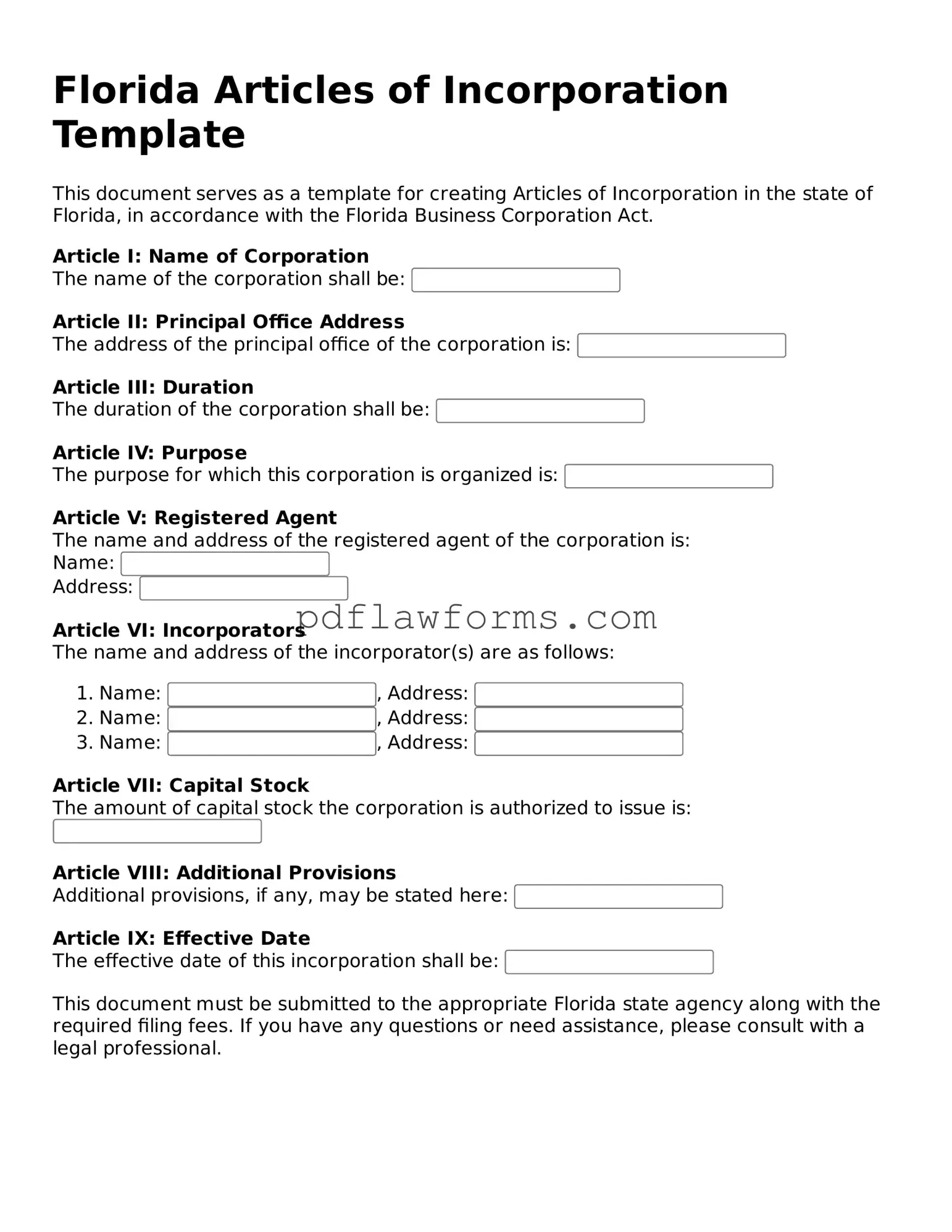

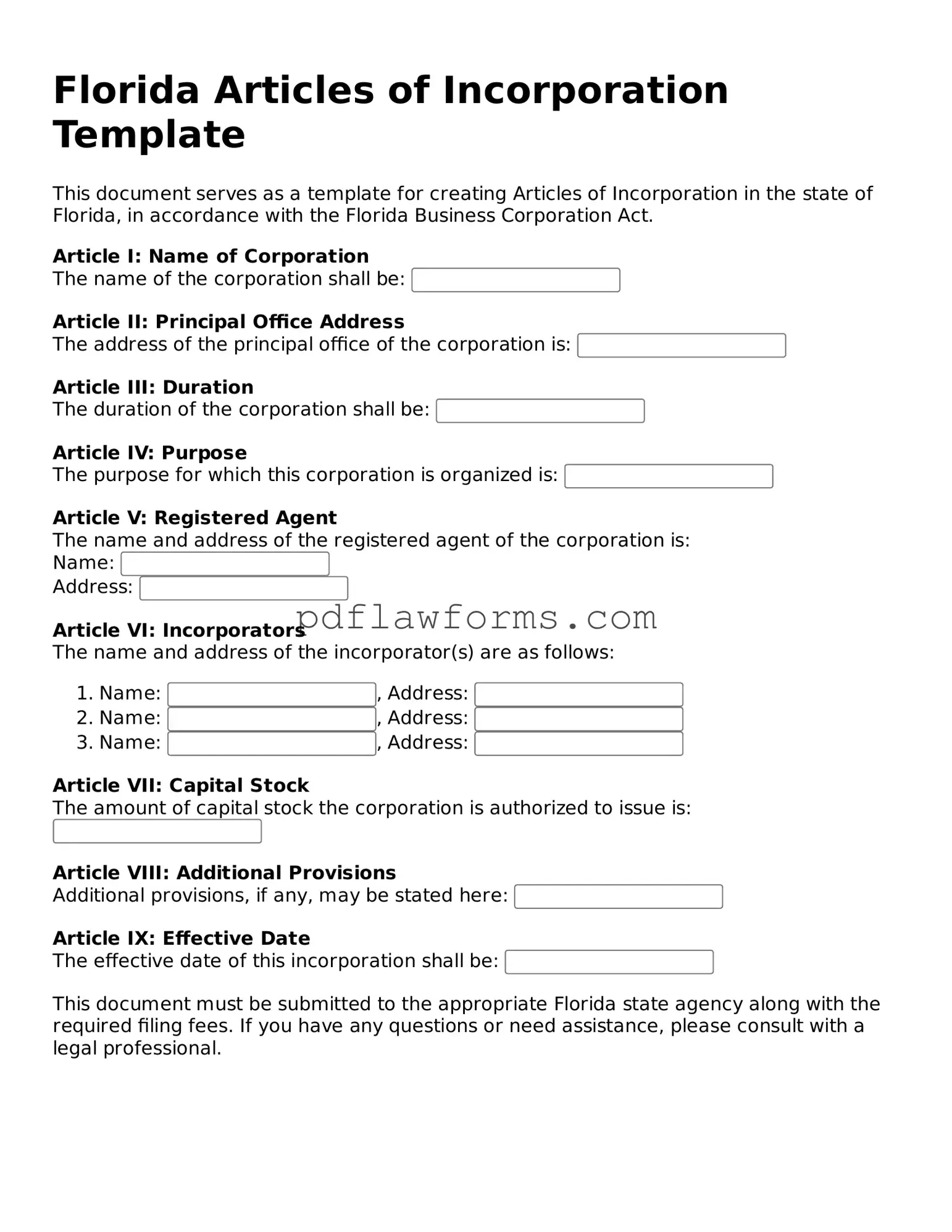

Articles of Incorporation Form for the State of Florida

The Florida Articles of Incorporation form is a legal document used to establish a corporation in the state of Florida. This form outlines essential details about the corporation, such as its name, purpose, and structure. Completing this form is a crucial step in starting a business in Florida, so be sure to fill it out by clicking the button below.

Make My Document Online

Articles of Incorporation Form for the State of Florida

Make My Document Online

You’re halfway through — finish the form

Edit and complete Articles of Incorporation online, then download your file.

Make My Document Online

or

⇩ Articles of Incorporation PDF