Filling out a California Quitclaim Deed form can be straightforward, but many people make common mistakes that can lead to complications. Understanding these pitfalls is crucial for ensuring a smooth property transfer process. Here are ten mistakes to watch out for.

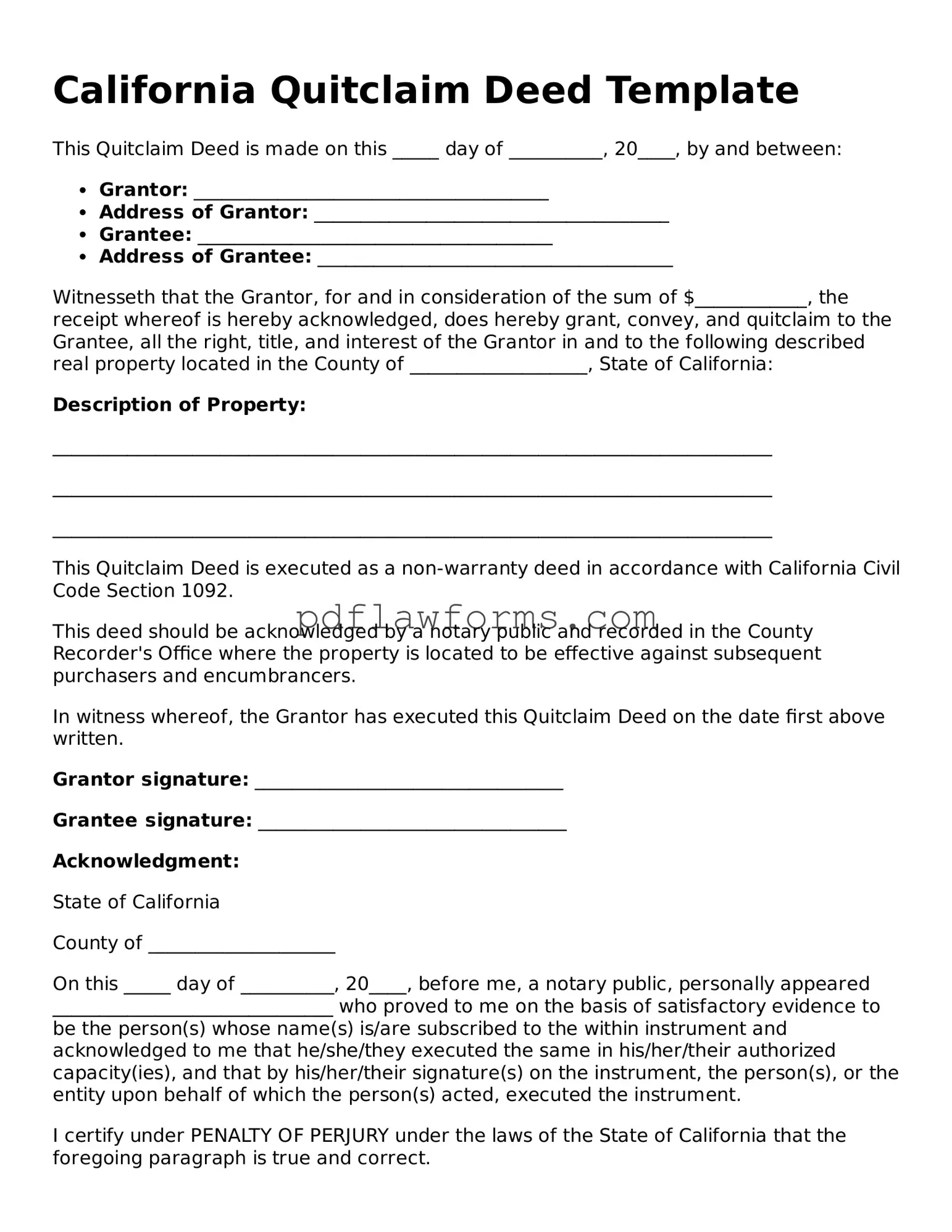

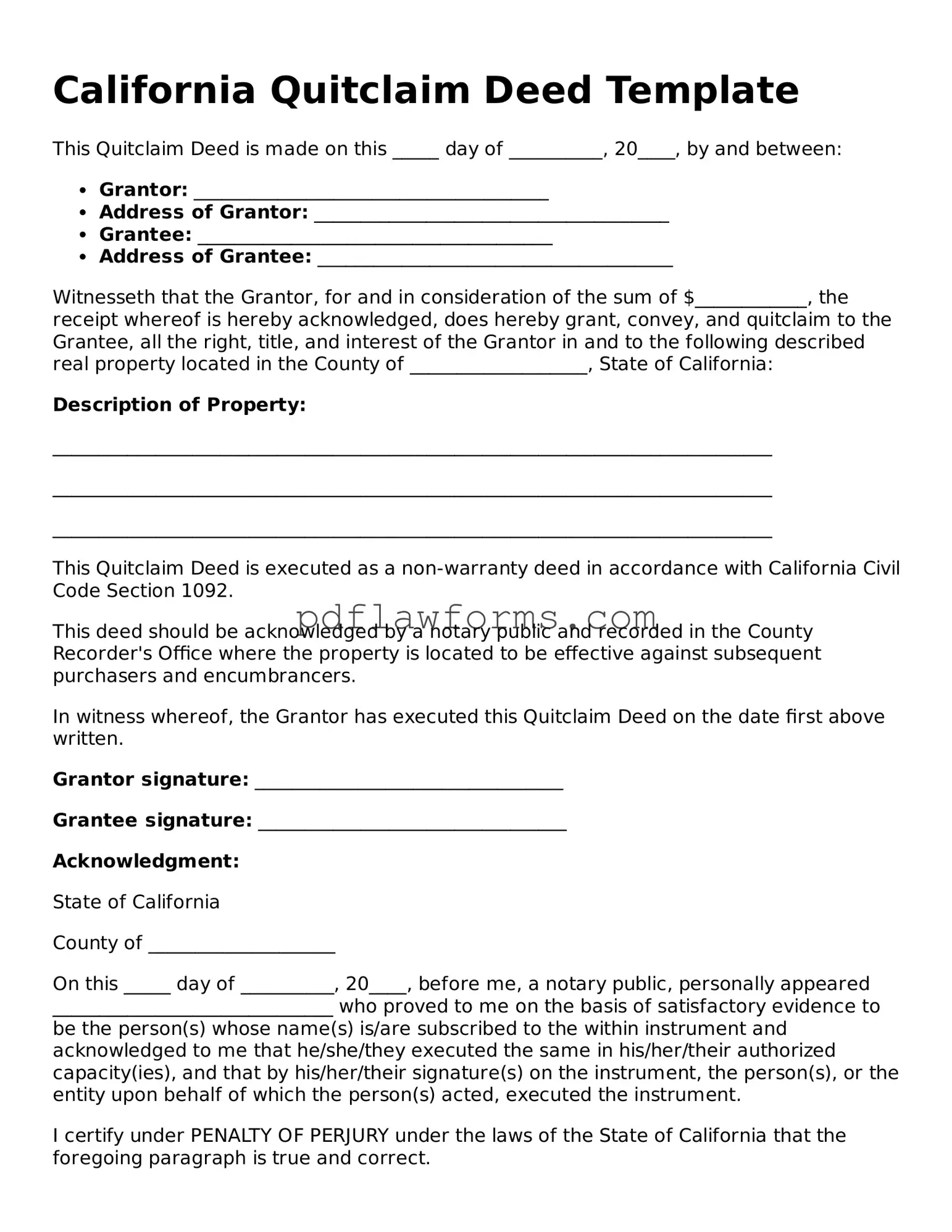

One frequent error is incomplete information. Individuals often forget to fill in all required fields, such as the names of the grantor and grantee. Omitting even a single detail can invalidate the deed, causing delays in the transfer process.

Another common mistake is incorrect property description. The property must be described accurately, including the address and legal description. Failing to provide a precise legal description can lead to disputes or difficulties in establishing ownership.

Many people overlook the need for proper signatures. The grantor must sign the deed in front of a notary public. If the signature is missing or not notarized, the document may not be legally binding, jeopardizing the transfer.

Additionally, some individuals mistakenly use the wrong form. A Quitclaim Deed is not suitable for every situation. For example, if the transfer involves a sale, a Grant Deed may be more appropriate. Choosing the correct form is essential for ensuring the transaction is legally sound.

Another mistake involves not recording the deed after it is completed. Recording the Quitclaim Deed with the county recorder's office is necessary to make the transfer public. Failing to do so can lead to issues with future claims on the property.

People often neglect to consult with a professional before completing the form. Legal advice can provide clarity on the implications of the transfer and help avoid potential pitfalls. Engaging a real estate attorney or consultant can save time and money in the long run.

Misunderstanding the tax implications of a Quitclaim Deed is another common error. While this type of deed does not typically trigger a transfer tax, it is essential to verify local regulations. Failing to consider tax consequences can lead to unexpected financial burdens.

Some individuals also forget to check for liens or encumbrances on the property. Before transferring ownership, it’s vital to ensure that no outstanding debts or legal claims exist against the property. Ignoring this step can result in complications for the new owner.

Inaccurate notary information is yet another mistake. The notary must provide their signature, seal, and the date of notarization. If any part of this information is incorrect or missing, the deed may not be valid.

Finally, many individuals fail to keep copies of the completed deed. It is essential to retain a copy for personal records and to provide proof of the transfer if needed in the future. Losing this documentation can create challenges down the road.

By being aware of these common mistakes, individuals can ensure a smoother experience when filling out a California Quitclaim Deed form. Taking the time to double-check details and seek professional guidance can prevent unnecessary complications.