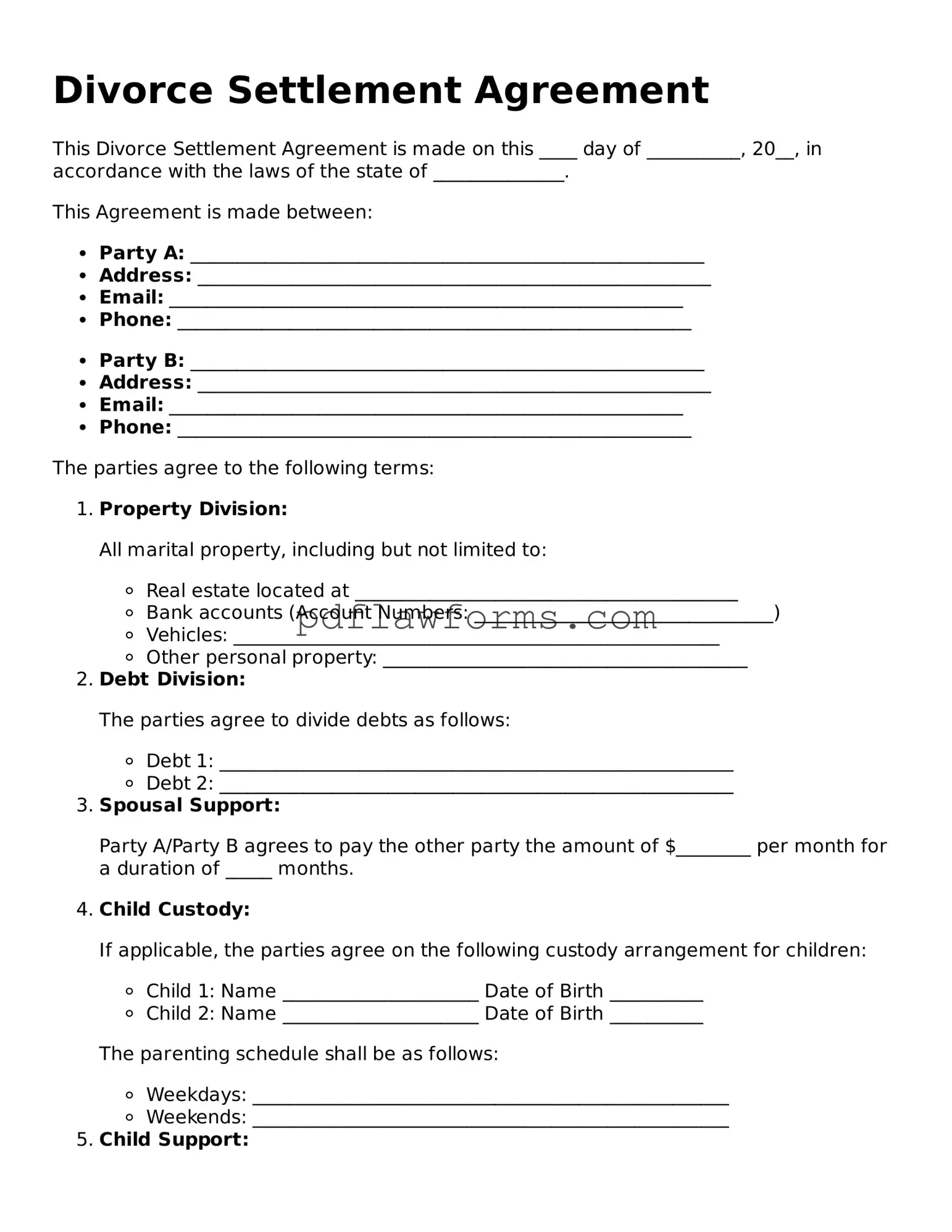

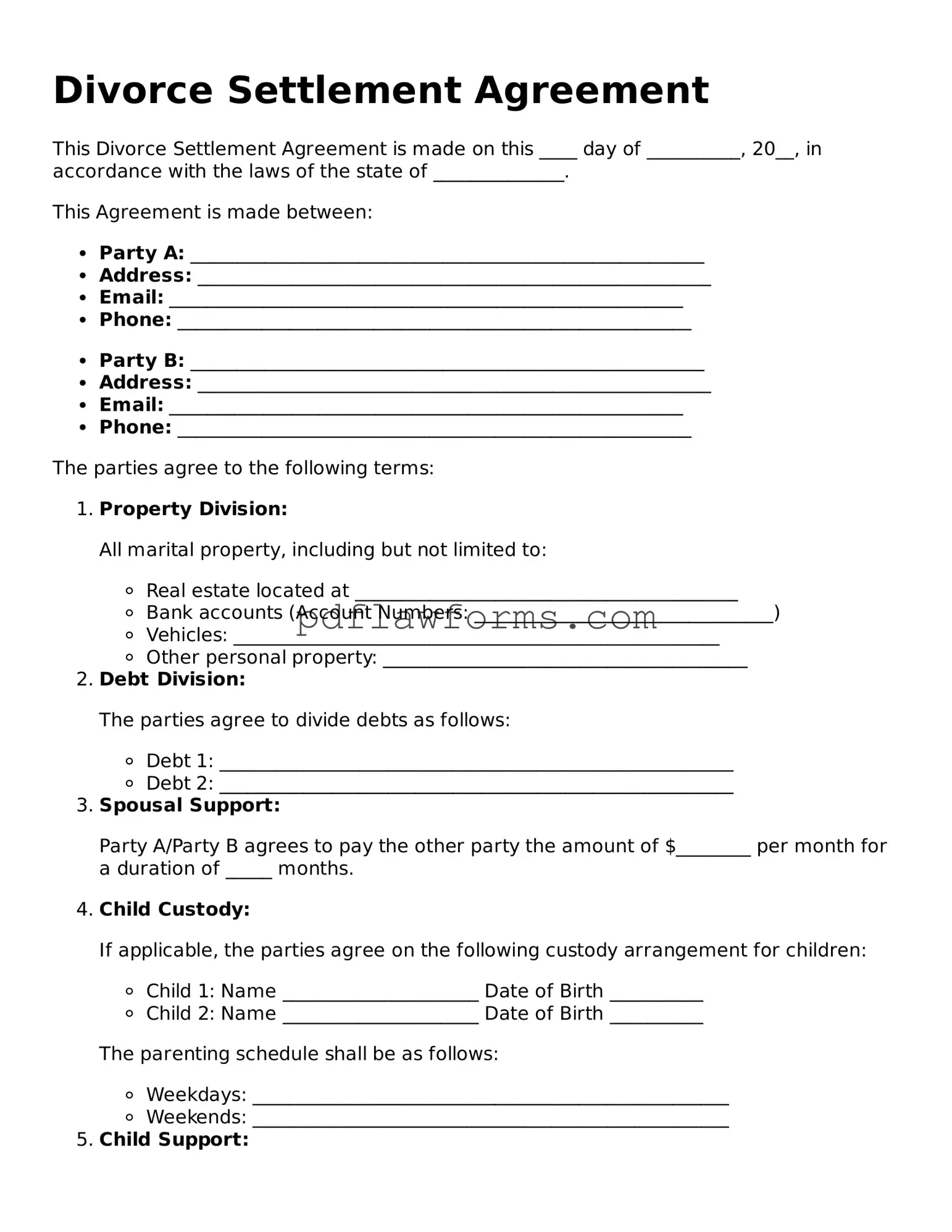

Filling out a Divorce Settlement Agreement can be a daunting task. Many people make mistakes that can have lasting consequences. One common error is failing to fully disclose all assets and debts. When individuals omit important financial information, they risk the settlement being challenged later. Transparency is crucial; it builds trust and ensures a fair division of property.

Another frequent mistake involves misunderstanding the implications of child support and alimony. Some individuals might think that these payments are set in stone, but they can be modified based on changes in circumstances. Failing to account for potential changes can lead to financial strain down the road. It’s essential to understand how these obligations work and to plan accordingly.

Many people also overlook the importance of including specific terms regarding the division of property. General statements can lead to confusion and disputes later. Instead, it’s better to be detailed. For example, specifying who gets the family home or how retirement accounts will be divided can prevent misunderstandings.

Another mistake is not considering tax implications. People often forget that certain assets can have tax consequences when sold or transferred. For instance, capital gains taxes on a property can affect the net value of what one party receives. Consulting a financial advisor can help clarify these issues and avoid costly surprises.

In some cases, individuals rush through the process without fully understanding the terms they are agreeing to. This can happen when emotions run high, and the desire to finalize the divorce overshadows careful consideration. Taking the time to read and understand each clause is vital. It’s better to take a little longer than to regret hasty decisions later.

Additionally, some people fail to seek legal advice. While it might seem tempting to handle everything independently, the complexities of a divorce settlement can be overwhelming. A lawyer can provide guidance and ensure that your rights are protected. Ignoring this step can lead to unfavorable outcomes.

Finally, individuals sometimes neglect to update their estate plans after finalizing the divorce. This can leave ex-spouses as beneficiaries on wills or insurance policies, which can create complications. It’s important to review and revise these documents to reflect the new reality. Taking these steps can help ensure that your wishes are honored and that your loved ones are protected.