When starting a business in Georgia, filling out the Articles of Incorporation form is a crucial step. However, many individuals make common mistakes that can lead to delays or complications. One frequent error is providing an incorrect name for the corporation. The name must be unique and not already in use by another entity in Georgia. To avoid this mistake, always conduct a name search through the Georgia Secretary of State’s website before submission.

Another common oversight is failing to include the correct registered agent information. The registered agent is the person or business designated to receive legal documents on behalf of the corporation. It’s important to ensure that the agent’s name and address are accurate and that they are available during business hours. Missing this information can result in legal complications down the line.

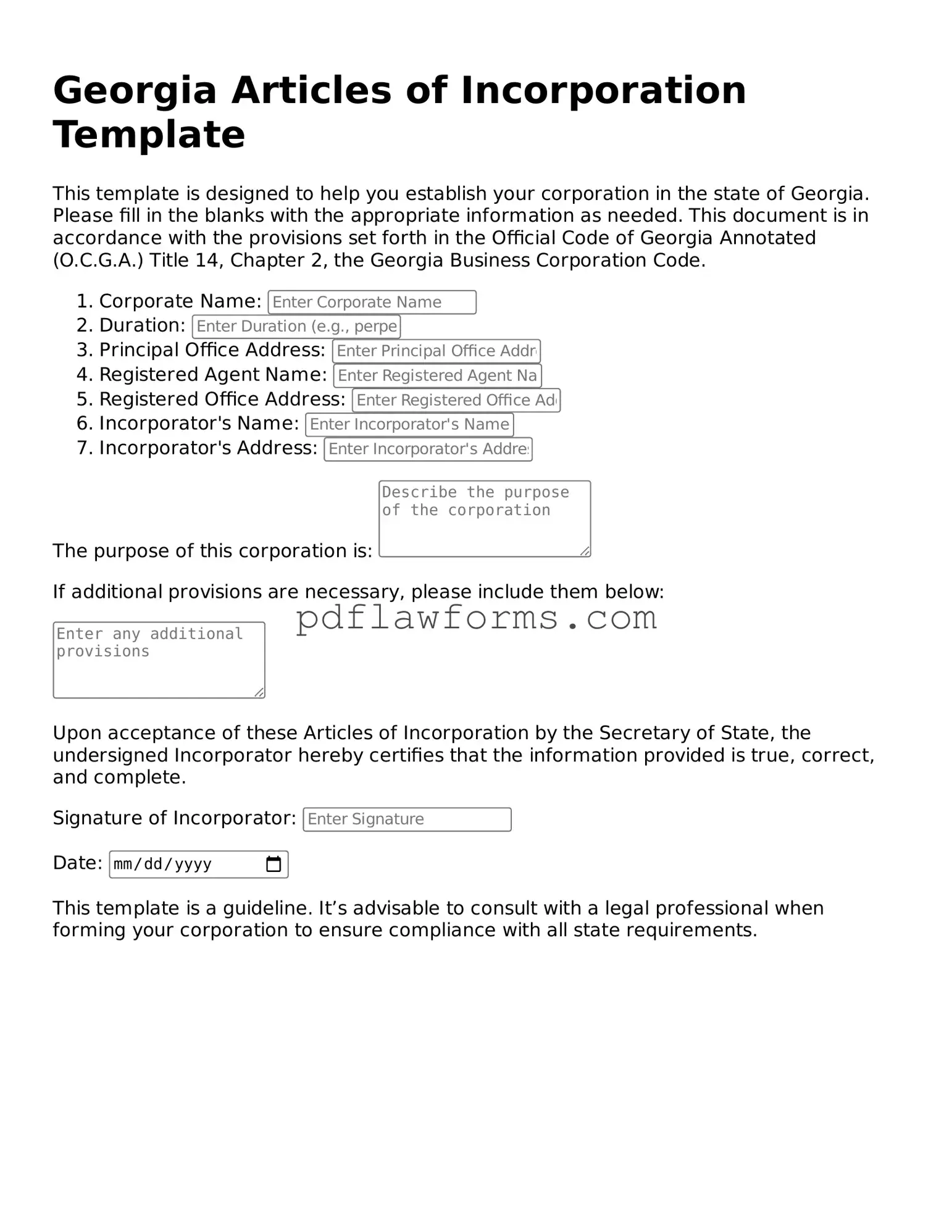

Many people also overlook the requirement for specifying the corporation’s purpose. While it may seem straightforward, the purpose must be clearly defined and should align with the activities the corporation plans to undertake. A vague or overly broad purpose can raise questions and may require additional clarification from the state.

Another mistake involves not including the correct number of shares the corporation is authorized to issue. This number should be realistic and reflect the company’s plans for growth. Underestimating or overestimating shares can lead to complications in future fundraising or ownership structure.

Additionally, individuals often forget to indicate whether the corporation will be for-profit or non-profit. This distinction is crucial as it affects the tax treatment of the corporation and the obligations of its directors and officers. Failing to make this designation can lead to misunderstandings and potential legal issues.

Signing the Articles of Incorporation is another area where mistakes frequently occur. All incorporators must sign the document, and it’s essential to ensure that the signatures are legible and match the names listed. Missing signatures or incorrect names can delay the filing process.

People sometimes neglect to pay the required filing fee. Each submission must include the appropriate payment to avoid rejection. It’s wise to double-check the current fee schedule on the Georgia Secretary of State’s website to ensure compliance.

Lastly, individuals may not keep copies of their filed Articles of Incorporation. Once filed, it’s crucial to maintain a copy for your records. This document serves as a foundational element of your business and may be needed for various purposes in the future.