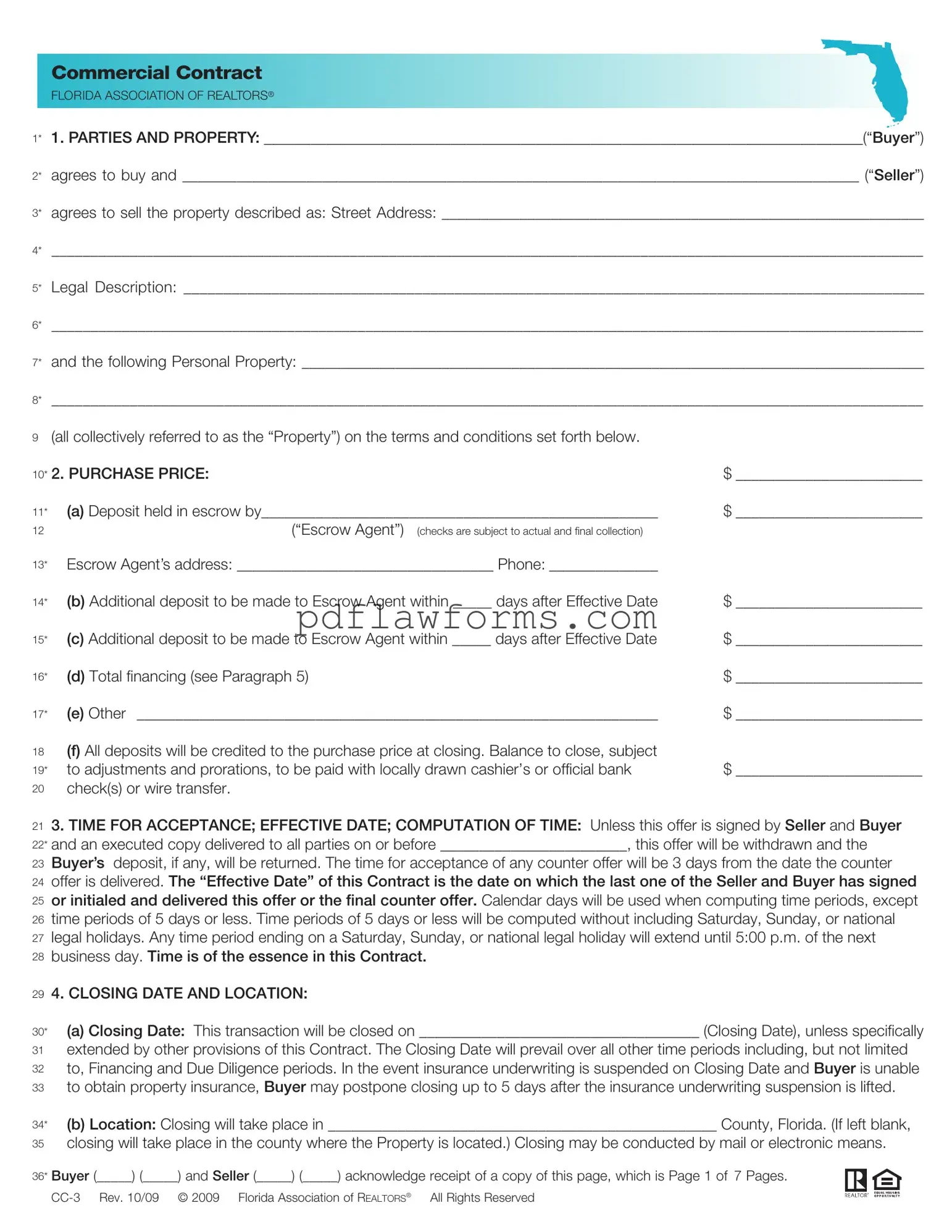

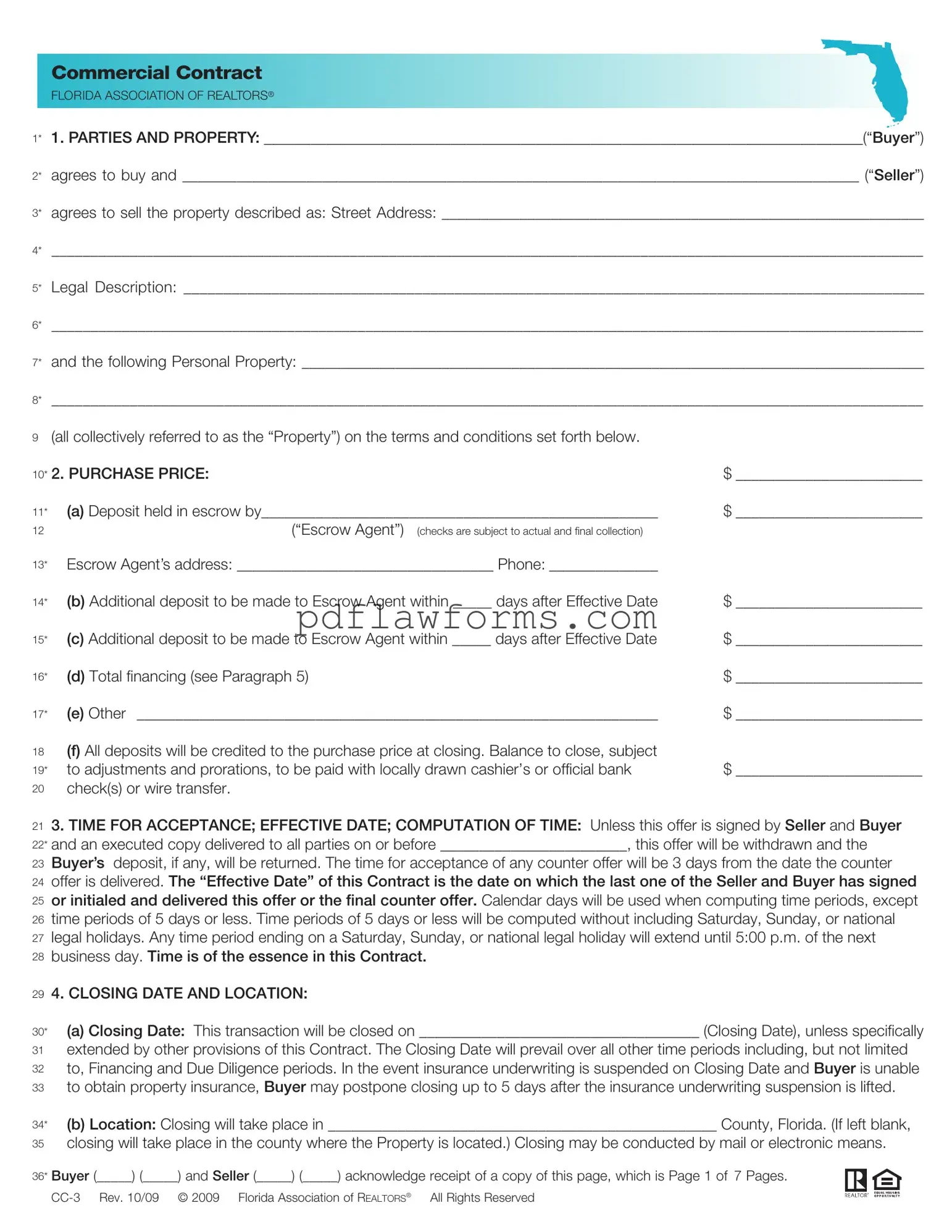

Fill Your Florida Commercial Contract Template

The Florida Commercial Contract form serves as a legal agreement between a buyer and a seller for the purchase and sale of commercial real estate in Florida. This standardized document outlines the terms and conditions of the transaction, including details about the property, purchase price, and responsibilities of both parties. For those ready to proceed, fill out the form by clicking the button below.

Make My Document Online

Fill Your Florida Commercial Contract Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Florida Commercial Contract online, then download your file.

Make My Document Online

or

⇩ Florida Commercial Contract PDF