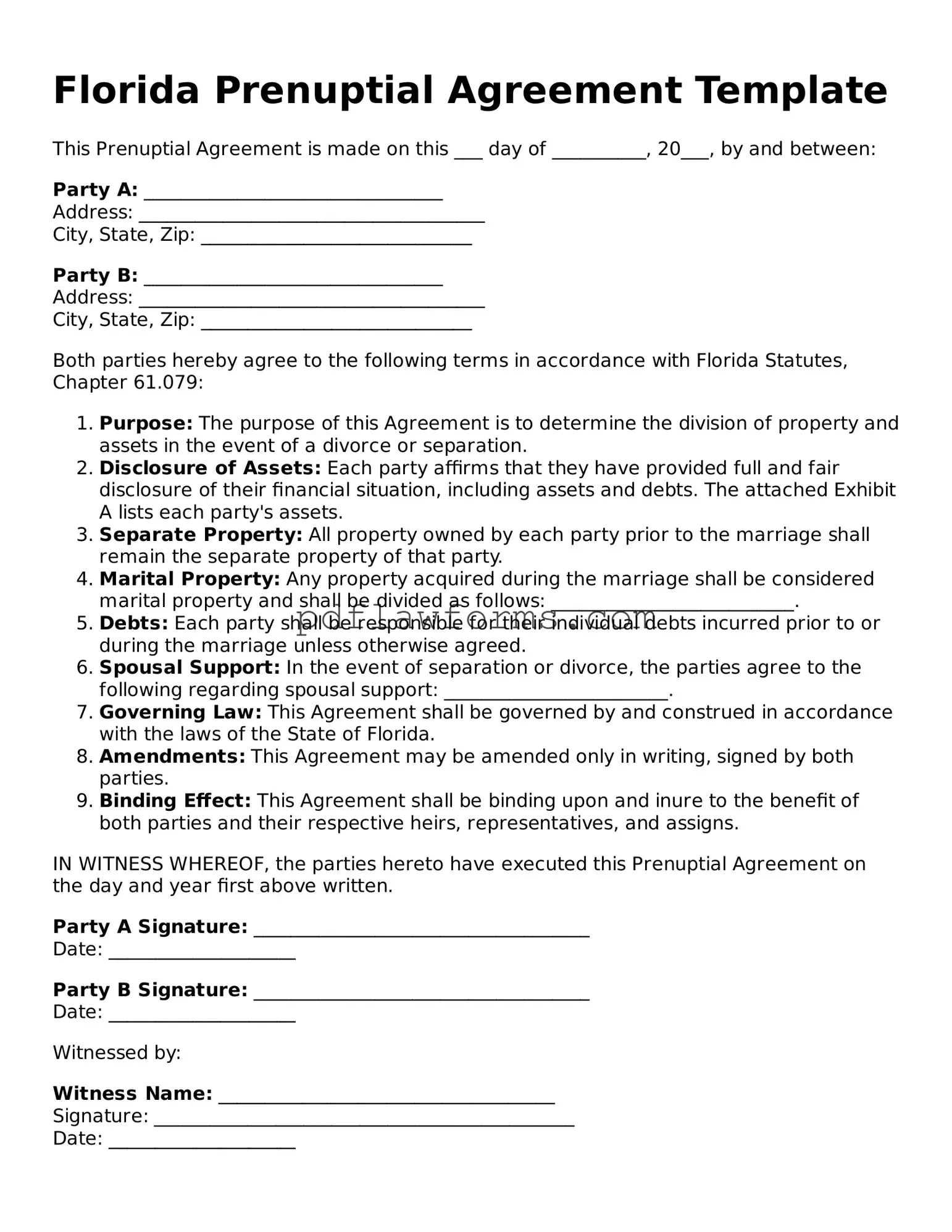

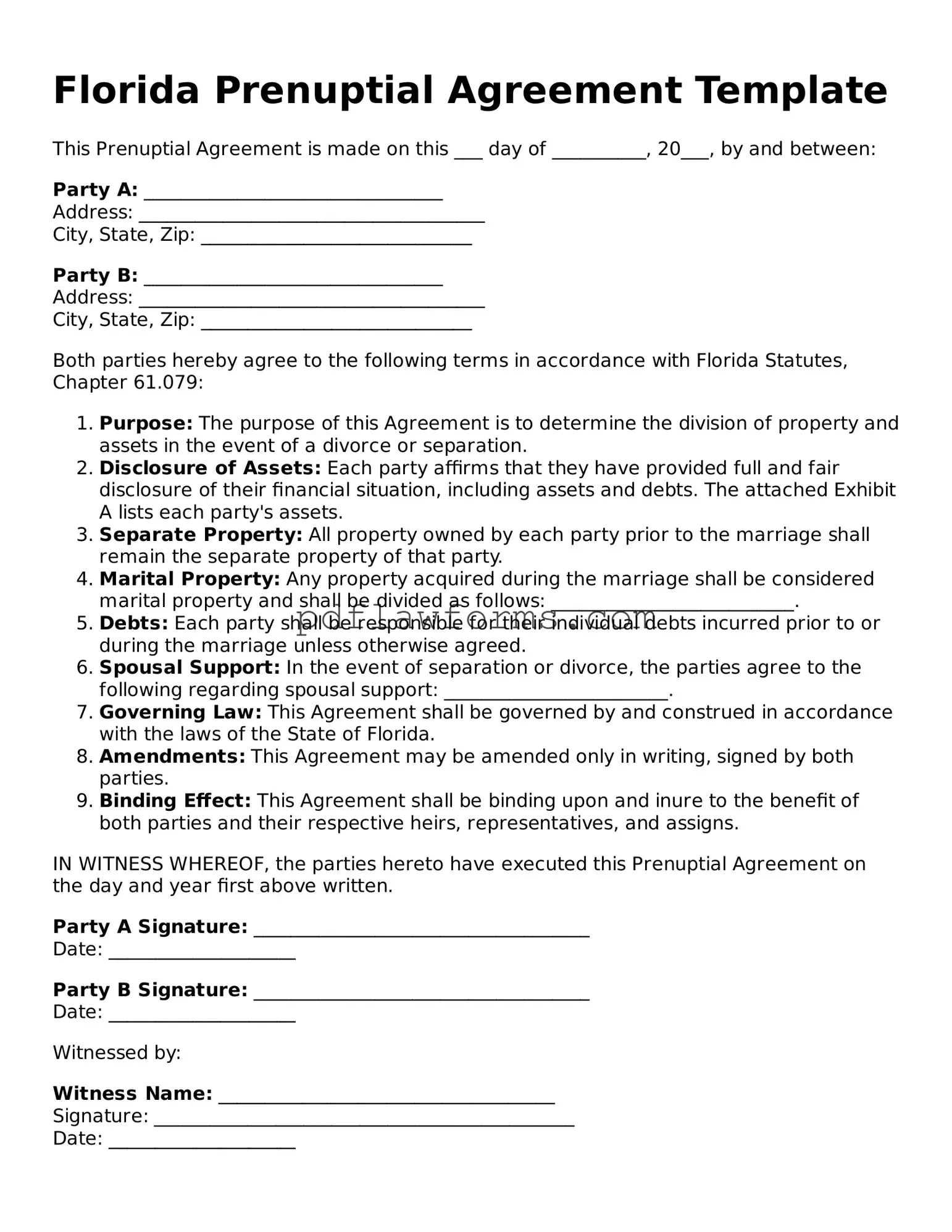

Prenuptial Agreement Form for the State of Florida

A Florida Prenuptial Agreement form is a legal document that outlines the financial and property rights of each spouse in the event of a divorce or separation. This agreement helps couples clarify their financial expectations and protect their individual assets before tying the knot. If you're considering a prenuptial agreement, take the first step by filling out the form below.

Click the button below to get started.

Make My Document Online

Prenuptial Agreement Form for the State of Florida

Make My Document Online

You’re halfway through — finish the form

Edit and complete Prenuptial Agreement online, then download your file.

Make My Document Online

or

⇩ Prenuptial Agreement PDF