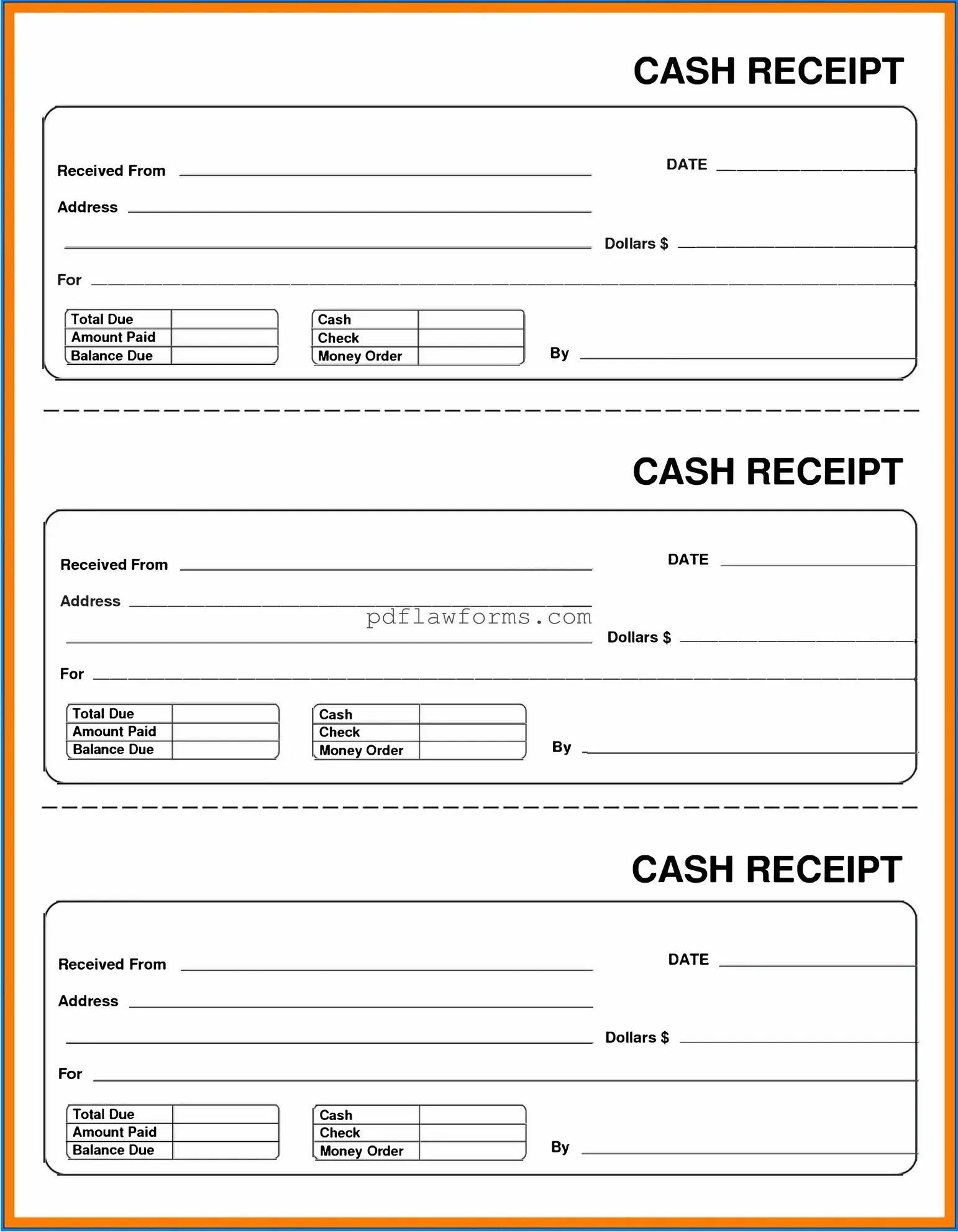

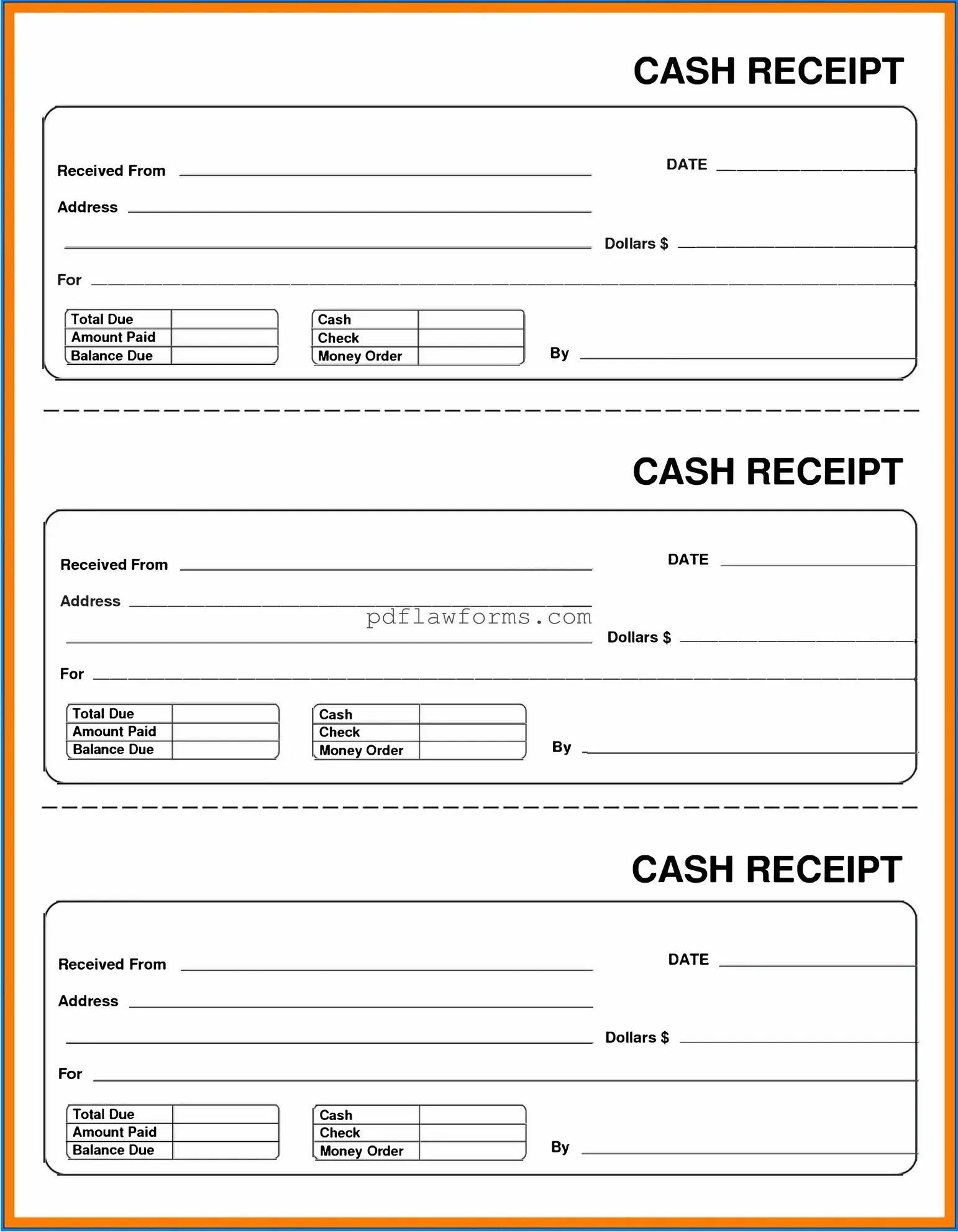

Filling out a Cash Receipt form may seem straightforward, but many people make common mistakes that can lead to confusion and errors. One frequent error is neglecting to include the date of the transaction. The date is crucial for record-keeping and tracking purposes. Without it, you may struggle to recall when the payment was made, which can complicate financial records down the line.

Another mistake often encountered is failing to write the amount clearly. Whether it’s handwritten or typed, legibility is key. If the amount is hard to read, it can lead to misunderstandings or disputes later. Always double-check that the figures are clear and correctly aligned with the corresponding fields on the form.

Additionally, some individuals forget to include the payer’s information. This includes the name and contact details of the person or entity making the payment. Omitting this information can create issues if you need to follow up for any reason. Ensuring this information is accurate helps maintain good communication and records.

Another common error is not specifying the purpose of the payment. It’s essential to indicate what the payment is for, whether it’s for services rendered, a product sold, or a deposit. This clarity helps both the payer and the recipient understand the transaction and its context.

Some people also mistakenly skip the signature section. A signature serves as a verification of the transaction and can be crucial for both parties involved. Failing to sign the form can lead to questions about the authenticity of the receipt, which may cause complications in the future.

In addition to these mistakes, individuals often neglect to keep a copy of the Cash Receipt for their own records. Retaining a copy is important for tracking payments and for reference during audits or financial reviews. It’s a simple step that can save a lot of hassle later.

Lastly, many people overlook the importance of reviewing the entire form before submission. A quick review can catch errors that might otherwise go unnoticed. Taking a moment to ensure all information is correct can prevent misunderstandings and ensure smoother transactions.