Filling out a Georgia Loan Agreement form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One of the most frequent errors is failing to read the instructions carefully. Each section of the form is designed to gather specific information. Skipping over these details may result in incomplete or inaccurate submissions.

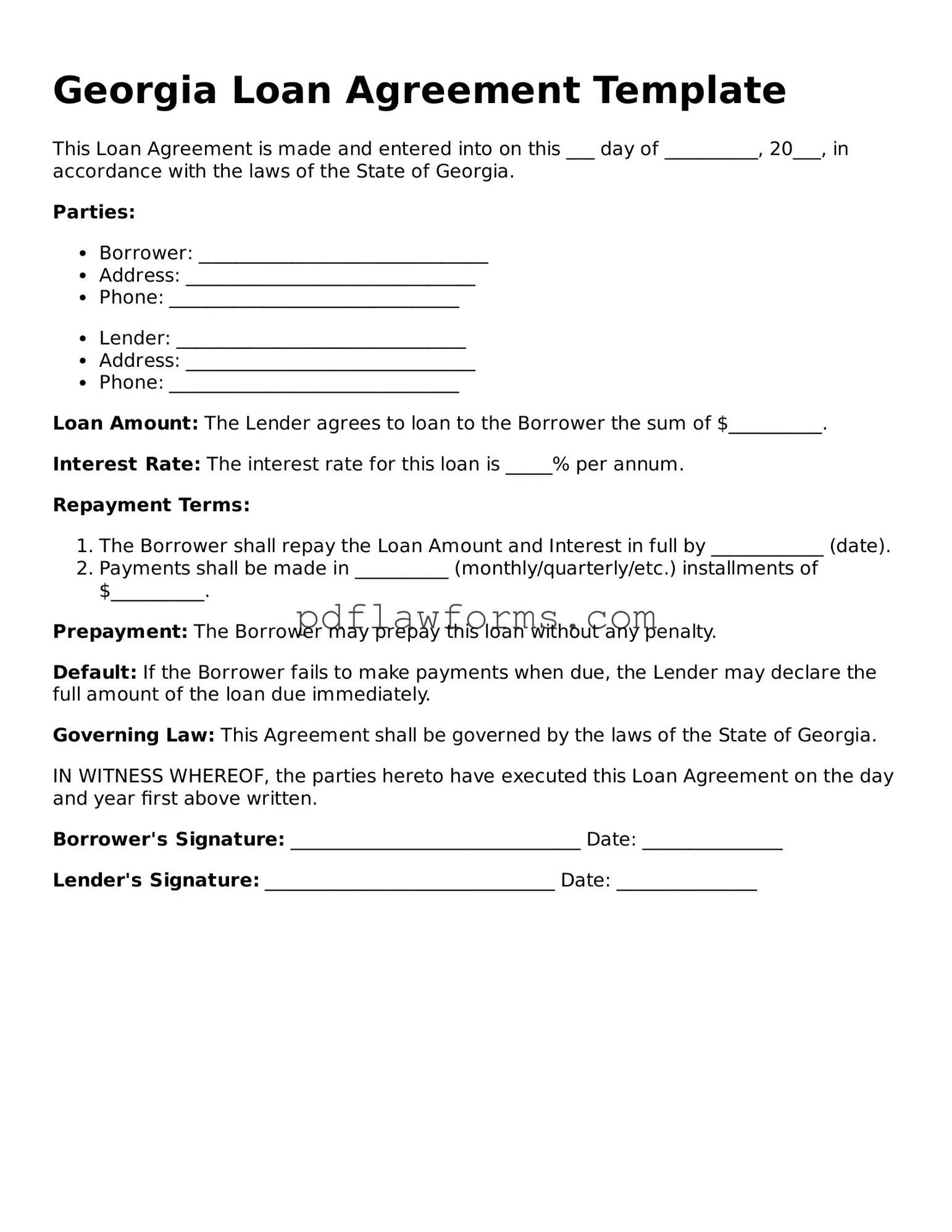

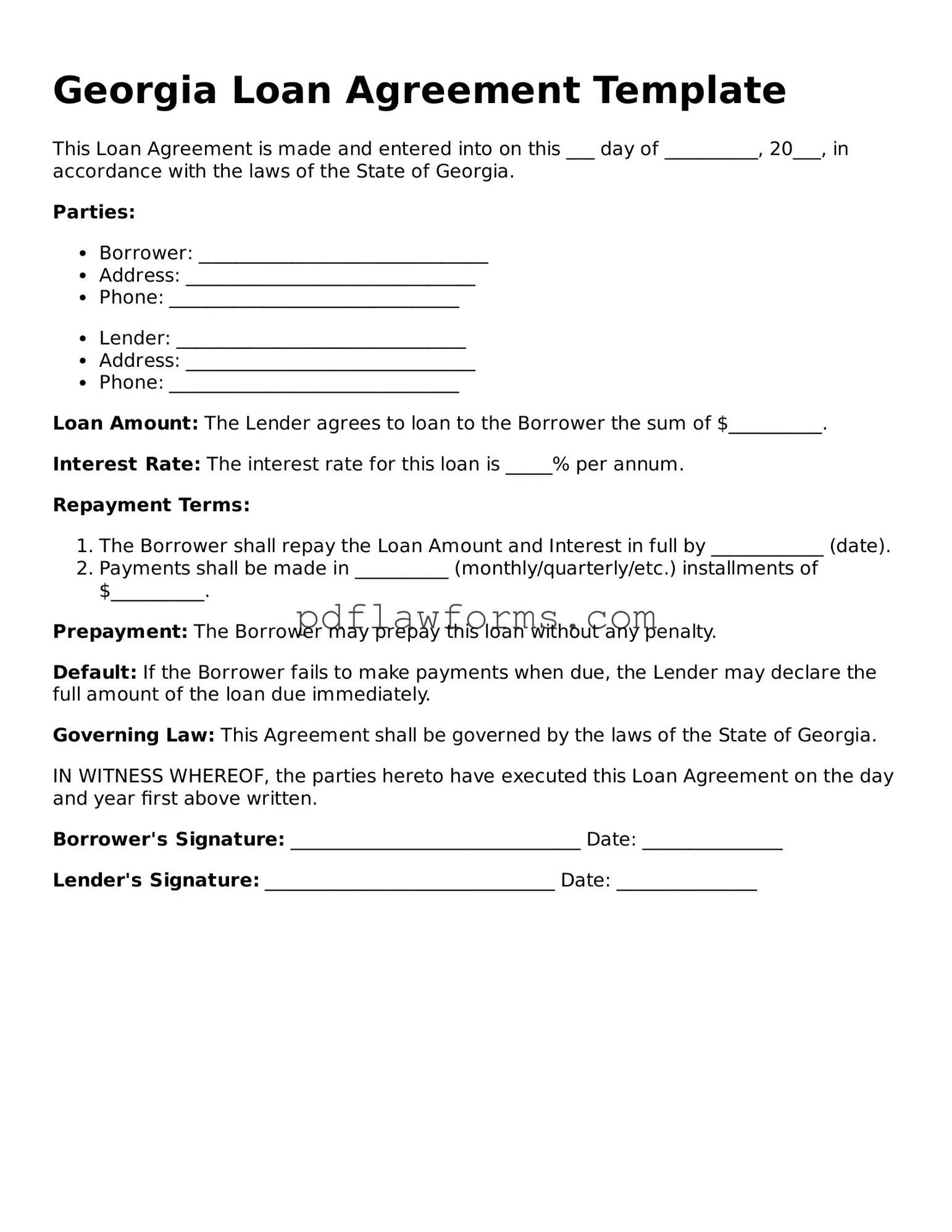

Another common mistake is not providing accurate personal information. This includes your name, address, and contact details. Even a small typo can lead to confusion or delays in processing your loan. Always double-check this information to ensure it is correct.

Many people overlook the importance of understanding the terms of the loan. It’s crucial to grasp the interest rate, repayment schedule, and any fees associated with the loan. Ignoring these details can lead to unexpected financial burdens later on. Take the time to read through the terms and ask questions if something is unclear.

In addition, individuals sometimes forget to sign and date the form. A signature is a critical part of the agreement, as it signifies your acceptance of the terms. Without it, the document may be considered invalid. Ensure that you sign in the designated area and include the date.

Another mistake is not providing supporting documentation when required. Lenders often ask for proof of income, identification, or other financial documents to verify your eligibility. Failing to include these can slow down the approval process or even result in denial.

Some borrowers neglect to keep a copy of the completed agreement for their records. This can be problematic if there are disputes or if you need to refer back to the terms in the future. Always retain a copy for your personal files.

Additionally, individuals may fail to disclose all debts or financial obligations. Being transparent about your financial situation is essential for lenders to assess your ability to repay the loan. Omitting information can lead to complications later on, including potential legal issues.

Another frequent oversight involves misunderstanding the repayment terms. Some borrowers may not realize that missing a payment can have serious consequences. Familiarize yourself with the repayment schedule and plan accordingly to avoid any pitfalls.

Finally, many individuals rush through the process without seeking assistance when needed. If you find yourself confused or uncertain about any part of the form, don’t hesitate to ask for help. It’s better to take a little extra time to ensure everything is correct than to face issues later.