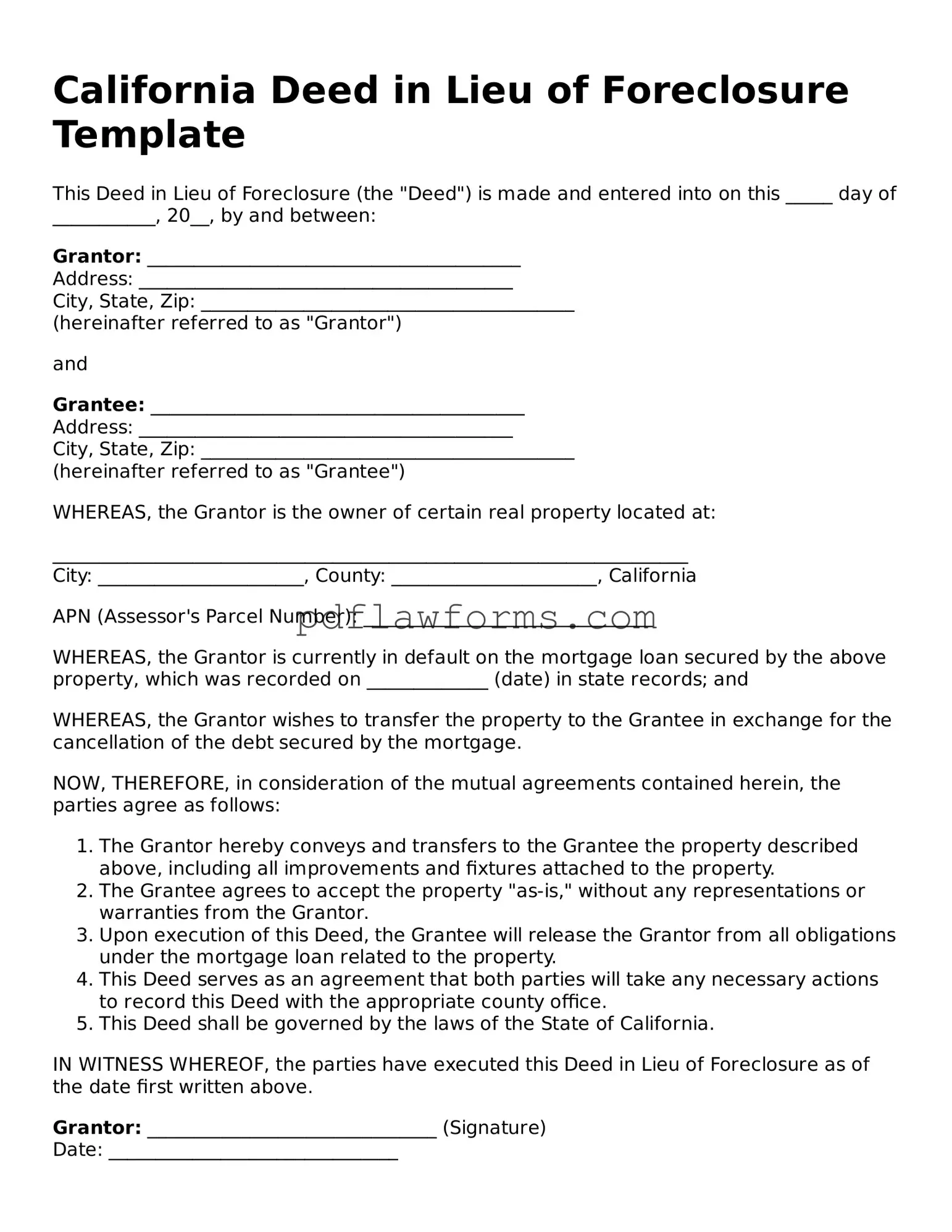

Deed in Lieu of Foreclosure Form for the State of California

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer their property to the lender to avoid the lengthy and costly foreclosure process. This option can provide a fresh start for homeowners facing financial difficulties, as it often leads to a quicker resolution and can help mitigate damage to their credit. If you're considering this option, take the first step by filling out the form below.

Make My Document Online

Deed in Lieu of Foreclosure Form for the State of California

Make My Document Online

You’re halfway through — finish the form

Edit and complete Deed in Lieu of Foreclosure online, then download your file.

Make My Document Online

or

⇩ Deed in Lieu of Foreclosure PDF