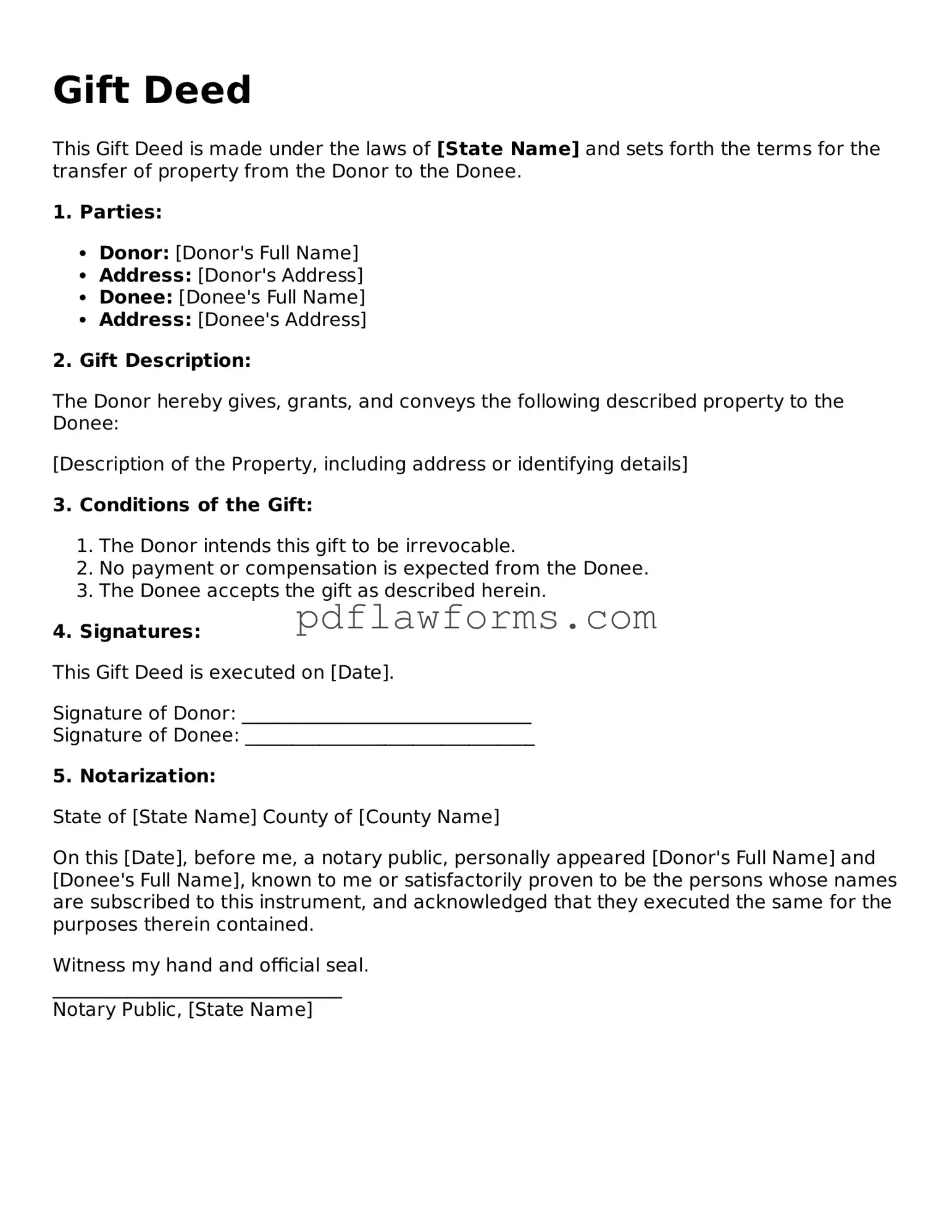

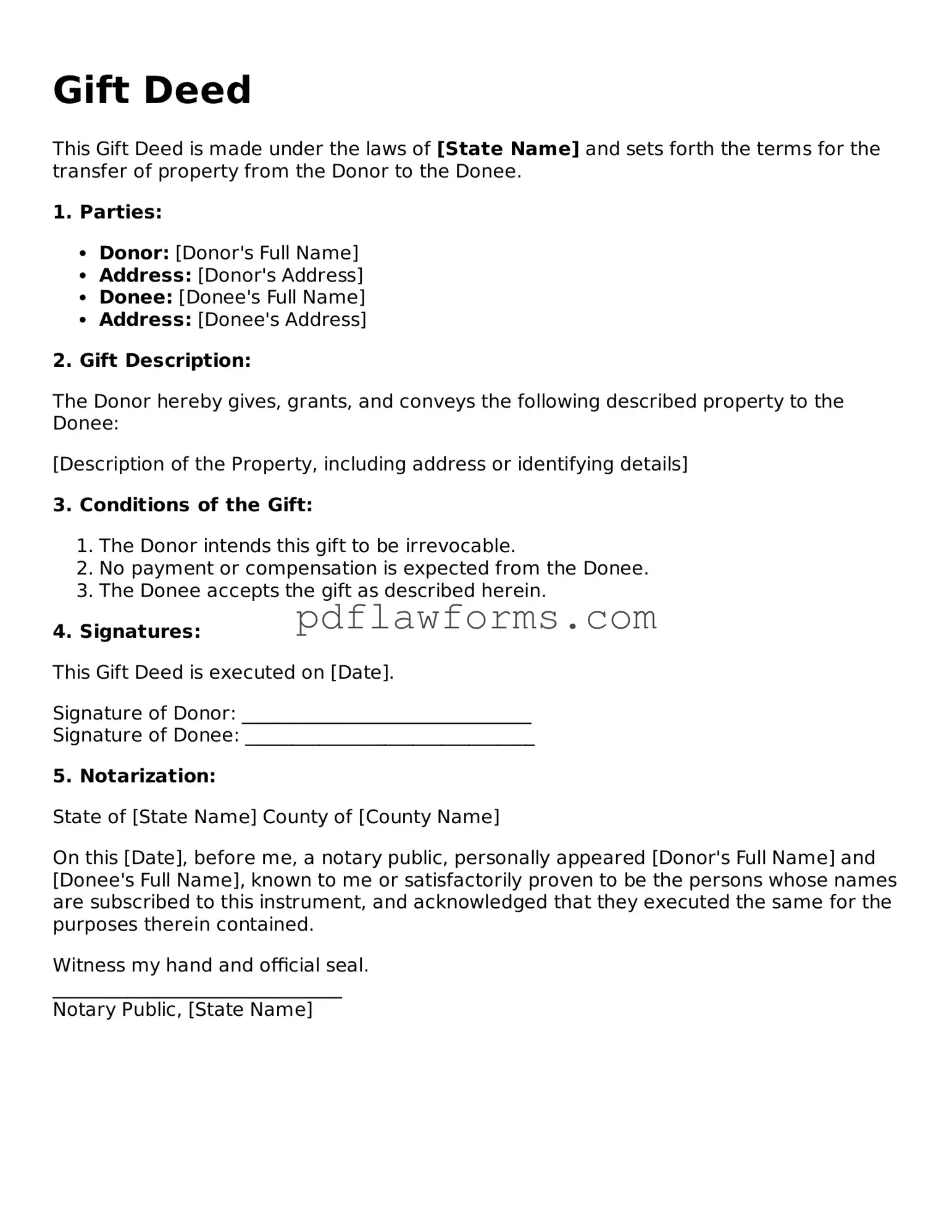

When it comes to gifting property, a Gift Deed is an essential document. However, many individuals stumble during the process of filling out this form. One common mistake is failing to include all necessary details about the property. It’s crucial to provide a complete description, including the address and any unique identifiers like parcel numbers. Omitting this information can lead to confusion and potential disputes down the line.

Another frequent error is neglecting to identify the parties involved clearly. The names of both the giver and the recipient must be spelled correctly and match their legal identification. Any discrepancies can raise questions about the legitimacy of the transfer. This simple oversight can complicate the gift process and may even result in legal challenges.

Additionally, many people overlook the importance of including the date of the gift. This date serves as a reference point for when the transfer took place. Without it, the document may lack clarity, and issues could arise regarding the timing of ownership. A well-dated Gift Deed helps establish a clear timeline for the transaction.

Another pitfall is the failure to sign the document properly. Both the giver and the recipient must sign the Gift Deed for it to be valid. In some cases, witnesses may also be required, depending on state laws. Skipping signatures or not following the required witnessing process can render the deed ineffective.

People often forget about the need for notarization. Many states require that a Gift Deed be notarized to ensure its authenticity. Notarization acts as a safeguard against fraud and provides an extra layer of protection for both parties involved. Neglecting this step can lead to complications in the future.

Another mistake is not considering tax implications. While gifts may not be subject to income tax, there can be gift tax considerations, especially for larger gifts. Understanding these tax responsibilities can help avoid unexpected financial burdens later on. Consulting a tax professional before completing the deed can provide valuable insights.

Finally, many individuals fail to keep copies of the completed Gift Deed. It’s essential to retain a copy for personal records and to provide one to the recipient. This ensures that both parties have access to the same information and can refer back to it if needed. Keeping a record helps in maintaining transparency and can be beneficial in case of any disputes.