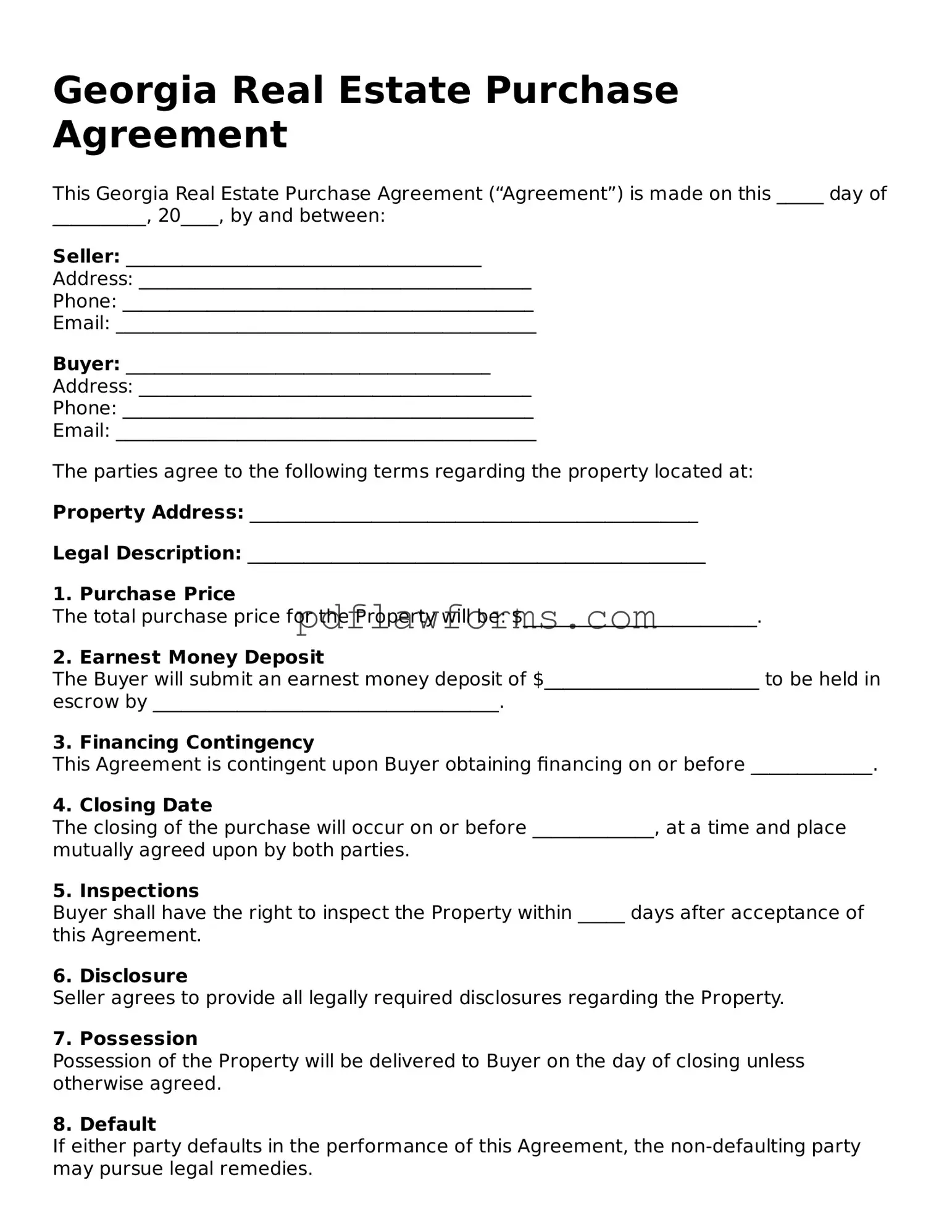

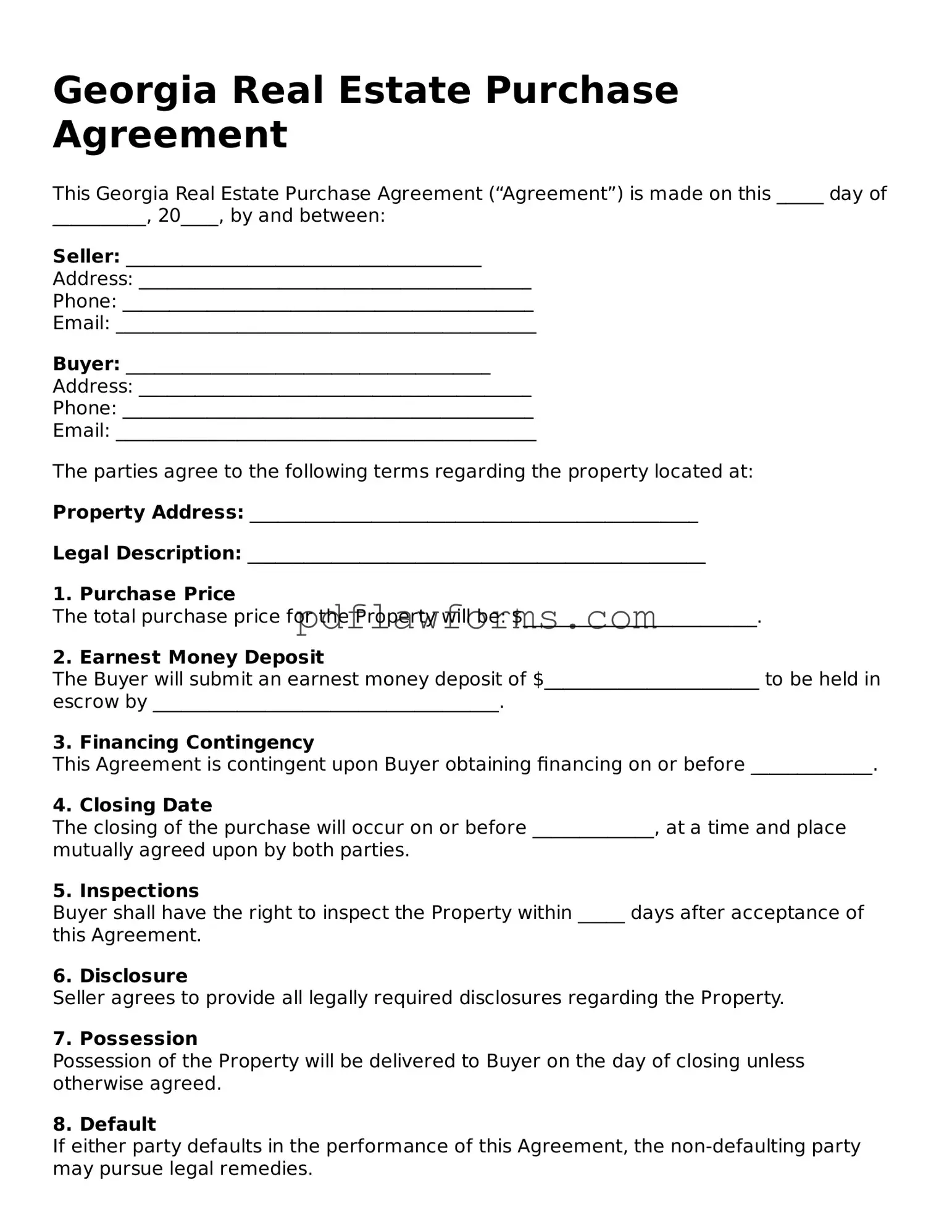

Filling out the Georgia Real Estate Purchase Agreement can be a straightforward process, but many people make common mistakes that can lead to complications later on. One frequent error is failing to provide accurate property descriptions. Buyers and sellers should ensure that the property address, lot number, and any other identifying details are correct. Inaccuracies can cause confusion and potentially delay the transaction.

Another common mistake involves not specifying the purchase price clearly. It is essential to state the exact amount being offered for the property. Leaving this section blank or using vague language can lead to misunderstandings between the parties involved. Always double-check that the price reflects what was agreed upon verbally.

Many individuals also overlook the importance of including all necessary contingencies. Contingencies protect buyers and sellers by outlining conditions that must be met for the sale to proceed. Omitting these can leave one party vulnerable. For example, a buyer might want to include a financing contingency to ensure they secure a mortgage before finalizing the purchase.

Additionally, failing to sign the agreement can render it invalid. Both the buyer and the seller must sign and date the document. Sometimes, one party assumes that an agreement is binding without signatures, which is a significant oversight. Always confirm that all required signatures are present before considering the deal official.

Another mistake is neglecting to include a closing date. This date is crucial as it sets a timeline for when the transaction will be completed. Without it, both parties may have different expectations about when the sale will close, leading to potential disputes.

Buyers often forget to review the terms related to earnest money deposits. This deposit shows the buyer's commitment to the purchase and should be clearly stated in the agreement. Not specifying the amount or the timeline for this deposit can lead to confusion and may jeopardize the deal.

In addition, some people fail to communicate any special requests or conditions. If there are specific items the buyer wants to remain with the property, such as appliances or fixtures, these should be clearly listed in the agreement. Without this information, there could be disagreements about what is included in the sale.

Lastly, overlooking the importance of consulting a real estate attorney or agent can be a critical error. While it’s possible to fill out the form independently, having professional guidance ensures that all sections are completed correctly and that the agreement complies with Georgia laws. This support can prevent costly mistakes and facilitate a smoother transaction.