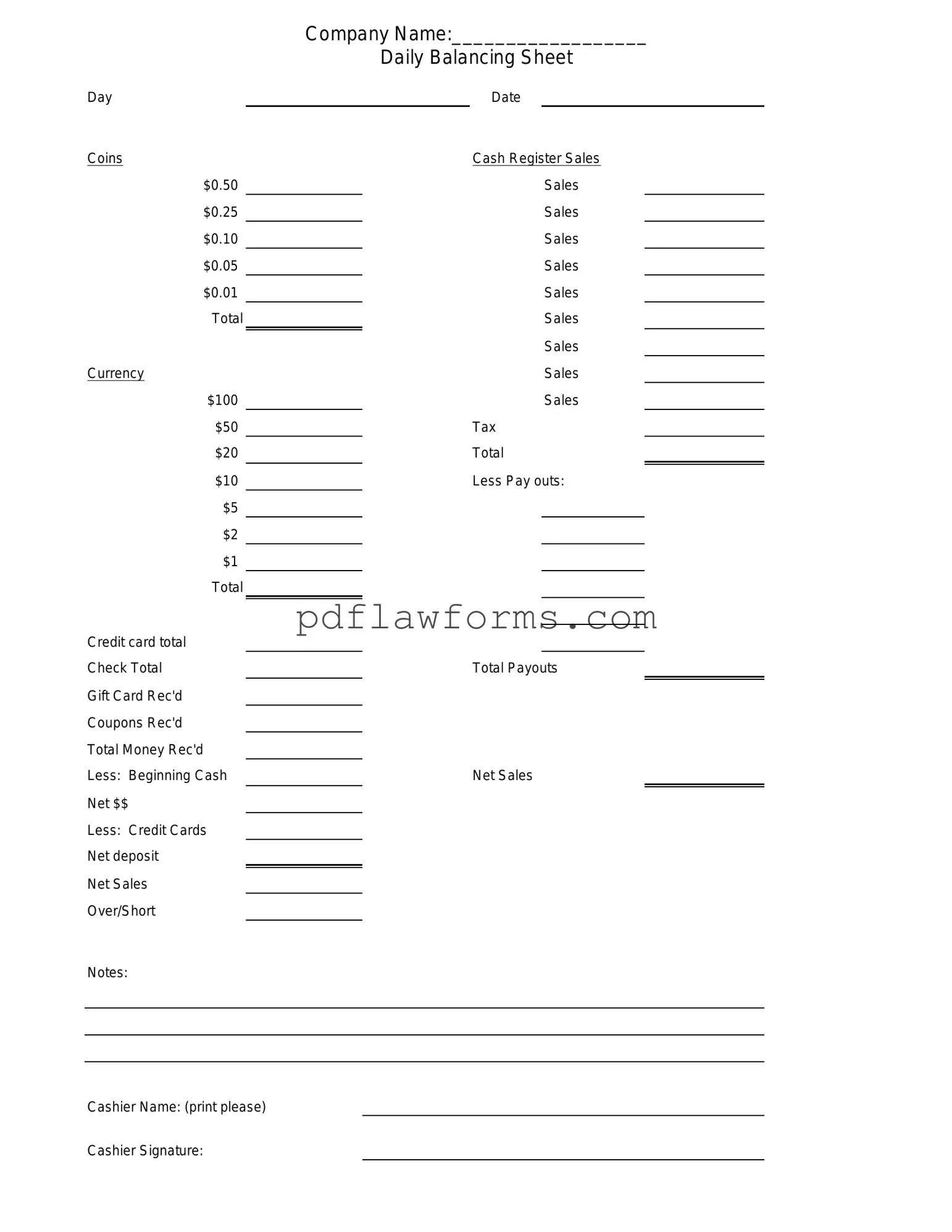

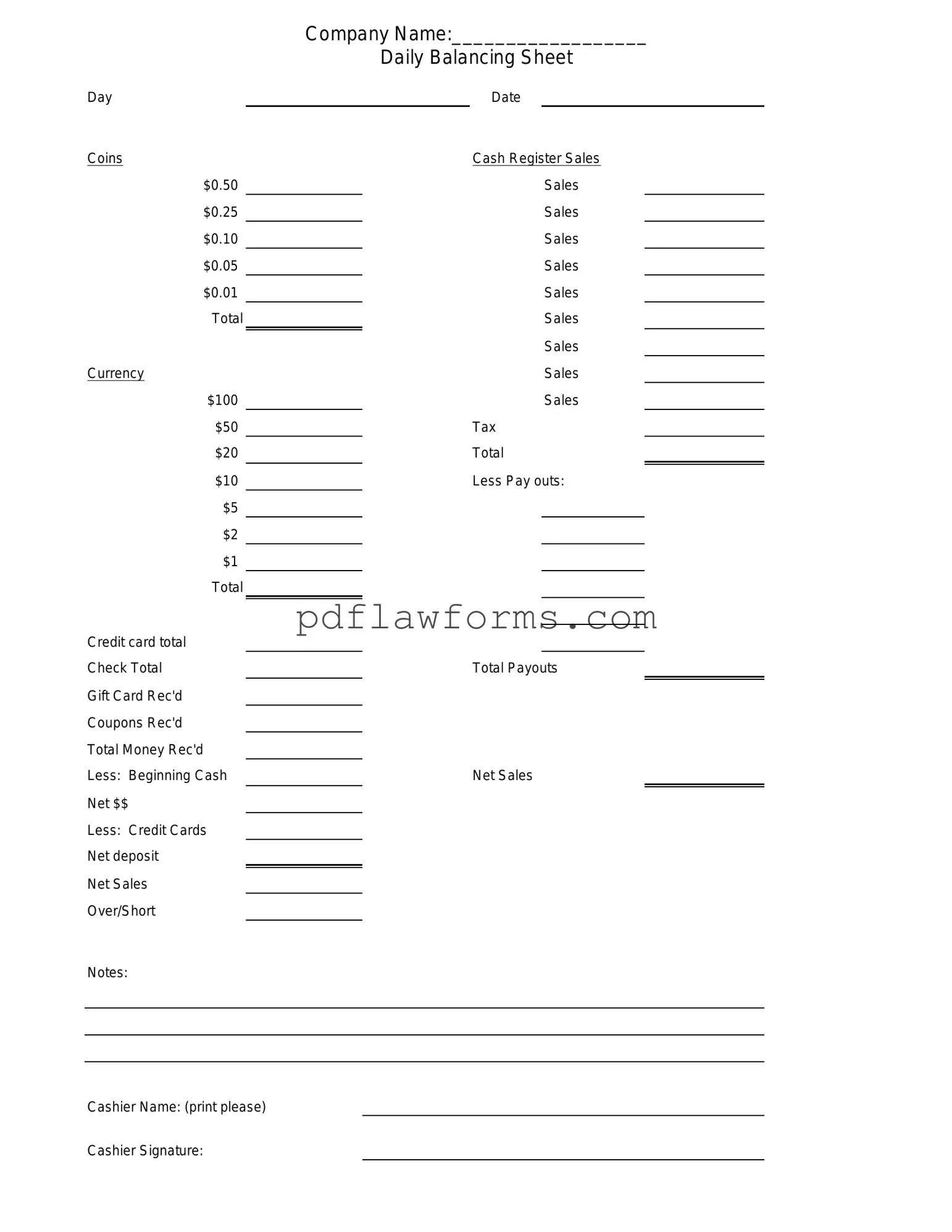

Fill Your Cash Drawer Count Sheet Template

The Cash Drawer Count Sheet is a crucial document used by businesses to track the amount of cash in a register at the end of a shift or business day. This form helps ensure accuracy in cash handling and provides a clear record for financial accountability. To streamline your cash management process, consider filling out the form by clicking the button below.

Make My Document Online

Fill Your Cash Drawer Count Sheet Template

Make My Document Online

You’re halfway through — finish the form

Edit and complete Cash Drawer Count Sheet online, then download your file.

Make My Document Online

or

⇩ Cash Drawer Count Sheet PDF