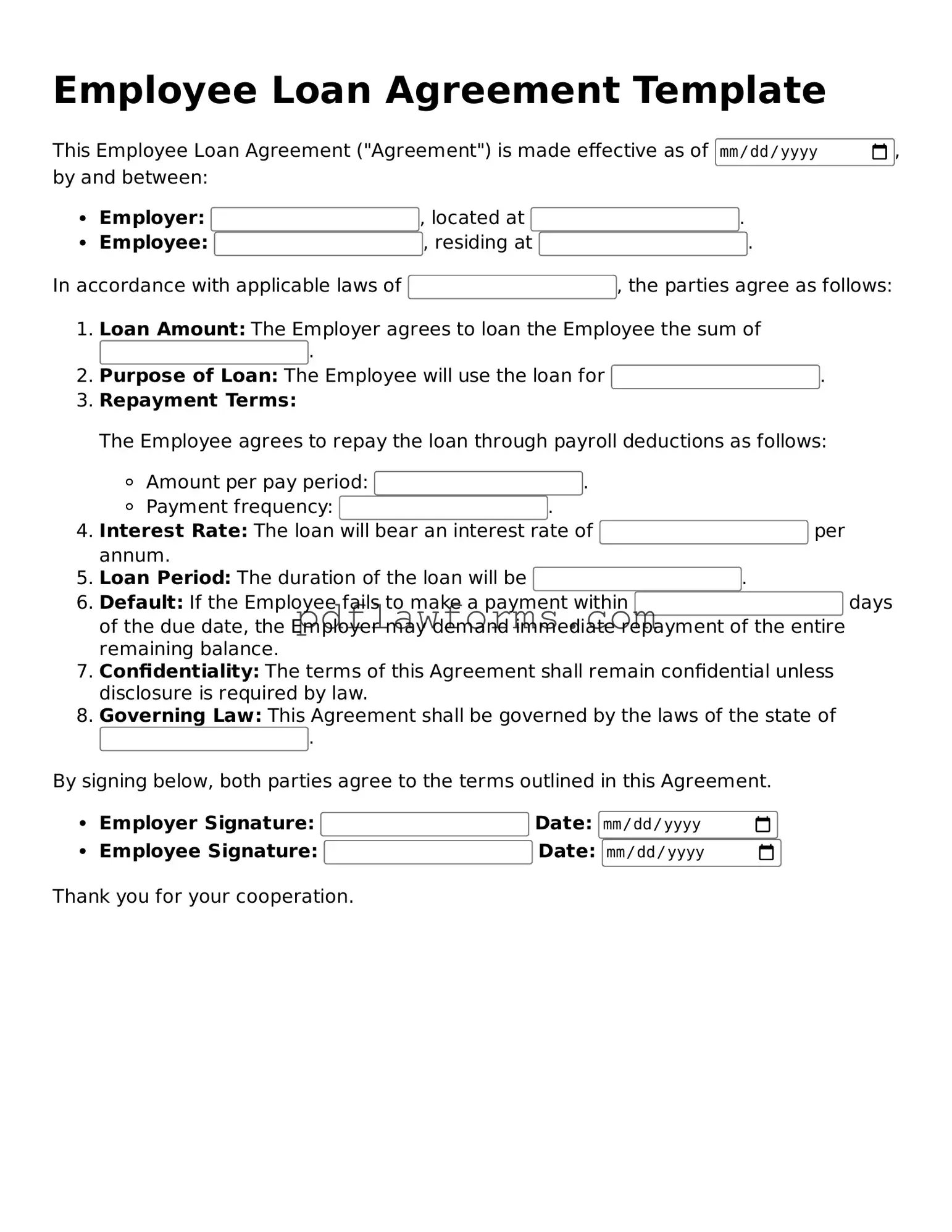

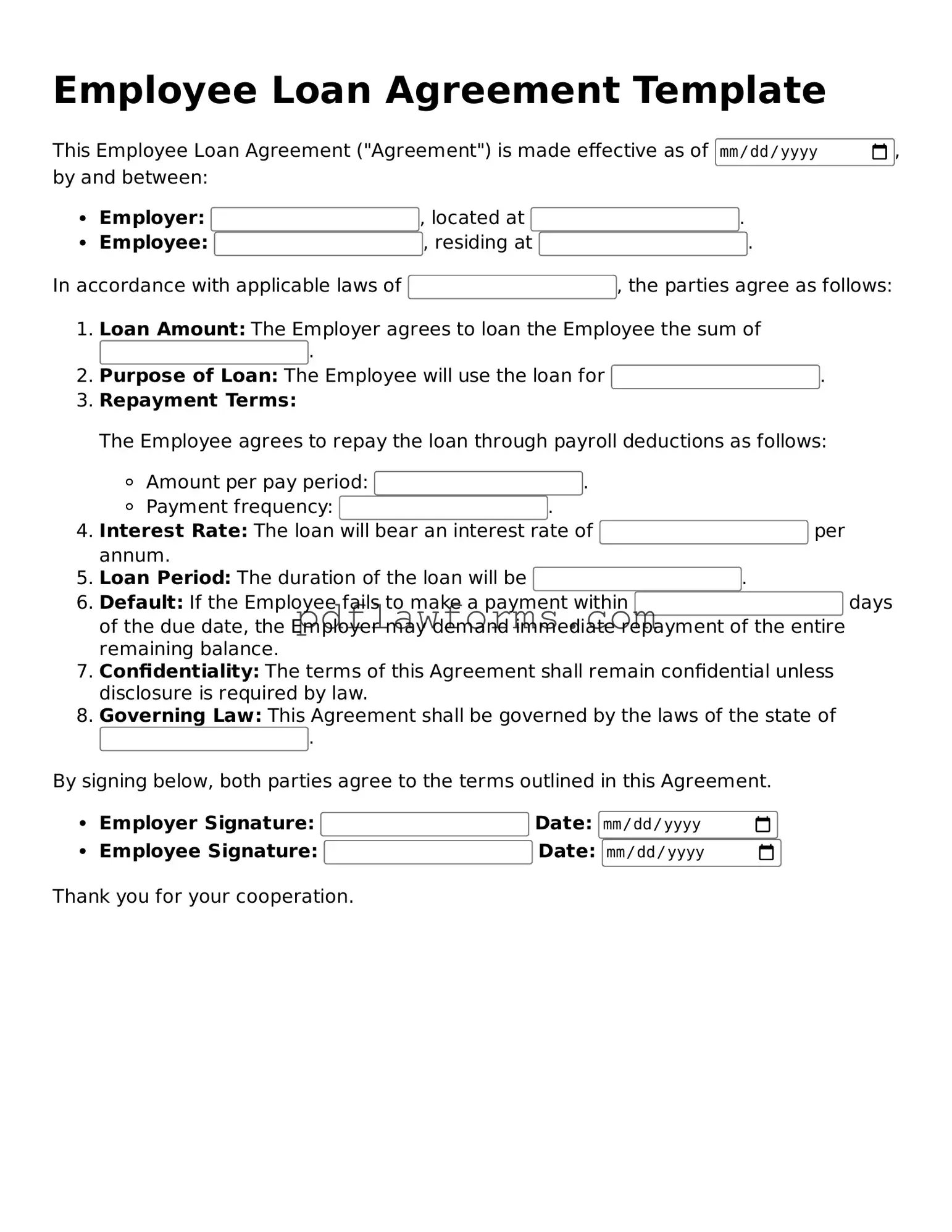

Official Employee Loan Agreement Form

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement protects both parties by clearly stating the repayment schedule, interest rates, and any other obligations. If you’re ready to move forward, fill out the form by clicking the button below.

Make My Document Online

Official Employee Loan Agreement Form

Make My Document Online

You’re halfway through — finish the form

Edit and complete Employee Loan Agreement online, then download your file.

Make My Document Online

or

⇩ Employee Loan Agreement PDF