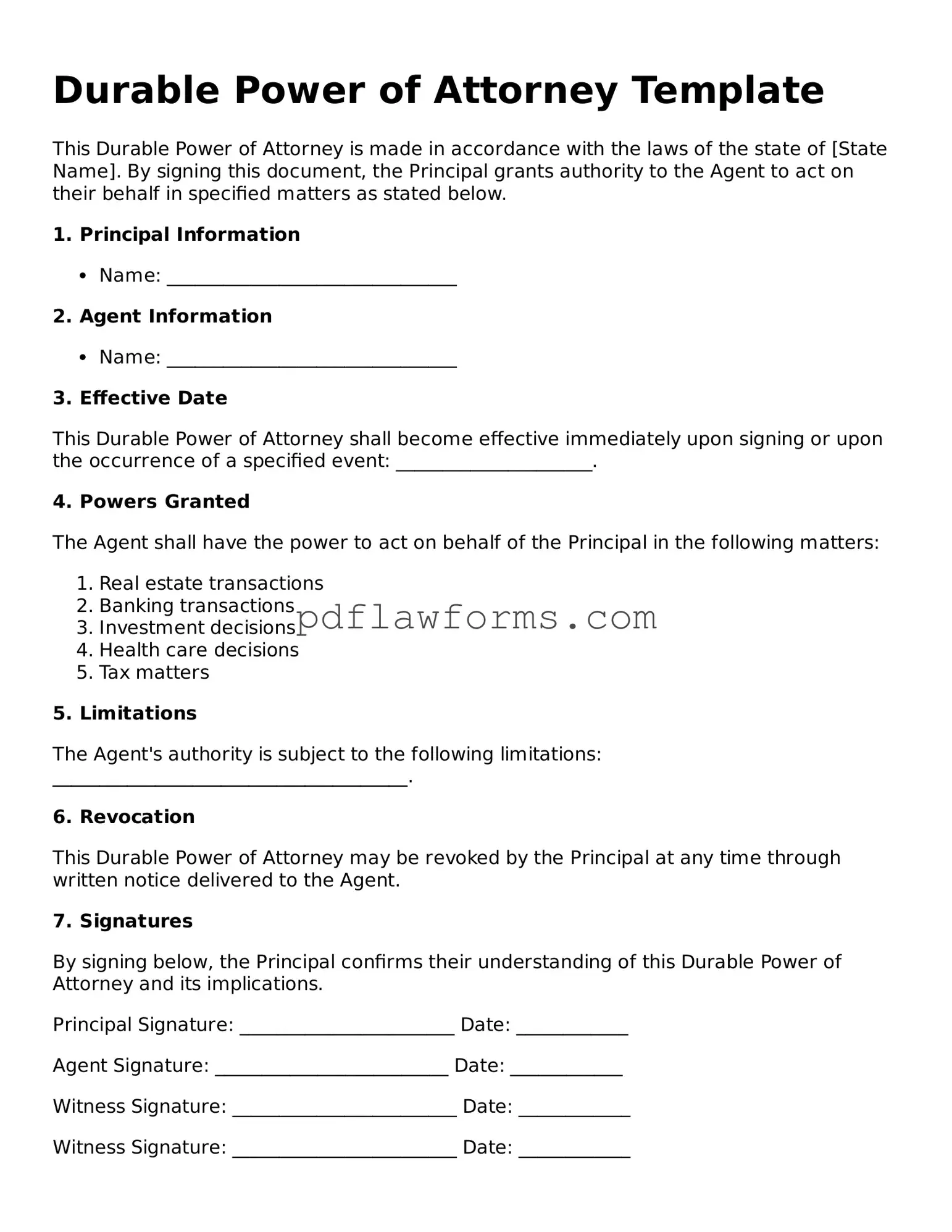

When filling out a Durable Power of Attorney (DPOA) form, individuals often encounter pitfalls that can have serious consequences. One common mistake is failing to specify the powers granted to the agent. Without clear instructions, the agent may not have the authority to act in a way that aligns with the principal's wishes. This lack of specificity can lead to confusion and disputes among family members.

Another frequent error is neglecting to date the document. A DPOA must be dated to establish its validity. If the form is not dated, it may be challenged in court, leading to delays in decision-making when it is most needed. Additionally, some people forget to sign the document in the presence of a notary or witnesses, which is often a requirement for the DPOA to be legally binding.

Many individuals also overlook the importance of choosing the right agent. This person should not only be trustworthy but also capable of making informed decisions. Appointing someone without considering their ability to handle financial or medical matters can result in poor choices that do not reflect the principal's best interests.

In some cases, people mistakenly believe that a DPOA automatically grants their agent the authority to make all decisions. In reality, certain powers may require explicit mention in the document. For instance, if the principal wants the agent to handle real estate transactions, this must be clearly stated. Otherwise, the agent may be limited in their ability to act.

Another common oversight involves not discussing the DPOA with the chosen agent beforehand. Open communication is essential. If the agent is unaware of their responsibilities or the principal's wishes, they may be ill-prepared to act when the time comes. This can lead to misunderstandings and conflict during critical moments.

Furthermore, failing to review and update the DPOA regularly can be detrimental. Life circumstances change—people move, relationships evolve, and health conditions can shift. Regularly revisiting the DPOA ensures that it remains aligned with the principal's current wishes and needs.

Some individuals also forget to consider the implications of their choices on family dynamics. Appointing one child as an agent over others can lead to feelings of resentment. It is crucial to be mindful of how these decisions may affect relationships among family members.

Additionally, people sometimes neglect to include alternate agents in the DPOA. If the primary agent is unable or unwilling to serve, having a backup can prevent delays in decision-making. This foresight can be invaluable in ensuring that the principal's wishes are honored without interruption.

Lastly, many individuals fail to provide copies of the DPOA to relevant parties, such as family members, healthcare providers, or financial institutions. Without access to the document, these entities may not recognize the agent's authority, which can hinder timely action in critical situations.

By being aware of these common mistakes, individuals can take proactive steps to ensure that their Durable Power of Attorney is filled out correctly and serves its intended purpose. Clarity, communication, and regular updates are key to creating a robust and effective DPOA.