form is essential for both the giver and receiver to avoid potential misunderstandings.

Ready to fill out your Gift Letter form? Click the button below!

Make My Document Online

Fill Your Gift Letter Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Gift Letter online, then download your file.

Make My Document Online

or

⇩ Gift Letter PDF