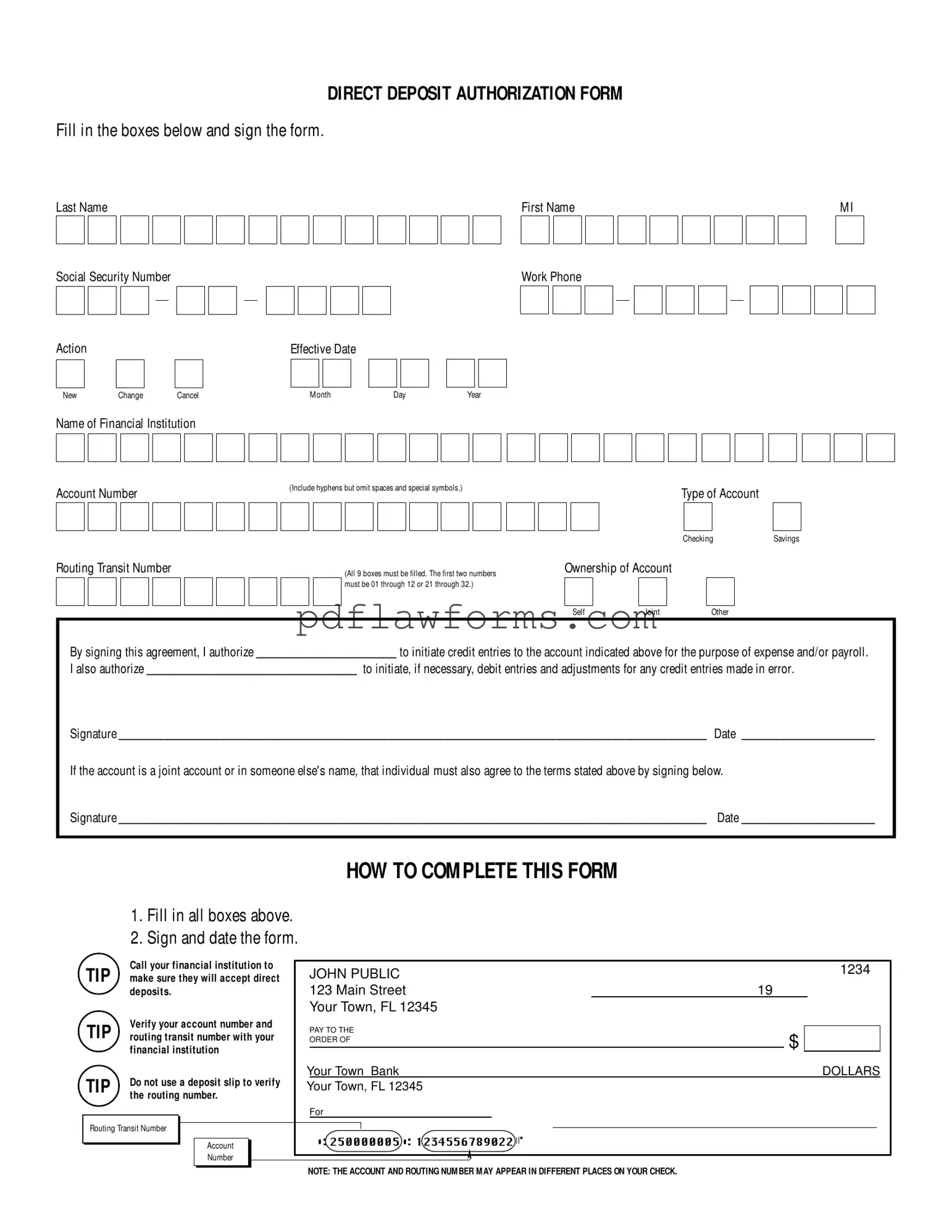

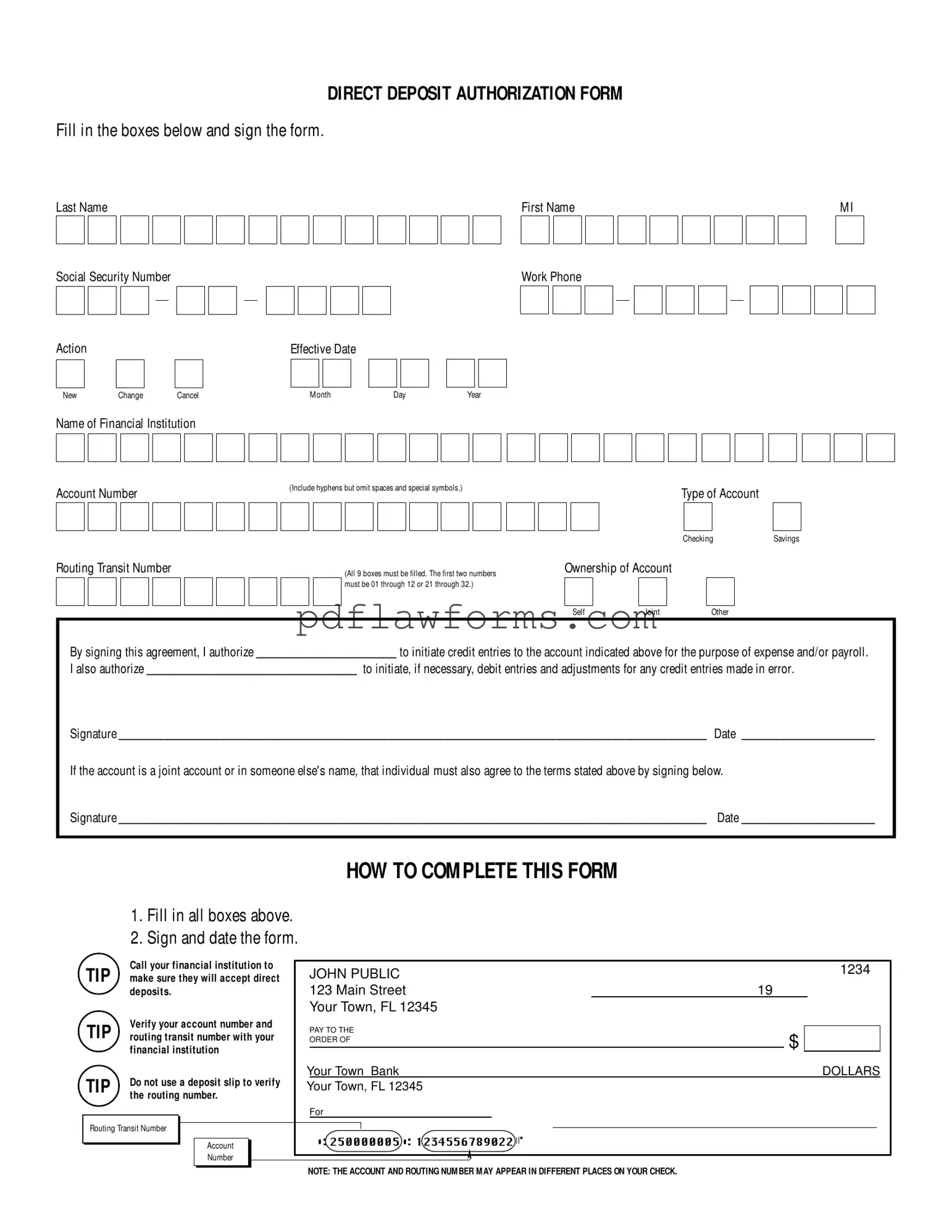

Fill Your Generic Direct Deposit Template

The Generic Direct Deposit form is a document that allows individuals to authorize their employers or other entities to deposit funds directly into their bank accounts. This streamlined process enhances convenience and security for receiving payments, whether for payroll or other expenses. To ensure timely and accurate deposits, please fill out the form by clicking the button below.

Make My Document Online

Fill Your Generic Direct Deposit Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Generic Direct Deposit online, then download your file.

Make My Document Online

or

⇩ Generic Direct Deposit PDF