Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. However, many individuals make mistakes when filling out this important document, particularly in Georgia. Understanding these common pitfalls can help you avoid them and create a valid will that reflects your intentions.

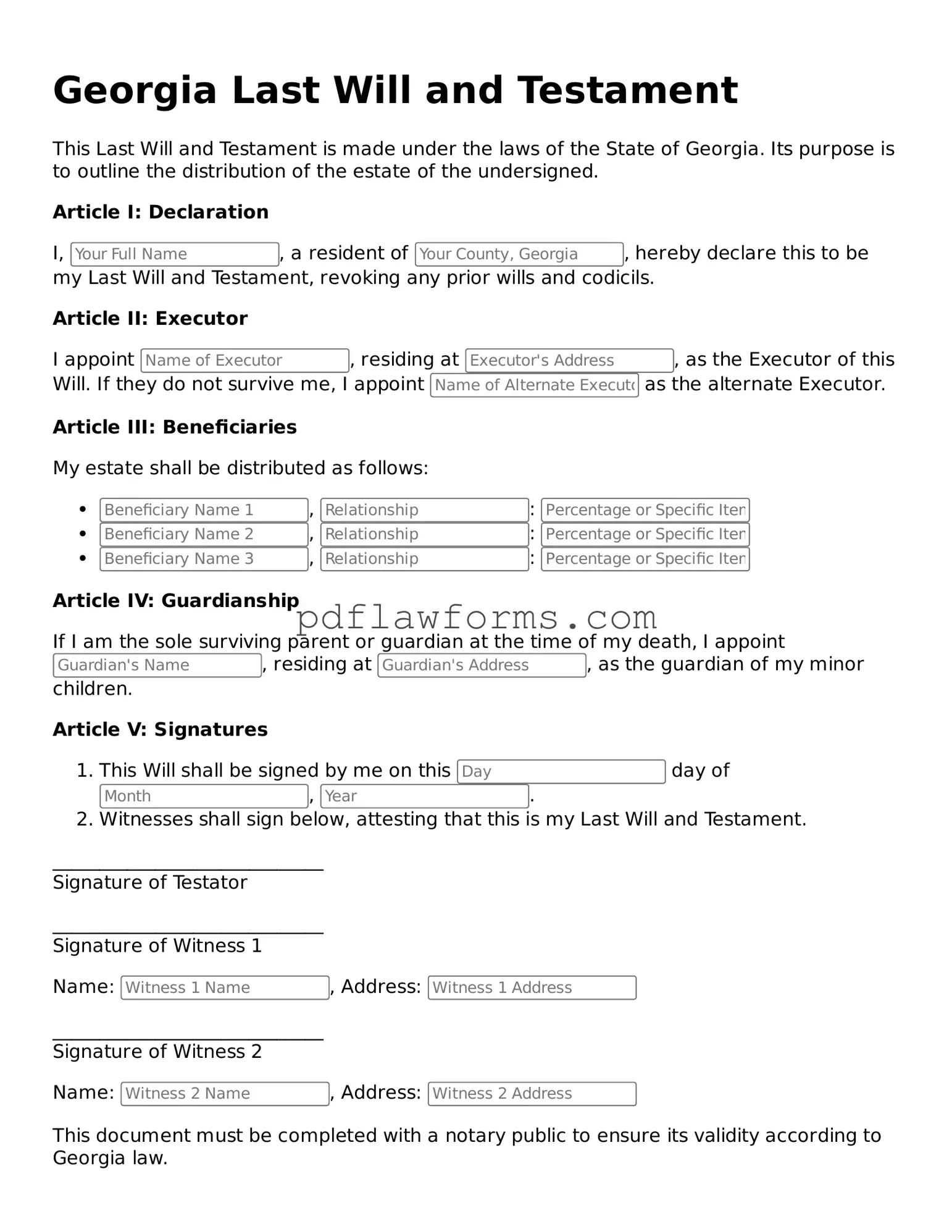

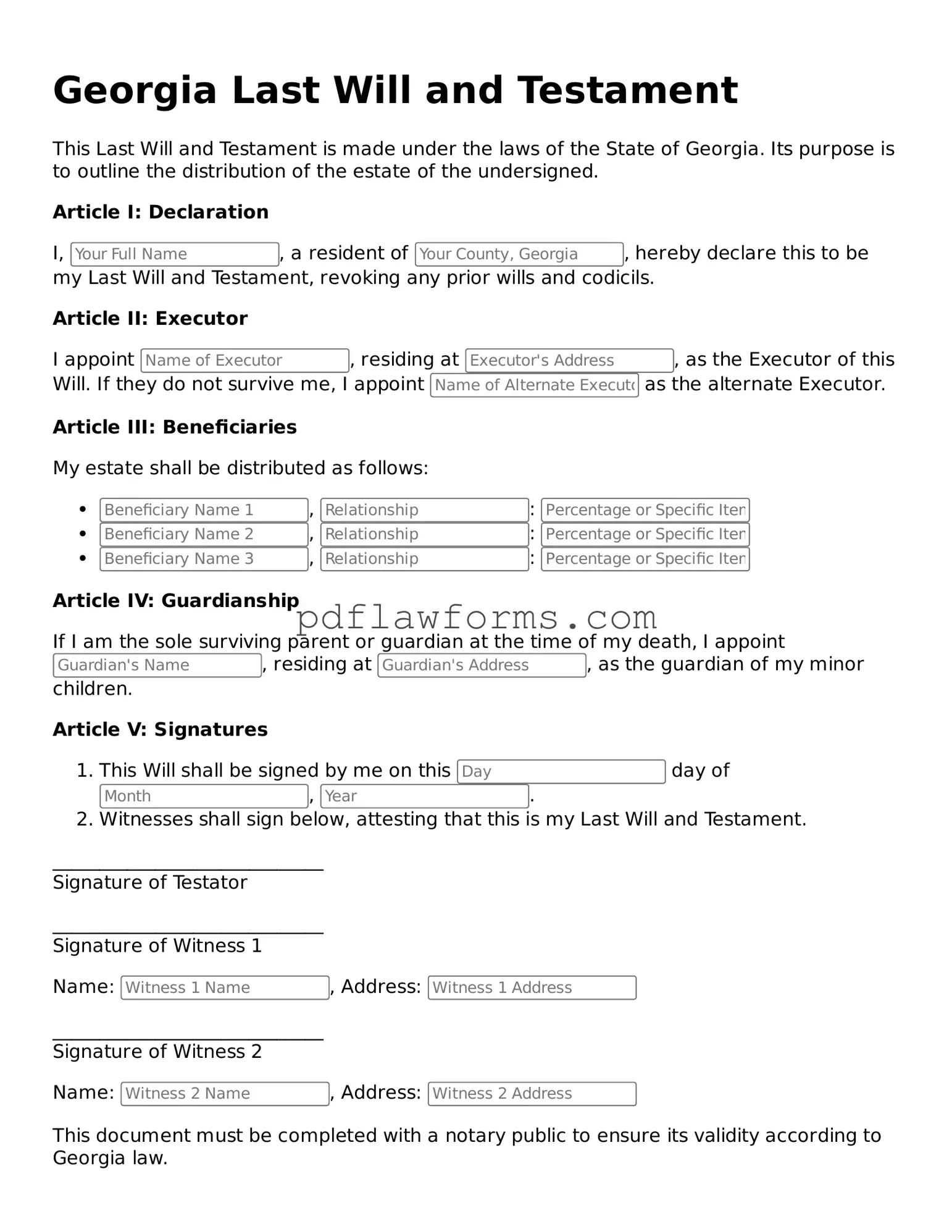

One frequent mistake is failing to properly identify the testator. The testator is the person creating the will. In Georgia, it is crucial to include your full legal name and address. Omitting any part of this information can lead to confusion and may even render the will invalid.

Another common error is neglecting to name an executor. The executor is responsible for carrying out the terms of the will. If you leave this section blank or choose someone who is unwilling or unable to serve, it can complicate the probate process. It’s advisable to select a trustworthy individual and discuss your decision with them beforehand.

Many people also overlook the importance of signatures. In Georgia, a will must be signed by the testator and witnessed by at least two individuals who are not beneficiaries. Failing to have the required signatures can invalidate the will. Ensure that all parties sign in the presence of one another to avoid this issue.

Another mistake is not being specific about asset distribution. Vague language can lead to disputes among heirs. Clearly detailing who receives what can help prevent misunderstandings and potential conflicts. Specificity is key to ensuring your wishes are honored.

Additionally, people often forget to update their wills after major life events, such as marriage, divorce, or the birth of a child. Life changes can significantly impact your wishes regarding asset distribution and guardianship. Regularly reviewing and updating your will is vital to ensure it reflects your current situation.

Some individuals also fail to consider the implications of including digital assets in their will. With the rise of online accounts, it’s important to address how these assets should be handled. Providing clear instructions can help your executor manage these assets effectively.

Lastly, many people mistakenly believe that once they fill out their will, it is set in stone. In reality, a will can and should be amended as circumstances change. Understanding how to create a codicil or a new will can help ensure your document remains relevant and effective over time.

By avoiding these common mistakes, you can create a Last Will and Testament that accurately reflects your wishes and provides peace of mind for you and your loved ones.