Fill Your Cg 20 10 07 04 Liability Endorsement Template

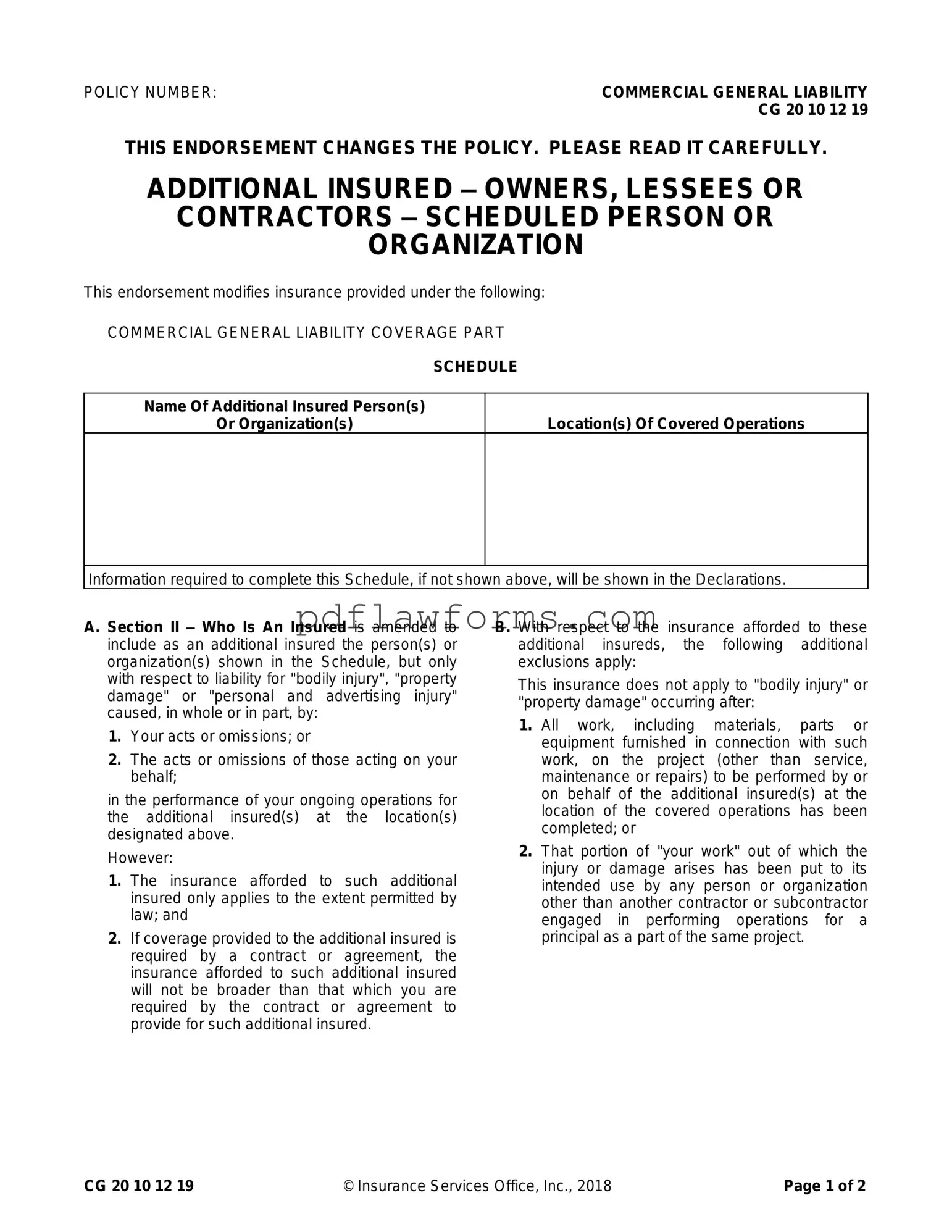

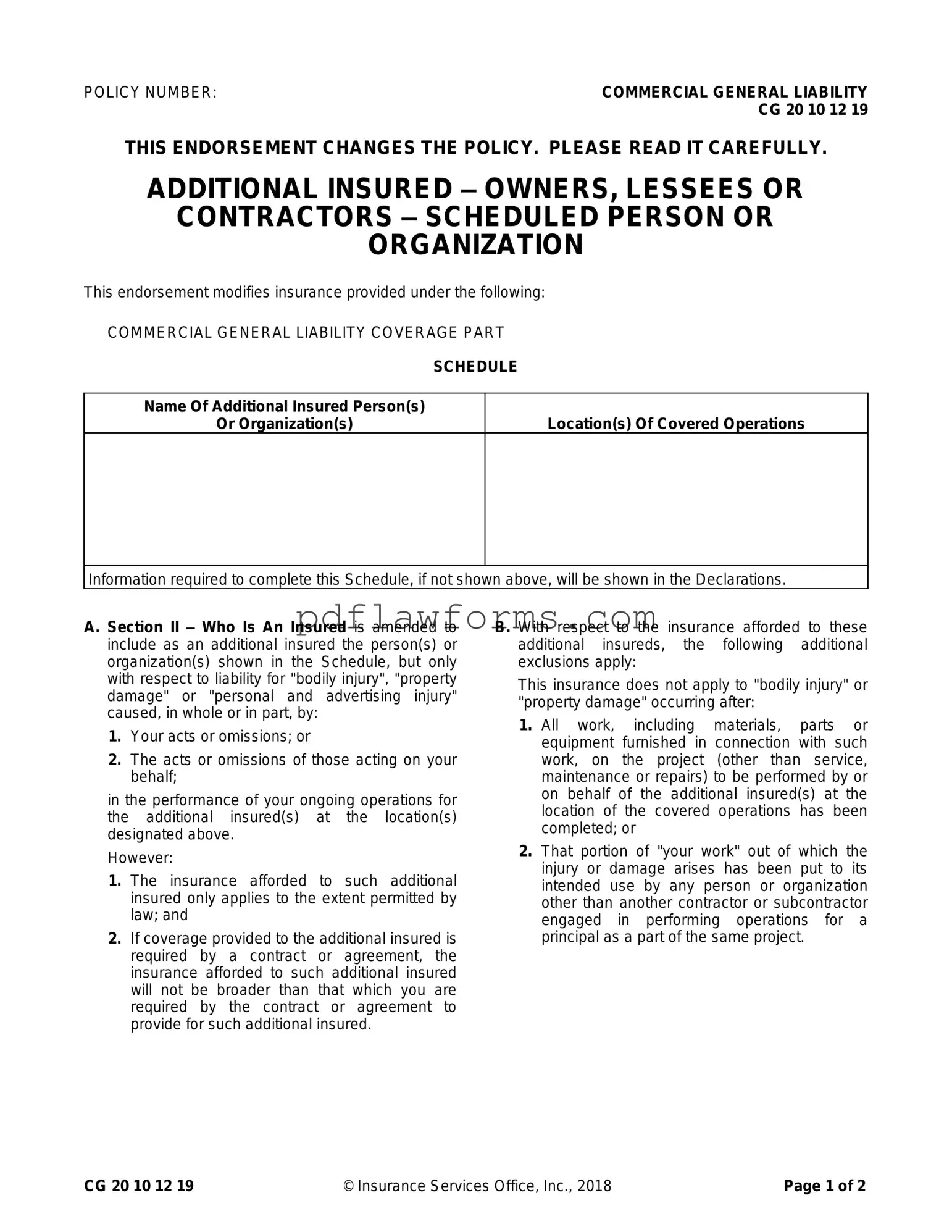

The Cg 20 10 07 04 Liability Endorsement form is a crucial document in commercial general liability insurance that adds specific individuals or organizations as additional insureds. This endorsement ensures that these additional parties are covered for certain liabilities arising from your operations, but only within the limits set by law and any applicable contracts. Understanding this form is essential for protecting your business and fulfilling contractual obligations, so be sure to fill it out by clicking the button below.

Make My Document Online

Fill Your Cg 20 10 07 04 Liability Endorsement Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Cg 20 10 07 04 Liability Endorsement online, then download your file.

Make My Document Online

or

⇩ Cg 20 10 07 04 Liability Endorsement PDF