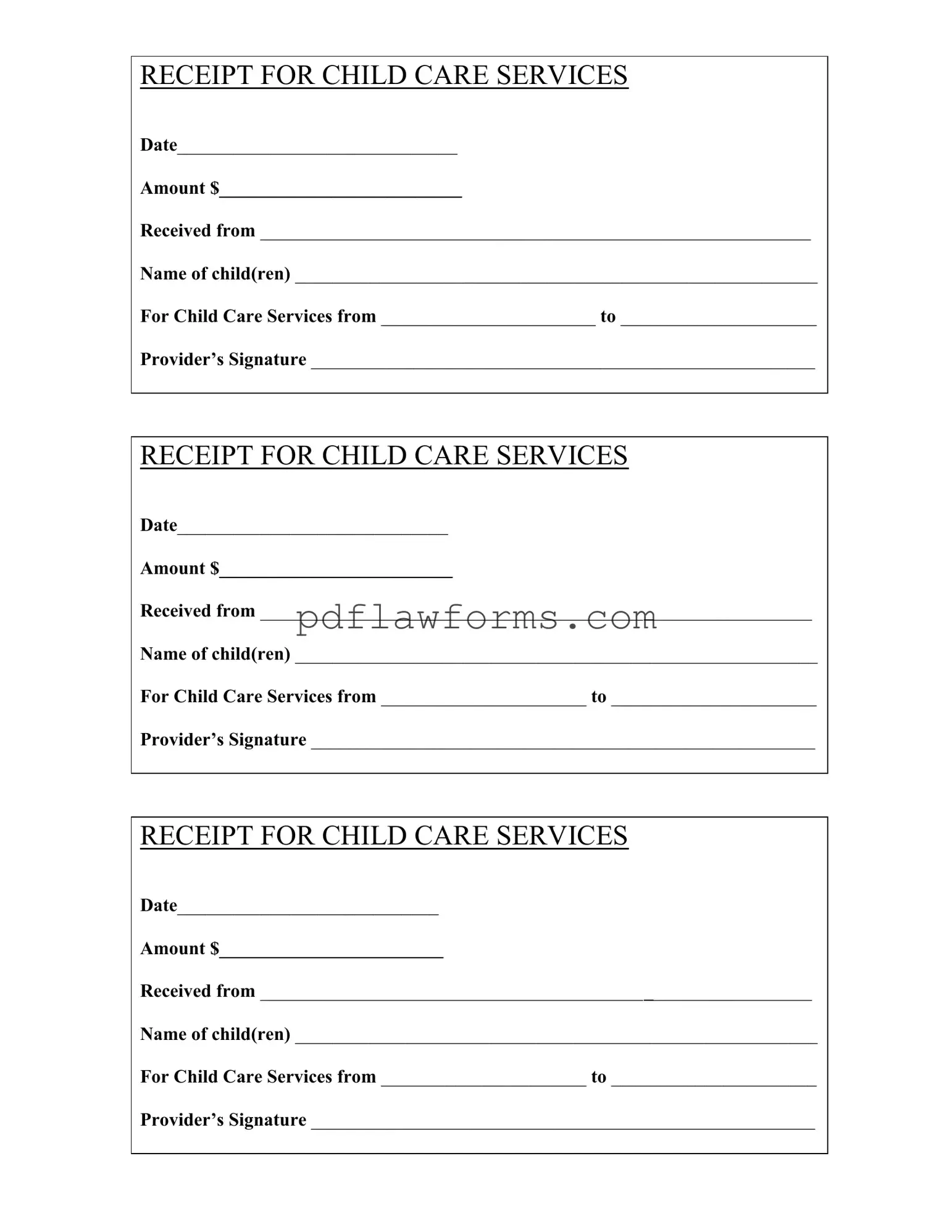

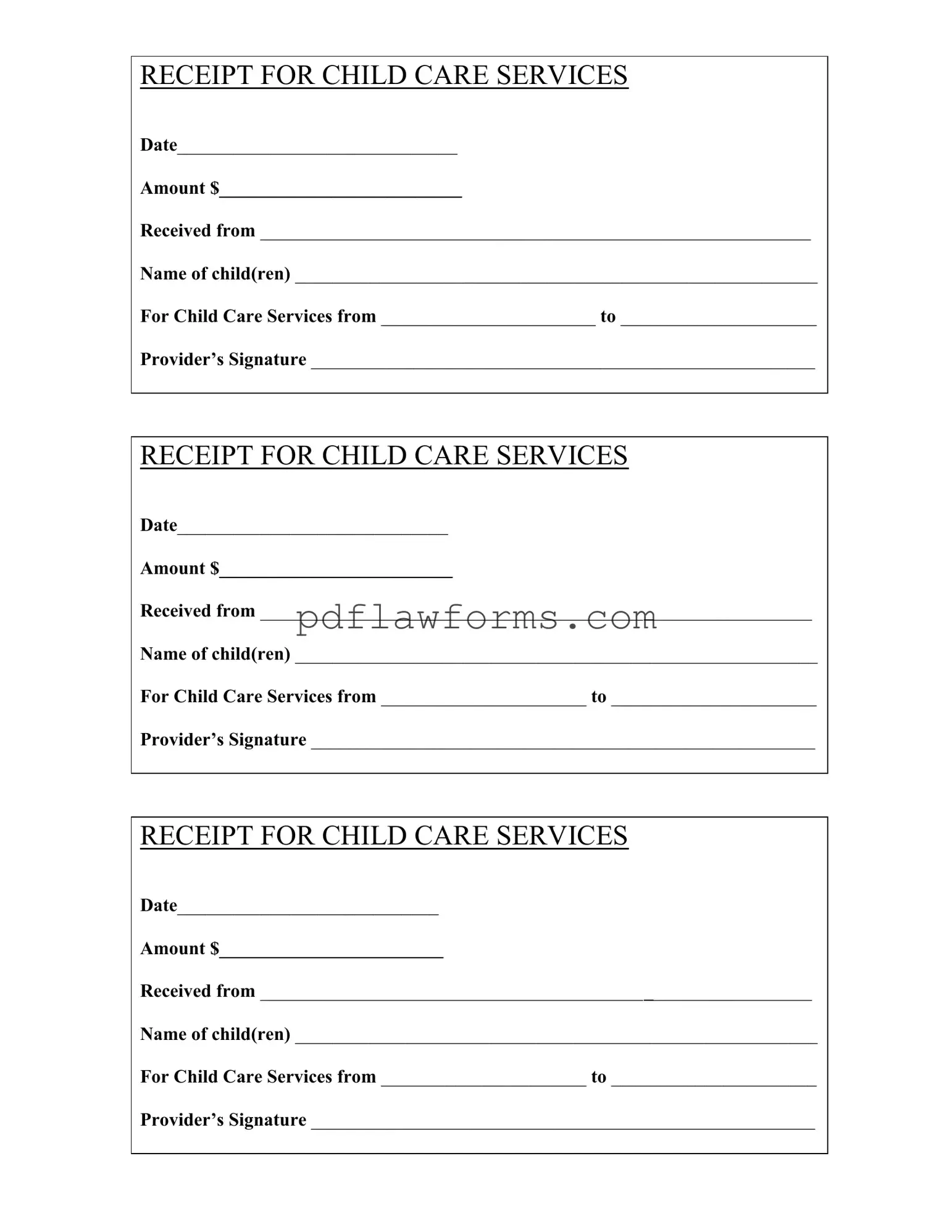

When filling out the Childcare Receipt form, many individuals inadvertently make mistakes that can lead to complications down the line. One common error is failing to include the date of service. This detail is crucial for record-keeping and tax purposes. Without it, the receipt may be deemed incomplete, creating potential issues when claiming childcare expenses.

Another frequent mistake is neglecting to specify the amount paid for the services. Leaving this field blank can raise questions and complicate matters when attempting to verify payments. It’s essential to provide a clear and accurate amount to avoid misunderstandings.

People often forget to fill in the name of the child(ren) receiving care. This oversight can lead to confusion, especially if multiple children are involved. Including this information ensures clarity and helps in tracking childcare expenses associated with each child.

Additionally, many individuals do not accurately complete the service dates. Providing the start and end dates of the childcare services is necessary for validating the receipt. Missing this information can create discrepancies when referencing the receipt later.

Another common error is omitting the provider’s signature. A signature is a vital component of the receipt, as it authenticates the transaction. Without it, the receipt may not be accepted as valid proof of payment.

Some people mistakenly use the same receipt for multiple payments. Each transaction should be documented separately on its own receipt. Combining payments can lead to confusion and makes it difficult to track expenses accurately.

Failing to keep a copy of the completed receipt is another mistake. Retaining a copy is crucial for personal records and for any future inquiries regarding the childcare services. Without a copy, individuals may find themselves without proof of payment.

Inaccurate or inconsistent information can also be a problem. For instance, if the name of the provider or the payment method differs from what is typically used, it may raise flags during an audit. Consistency is key to ensuring the receipt is accepted without issue.

Some individuals neglect to review the form for errors before submission. Simple typos or incorrect entries can invalidate the receipt. Taking a moment to double-check the information can save time and prevent future complications.

Finally, failing to understand the purpose of the receipt can lead to mistakes. It is essential to recognize that this document serves not only as proof of payment but also as a critical piece of documentation for tax deductions. Understanding its importance can motivate individuals to fill it out accurately and completely.