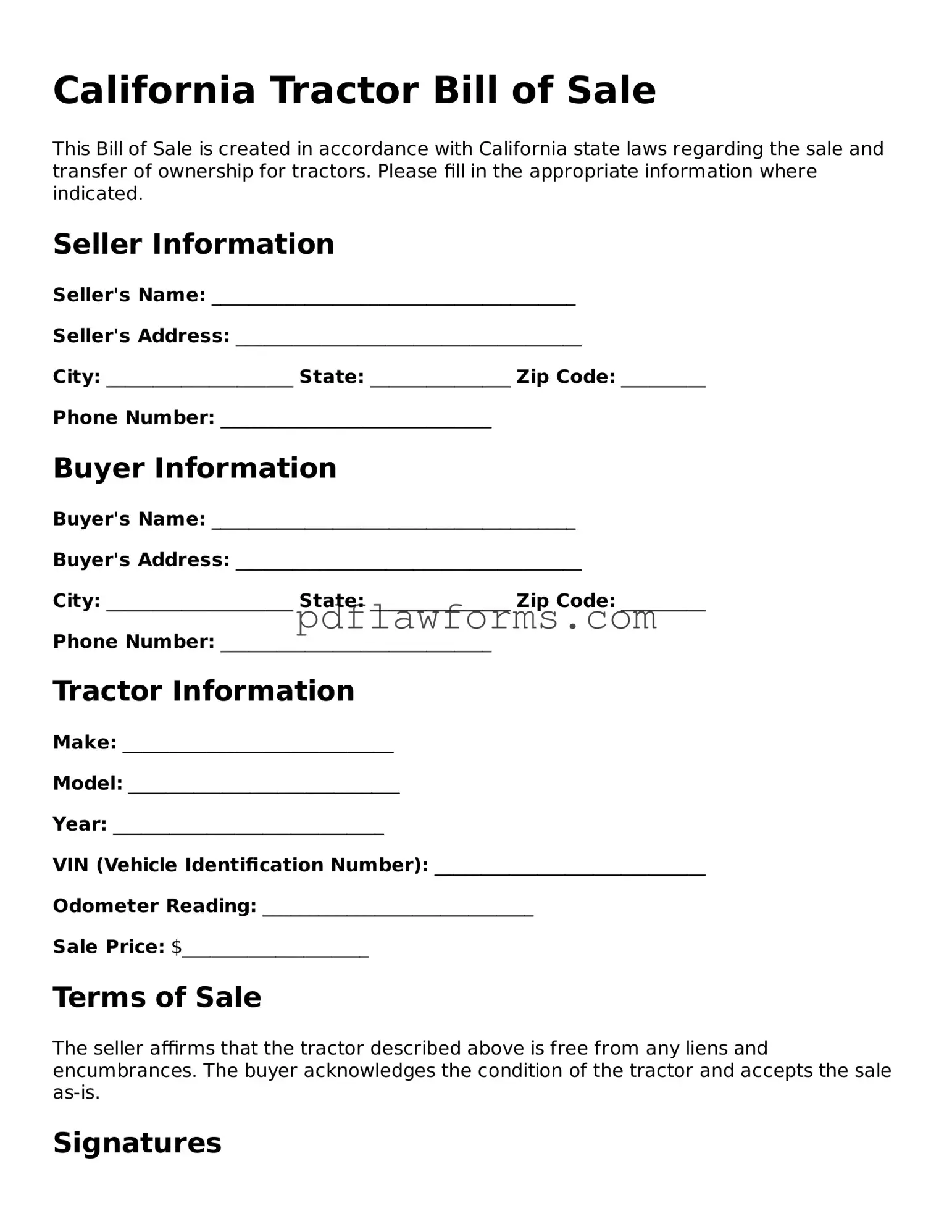

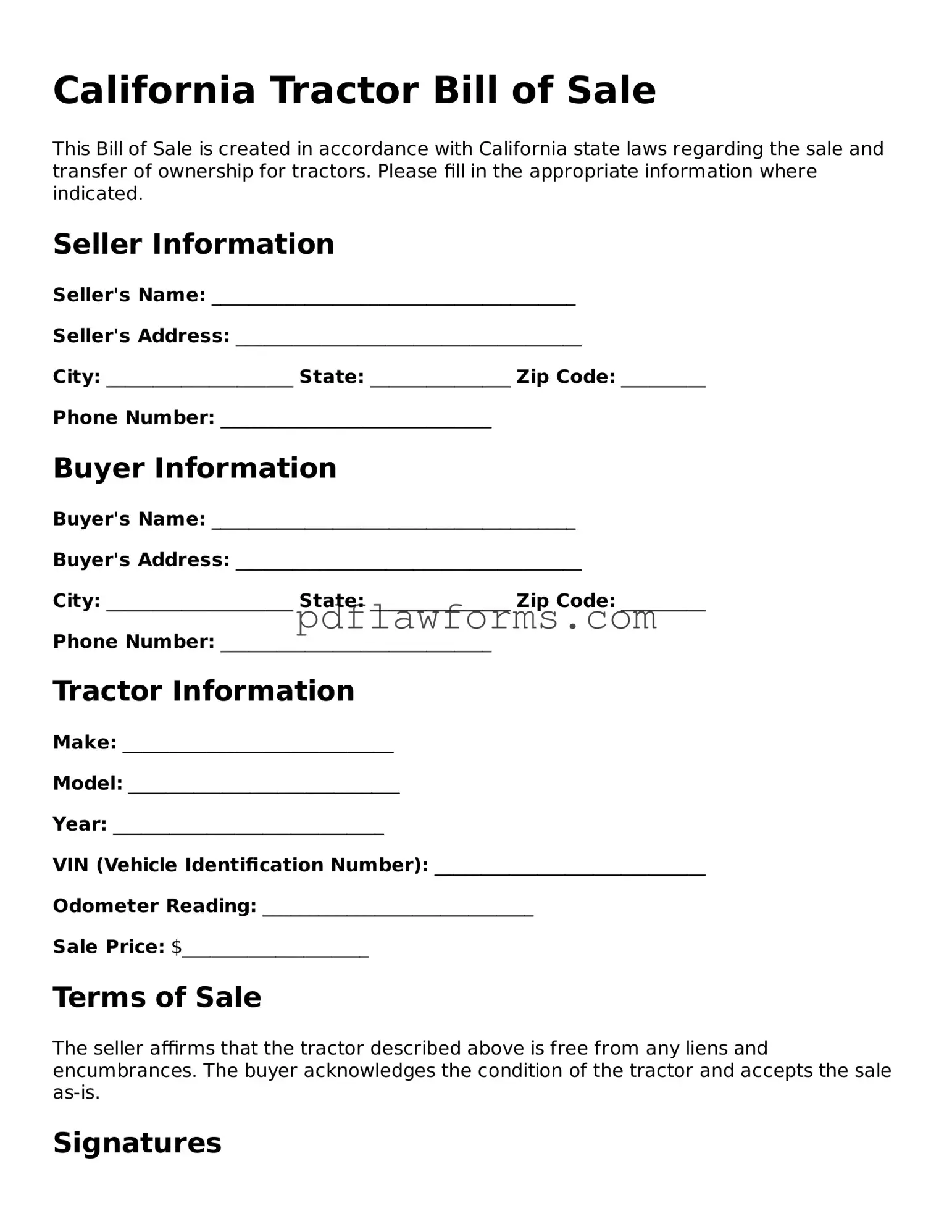

Tractor Bill of Sale Form for the State of California

The California Tractor Bill of Sale form is a legal document that records the sale of a tractor between a buyer and a seller. This form helps protect both parties by providing a clear record of the transaction. If you're ready to complete your sale, fill out the form by clicking the button below.

Make My Document Online

Tractor Bill of Sale Form for the State of California

Make My Document Online

You’re halfway through — finish the form

Edit and complete Tractor Bill of Sale online, then download your file.

Make My Document Online

or

⇩ Tractor Bill of Sale PDF