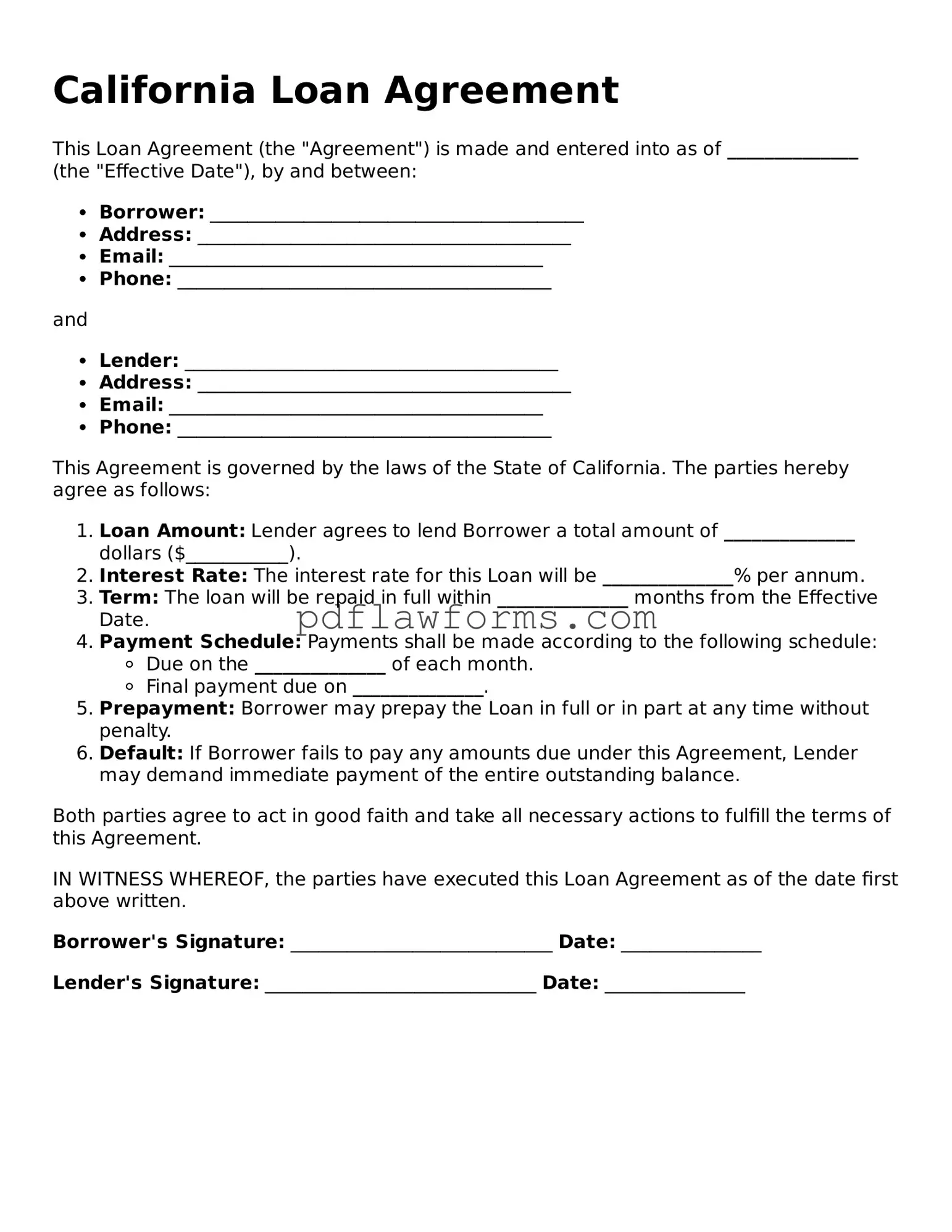

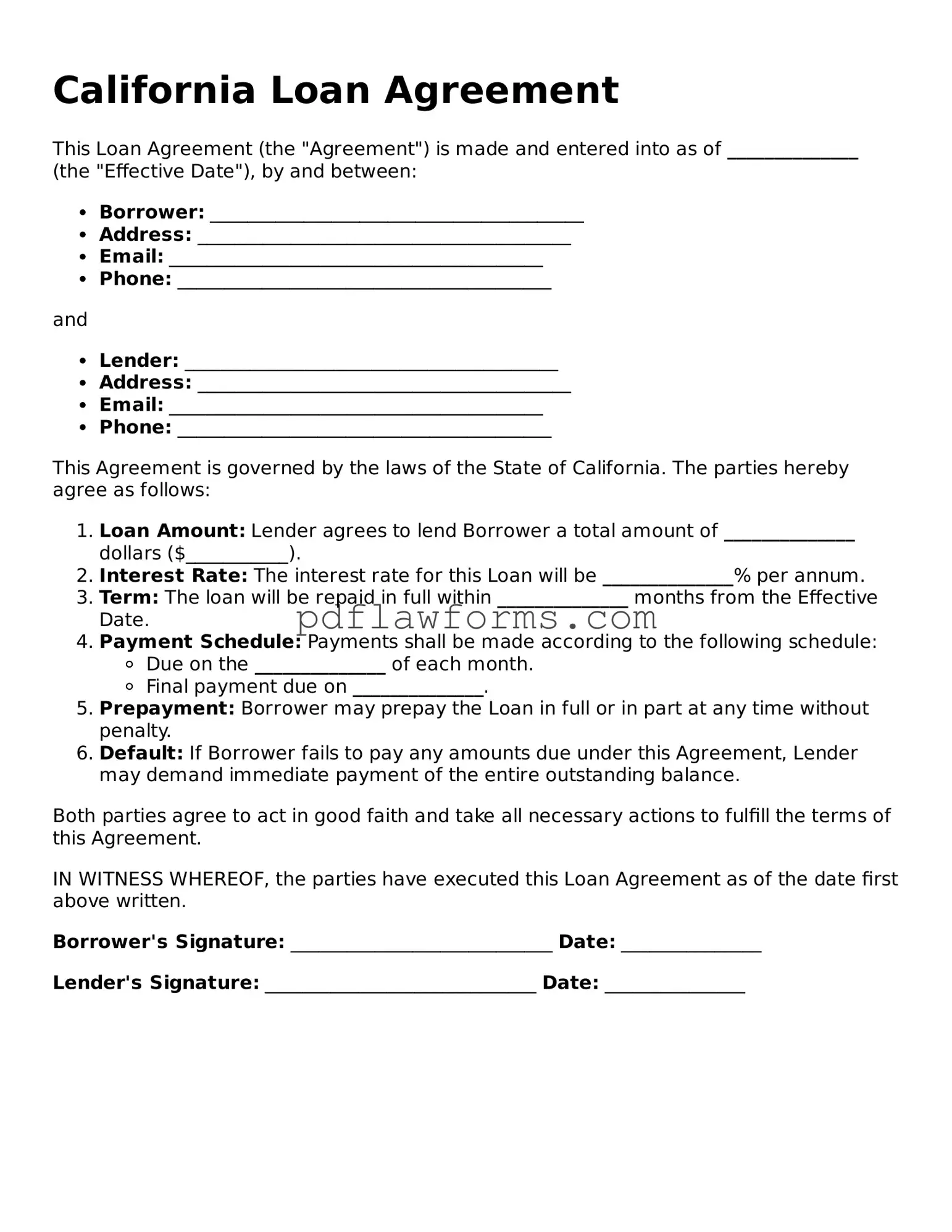

Loan Agreement Form for the State of California

The California Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form serves to protect the interests of both parties by clearly defining repayment schedules, interest rates, and other essential details. For those looking to secure a loan in California, completing this form accurately is crucial; click the button below to get started.

Make My Document Online

Loan Agreement Form for the State of California

Make My Document Online

You’re halfway through — finish the form

Edit and complete Loan Agreement online, then download your file.

Make My Document Online

or

⇩ Loan Agreement PDF