Fill Your Erc Broker Market Analysis Template

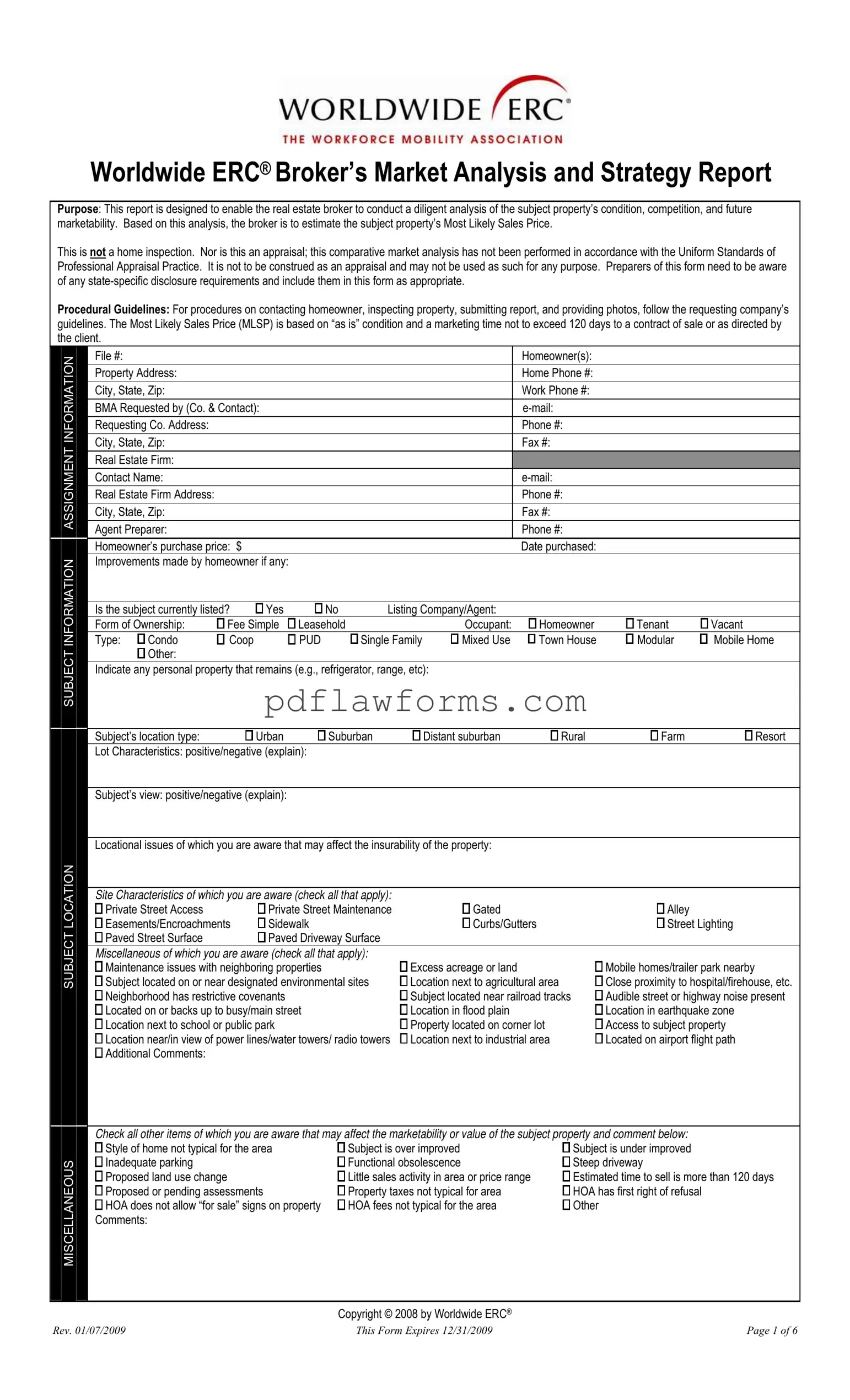

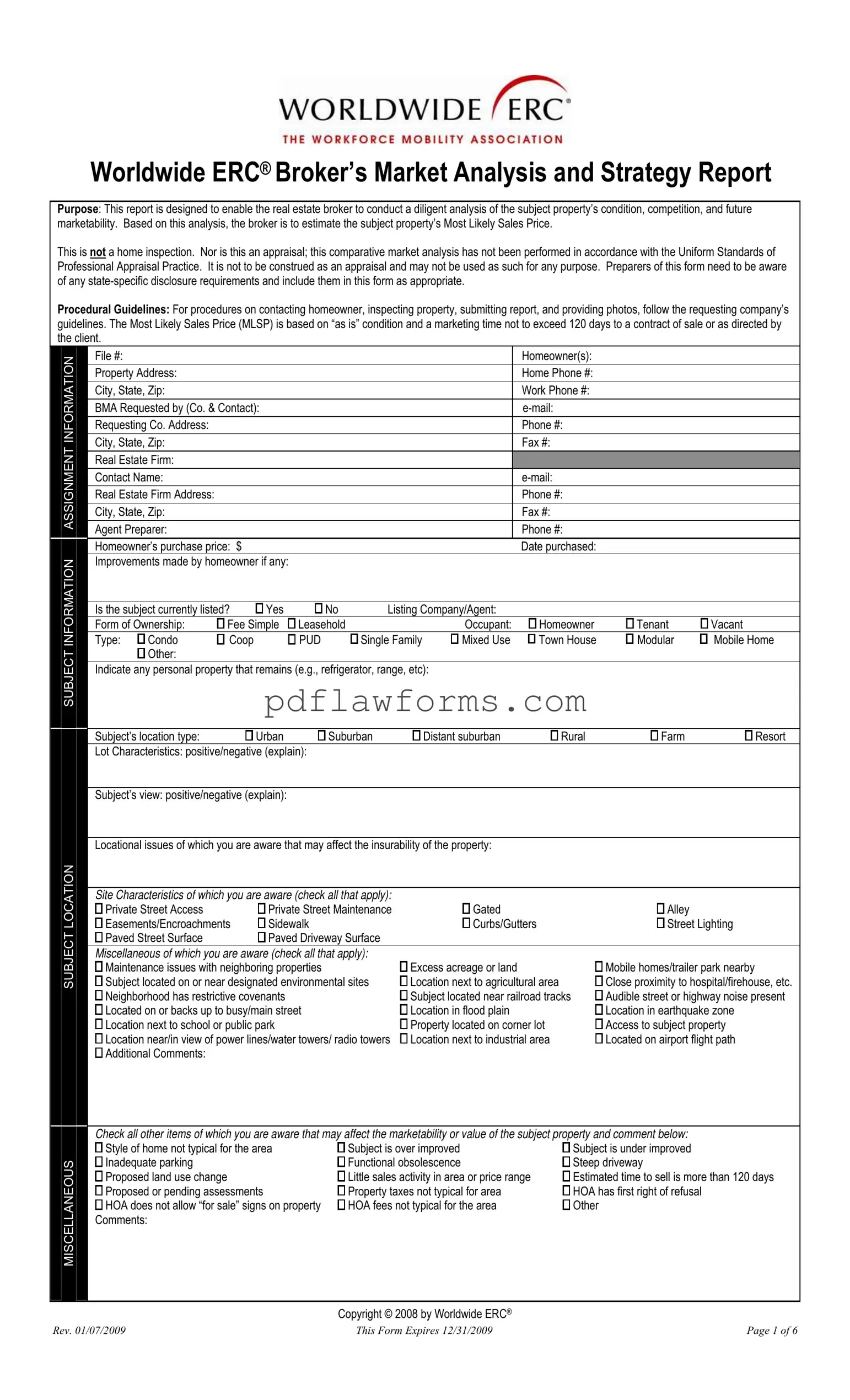

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a tool for real estate brokers to assess a property's condition, competition, and future marketability. This report enables brokers to estimate the Most Likely Sales Price based on a thorough analysis, but it is important to note that it does not constitute a home inspection or an appraisal. Brokers must also adhere to state-specific disclosure requirements while completing this form.

To initiate your analysis, please fill out the form by clicking the button below.

Make My Document Online

Fill Your Erc Broker Market Analysis Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Erc Broker Market Analysis online, then download your file.

Make My Document Online

or

⇩ Erc Broker Market Analysis PDF