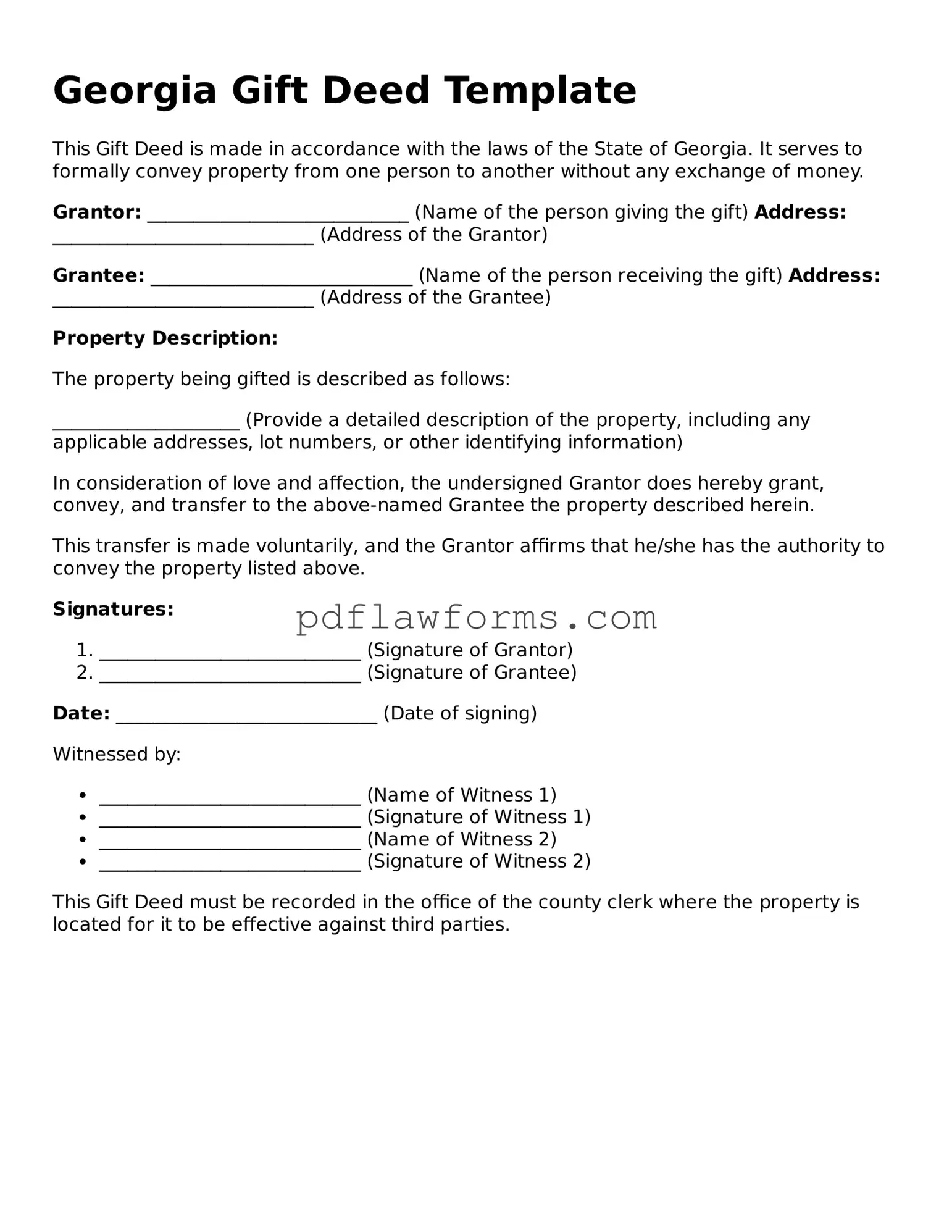

Filling out a Georgia Gift Deed form can be straightforward, but many people make common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure the process goes smoothly. One frequent error is failing to include the proper legal description of the property. Instead of using vague terms, it’s essential to provide a detailed description that identifies the property clearly. This helps avoid any confusion regarding what is being gifted.

Another mistake is neglecting to include the names of both the donor and the recipient. It’s important to ensure that both parties' names are spelled correctly and match their legal identification. Any discrepancies can lead to issues with the validity of the deed. Additionally, some individuals forget to sign the form. Without a signature, the deed is not legally binding, which means the gift may not be recognized.

Many people also overlook the need for a witness or notarization. In Georgia, having a witness sign the Gift Deed can add an extra layer of legitimacy. Notarization further verifies the identities of the parties involved and the authenticity of the signatures. Omitting this step can lead to challenges in proving the deed's validity later on.

Another common error is not considering tax implications. While gifting property may seem straightforward, it’s wise to understand any potential tax consequences. The donor may be subject to gift tax if the value of the gift exceeds a certain amount. Consulting a tax professional can provide clarity on this issue.

People often forget to check for existing liens or encumbrances on the property. If there are any outstanding debts or claims against the property, the gift may not be valid. It’s crucial to ensure that the property is free and clear before proceeding with the gift.

Finally, some individuals fail to keep copies of the completed Gift Deed. It’s important to retain a copy for personal records and to provide a copy to the recipient. This ensures that both parties have proof of the transaction, which can be useful in the future.

By being aware of these common mistakes, individuals can navigate the process of filling out a Georgia Gift Deed more effectively. Taking the time to double-check each detail can prevent future complications and ensure that the gift is legally recognized.